Introduction

Recently, India’s aviation market has witnessed a surge in demand, creating excitement across the industry. This article delves into the dynamic landscape of the Indian Aviation Sector, highlighting key players, market shares, and significant developments shaping its trajectory.

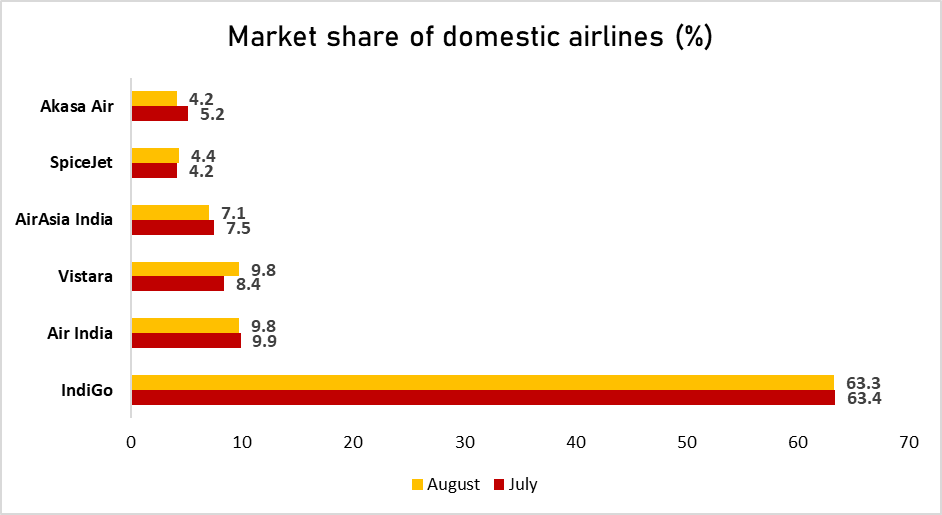

IndiGo Soars High with 63.3% Market Share

IndiGo, India’s largest airline, continues to dominate the aviation landscape, boasting an impressive market share of 63.3 percent in the month of August. This staggering figure solidifies IndiGo’s position as the preferred choice for air travel in the country.

Vistara Gains Traction

Vistara, a rising star in the Indian aviation scene, experienced a notable uptick in market share compared to the previous month. Garnering 9.8 percent of the domestic aviation market in August, up from 8.4 percent in July, Vistara is steadily making its mark.

Air India Holds Steady

Air India, an established player, maintained its market share at 9.8 percent in August. This consistency reflects the airline’s resilience in a competitive market.

AirAsia India’s Foothold

AirAsia India secured a respectable 7.1 percent market share in August, further diversifying the aviation landscape in the country. This contribution is noteworthy and adds to the vibrancy of the sector.

Tata Airlines: A Collective Force

The combined market share of Tata Airlines—comprising Air India, Vistara, and AirAsia India—stood at an impressive 26.7 percent during the same period. This collective strength underscores the impact of strategic alliances in the aviation industry.

Akasa Air Faces Turbulence

Akasa Air experienced a dip in its domestic market share, dropping to 4.2 percent in August. This decline is attributed to operational challenges stemming from pilot resignations. As a result, Akasa Air now finds itself in the sixth position, trailing behind its competitors.

Key Takeaways

The robust demand in India’s aviation sector has spurred a wave of strategic initiatives. Many industry players are contemplating substantial investments, including acquiring new aircraft and expanding operational capacities.

IndiGo, in a groundbreaking move, recently placed an order for an astounding 500 A320neo aircraft from Airbus. This monumental deal marks a historic milestone in the realm of civil aviation. Additionally, earlier this year, the newly privatized Air India made waves by ordering 470 narrow and wide-body jets from Boeing and Airbus.

These significant developments signal a paradigm shift in India’s commercial aviation landscape. The coming years promise heightened competition and a renewed vigor in the domestic market.

India’s aviation sector stands at the cusp of an exciting phase characterized by burgeoning demand and strategic investments. The industry’s resilience and adaptability are evident as key players carve out their niches in this dynamic market.

Fitch Ratings Maintains India’s Growth Forecast at 6.3% for FY24

Introduction

Inflation concerns have taken center stage in discussions surrounding India’s economic landscape. Fitch Ratings, a renowned global credit rating agency, has maintained its growth forecast for India in the current fiscal year at an encouraging 6.3 percent. This affirmation comes despite the challenges posed by tighter monetary policy and export weaknesses.

This article delves into the various facets of India’s economic scenario, shedding light on its strengths and vulnerabilities.

Resilience Amidst Challenges

While facing headwinds, the Indian economy displays remarkable resilience. Fitch’s endorsement of the 6.3 percent growth projection is a testament to this enduring strength. Acknowledging that this resilience is not impervious to the broader global economic slowdown is crucial. The Reserve Bank of India’s assertive stance, marked by 250 basis points of interest rate hikes in the past year, further underscores the gravity of the situation.

Inflationary Pressures: A Closer Look

The revision of year-end inflation projections paints a sobering picture. The looming threat of El Nino has prompted Fitch to adjust its forecast upwards. While the impact on consumers may be transient, underlying factors exert sustained pressure on the economy. This necessitates a holistic approach to address the multifaceted challenges at hand.

Monsoon Season’s Crucial Role

India’s agrarian economy places substantial importance on the monsoon season. A poor monsoon can potentially thwart the Reserve Bank of India’s efforts to rein in inflation. The intricate interplay between weather patterns and economic policy underscores the need for a nuanced strategy to navigate these challenges effectively.

