Introduction

In August, the Indian stock market witnessed an intriguing phenomenon as retail investors flocked to derivatives markets in record numbers, seemingly impervious to the warnings issued by market regulators.

Understanding Futures and Options

What are Futures and Options?

Futures and options are the major stock derivatives trading in a share market, which derive their value from an underlying asset. This could include company stock, broader stock market indices, commodities, ETFs, etc. These are contracts signed by two parties for trading a stock asset at a predetermined price on a later date, with gains or losses realized upon the expiry of the contract.

Regulator Warnings and Retail Response

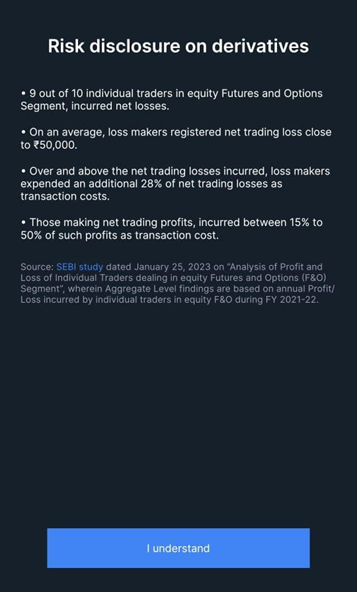

Previously, SEBI had asked brokers to run mandatory disclosures and warnings on the platform regarding the risks associated with trading in derivative products to educate and protect investors. Despite these efforts, the number of retail participants trading in derivatives on the NSE hit a record high in August.

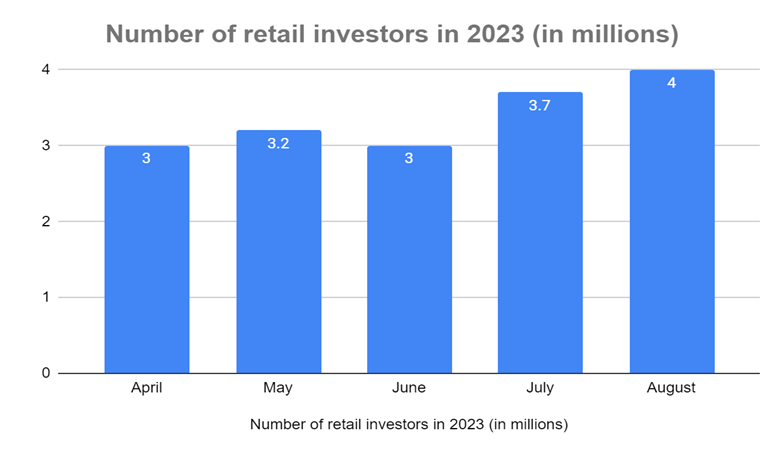

The number of traders increased to 4 million, up from 3.7 million in July, well above the average of 2.8 million per month during 2022-23.

Key Takeaways

According to research conducted by SEBI, it was found that 9 out of 10 traders lose money while trading in derivative options. Despite this, traders rushed to derivative products, driven by the growing popularity of relatively cheaper zero-day options that expire daily.

The Allure of Zero-Day Options

The low cost of zero-day options compared to monthly or weekly expiry options entices investors with the hope of unlimited gains. Moreover, with markets hitting all-time highs, this positive sentiment further fuels the trend.

Risk Management and Volatility

However, it is crucial to have a proper risk management strategy and understand the volatility of derivative products before trading them.

The surge in retail investors participating in derivatives markets in August highlights a growing trend in the Indian stock market. Despite warnings from regulators, the allure of potential gains, especially with zero-day options, has led to record-breaking numbers. However, investors must approach this market cautiously and have a solid risk management strategy.

Net Tax Collections for FY23 Surge by 23%

In a promising turn of events, the first half of FY24 witnessed a substantial 20% surge in the Center’s direct tax receipts, amounting to an impressive Rs 3.54 lakh crore as of September 15, 2023. This notable increase signifies a positive trajectory for India’s fiscal health and economic stability.

Corporate Taxes Lead the Way

Specifically, corporate tax collections took the lead, reaching an impressive Rs 2.80 lakh crore, demonstrating a remarkable rebound from the previous fiscal year. This surge can be attributed to increased profitability among corporations, particularly in the second quarter. Reduced input costs and a favorable business environment contributed to this commendable performance.

Personal Income Tax Contributions Show Steady Growth

Simultaneously, personal income tax contributions demonstrated steady growth, amounting to Rs 74,481 crore during the initial two quarters of the current fiscal year. This continued rise reflects a positive trend in individual earnings, indicating improved financial stability among citizens.

Comparative Analysis: FY23 vs. FY24

In contrast, during the first half of FY23, the advance tax collections stood at Rs 2.95 lakh crore, highlighting a substantial year-on-year improvement. This notable tax revenue surge indicates a strengthened economic landscape poised for further growth.

Gross Tax Collections and Refunds

As of September 15, the gross tax collections for FY23 reached an impressive Rs 9.85 lakh crore. It’s worth noting that the Center has issued refunds totaling Rs 1.22 lakh crore thus far this year. Consequently, the net tax collections for FY23 amounted to an outstanding Rs 8.63 lakh crore, reflecting a substantial year-on-year increase of 23%.

Key Takeaways

The healthy advance tax numbers suggest that the economic growth momentum has continued in the second quarter, as corroborated by various high-frequency indicators. Cumulative tax revenues are projected to reflect an even healthier trend by the end of the current month. This positive trajectory will be pivotal in offsetting the increasing fiscal deficit relative to the year-ago period.

Fiscal Planning and Economic Stability

The government’s original projection for direct tax collection in FY24 was Rs 18.20 lakh crore, with an estimated growth rate of 9.6%. While this growth rate may be slower than the previous fiscal year’s direct tax collection, it holds significant importance in maintaining control over the fiscal deficit. This is particularly crucial in light of the government’s need to front-load capital expenditures to stimulate economic growth amid global economic uncertainties.

For FY23, the initial budget estimate for direct tax revenue was Rs 14.2 lakh crore, later revised to Rs 16.5 lakh crore. However, the figure surpassed expectations, reaching an impressive Rs 16.61 lakh crore.

The surge in net tax collections for FY23 by a substantial 23% is a testament to India’s resilient economy. The robust corporate and personal income tax collection performance indicates a positive trajectory for the nation’s financial well-being. This upward trend provides a strong foundation for sustained economic growth in the coming years.

FAQs

What factors contributed to the surge in corporate tax collections?

The surge in corporate tax collections can be attributed to increased profitability among corporations, reduced input costs, and a favorable business environment.

How does the growth in personal income tax contributions impact the economy?

The steady growth in personal income tax contributions reflects improved financial stability among citizens, positively impacting overall economic health.

Why is controlling the fiscal deficit important for the government?

Controlling the fiscal deficit is crucial as it allows the government to maintain stability in the face of economic uncertainties and front-load capital expenditures to stimulate growth.

What does the positive trend in advance tax numbers signify for India's economy?

The positive trend in advance tax numbers indicates that the economic growth momentum has continued, as supported by various high-frequency indicators. This bodes well for the overall economic outlook.

Is trading in derivatives suitable for beginners?

Trading in derivatives can be complex and carries a higher level of risk. It is advisable for beginners to gain a thorough understanding and possibly seek professional advice before entering this market.

What are some common risk management strategies for derivative trading?

Risk management strategies include setting stop-loss orders, diversifying your portfolio, and avoiding over-leveraging.

Are there any tax implications for gains made in derivatives trading?

Tax regulations regarding gains from derivatives trading may vary by jurisdiction. It is recommended to consult with a tax professional or accountant for personalized advice.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.