Key Takeaways

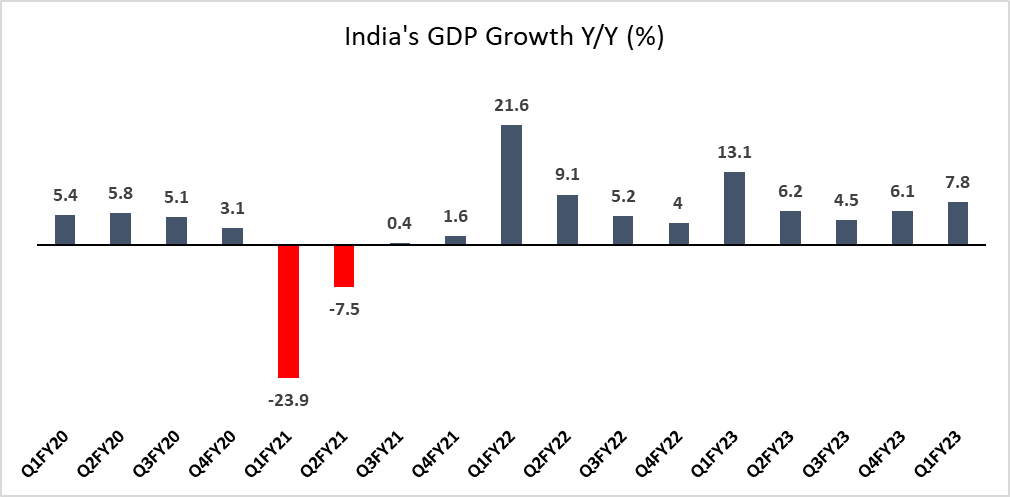

In Q1, India witnessed an impressive 7.8 percent growth in GDP. This marks a significant upturn from the 6.1 percent growth observed in the previous quarter. However, it is imperative to recognize the role of the favorable base effect in amplifying this growth rate. Contextualizing these figures provides a more accurate understanding of the economic trajectory.

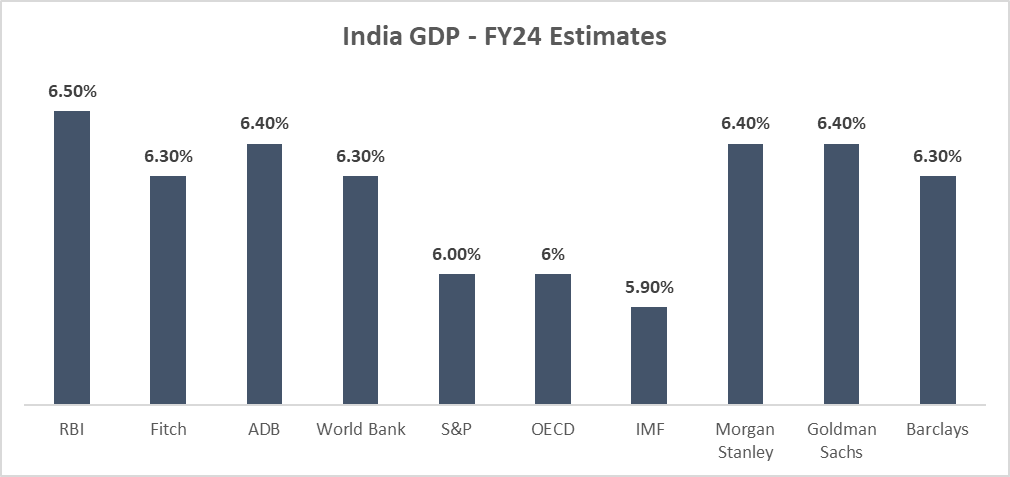

Various agencies have weighed in on India’s growth prospects for FY24, offering a range of estimates between 5.9 percent and 6.5 percent. The IMF’s conservative estimate of 5.9 percent contrasts with the RBI’s bullish projection of 6.5 percent. Though not stellar, these projections need to be viewed in light of the global challenges confronting economies worldwide.

Even within the context of these projections, India is poised to emerge as the fastest-growing major economy globally. This speaks to the dynamism and potential underpinning the nation’s economic fabric. Navigating the headwinds of inflation and global economic slowdown is a testament to India’s resilience and adaptability.

In conclusion, India’s economic landscape presents a complex tapestry of challenges and opportunities. Fitch’s endorsement of a 6.3 percent growth forecast underscores the nation’s enduring economic resilience. However, inflationary pressures and global economic headwinds necessitate a judicious approach to policy-making. India’s ability to weather these challenges will undoubtedly shape its trajectory in the global economic arena.

FAQs

How does inflation impact the average consumer in India?

Inflation can lead to a rise in the prices of goods and services, affecting the purchasing power of consumers.

Why is the Reserve Bank of India's monetary policy crucial in addressing inflation?

The RBI's monetary policy, including interest rate decisions, influences borrowing costs and, consequently, spending and investment levels in the economy.

How do global economic trends affect India's growth prospects?

India, like many other economies, is interconnected with global markets. Economic trends worldwide can influence exports, imports, and foreign investments.

What key factors contribute to India's status as the fastest-growing major economy?

India's large and dynamic consumer base and a burgeoning entrepreneurial ecosystem position it favorably for robust economic growth.

What factors are driving the surge in demand in India's aviation sector?

The surge in demand can be attributed to a combination of factors, including economic growth, increasing disposable incomes, and a growing preference for air travel.

How is IndiGo maintaining its dominant position in the market?

IndiGo's success is attributed to its efficient operations, customer-centric approach, and strategic route planning.

What role does government policy play in shaping the aviation sector in India?

Government policies, including regulatory frameworks and infrastructure development, have a crucial impact on the growth and sustainability of the aviation industry in India.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.