Introduction

In the dynamic landscape of global economics, monitoring indicators that reflect a country’s financial health is crucial. One such indicator is the current account deficit, a term often heard but not always fully understood.

This article delves into India’s current account deficit, breaking down the numbers and dissecting the factors contributing to its fluctuations.

Q1FY24: A Narrowing Gap

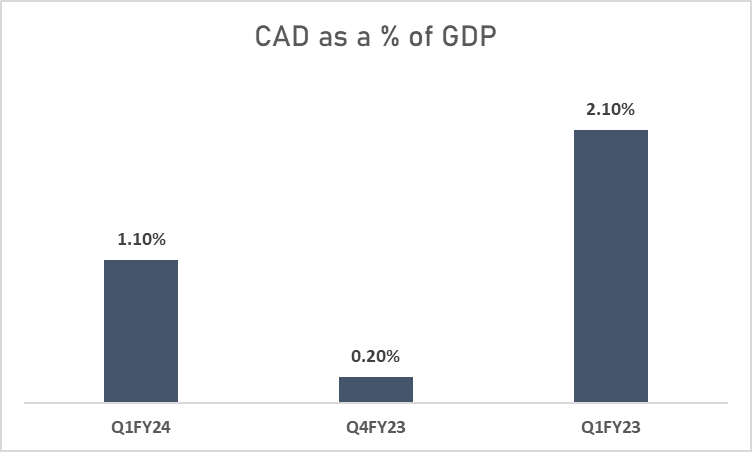

According to data from the Reserve Bank of India, in the first quarter of this financial year, India’s current account deficit widened slightly, reaching $9.2 billion, approximately 1.1% of the GDP. However, compared to the same period in the previous year, there’s a glimmer of improvement.

A Comparative Analysis

To put things in perspective, let’s rewind to the first quarter of the previous fiscal year (Q1FY23), where India faced a current account deficit of $17.9 billion, about 2.1% of the GDP. The contrast is evident, indicating progress.

Unpacking the Trade Deficit

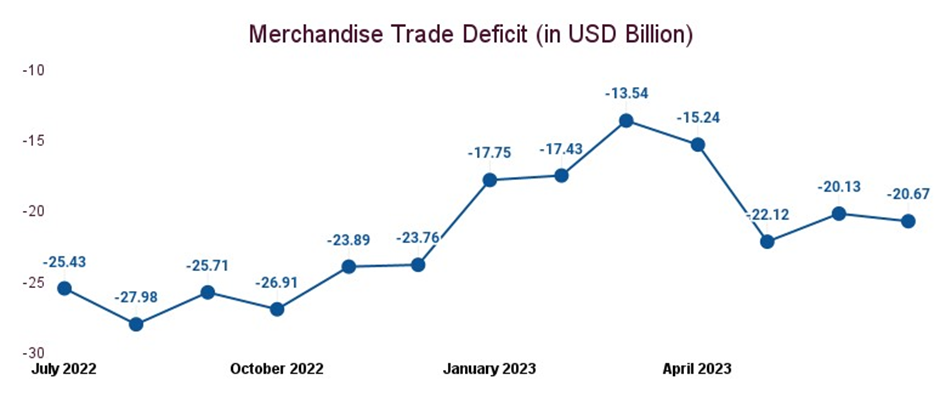

At the core of a current account deficit lies the trade deficit. This occurs when a country’s imports exceed its exports in terms of goods and services. Notably, the trade deficit often constitutes the largest portion of the current account deficit.

India’s Trade Scenario

Currently, India finds itself in a scenario where it’s purchasing more goods and services from other countries than it’s selling. This trend has contributed significantly to the widening of the current account deficit.

Slowdown in Merchandise Exports

India’s merchandise export slowdown is a prominent factor contributing to the widening deficit. Countries in the Western hemisphere and China show less interest in Indian products, leading to declining exports.

The Silver Lining: Service Exports

On a positive note, service exports are showing resilience, experiencing a notable surge of about 22.8% in the March quarter. However, concerns about the global market’s demand for software and banking services linger.

The Oil Conundrum

India’s heavy reliance on imported crude oil has become a significant factor in the deficit equation. With crude oil prices soaring, crossing the $90 per barrel mark in September and inching closer to $100, the current account deficit faces further expansion.

Projections for the Future

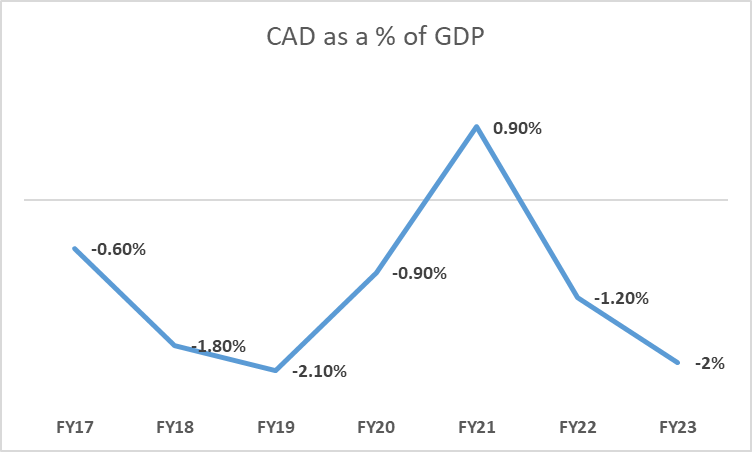

Research agency ICRA projects that India’s current account deficit could swell between $73 billion and $75 billion for 2024. This would constitute approximately 2.1% of the GDP, up from $67 billion, or 2% of the GDP, in the previous fiscal year.

India’s current account deficit paints a complex economic picture, influenced by many factors, including trade dynamics, export trends, and global commodity prices. While challenges persist, there are also opportunities for growth and resilience. Understanding these intricacies is essential for informed economic decision-making.

FAQs

What is a current account deficit?

A current account deficit occurs when a country's imports of goods and services exceed its exports, leading to a negative balance in its existing account.

How does the trade deficit impact the current account deficit?

The trade deficit, which represents the imbalance between a country's imports and exports of goods and services, is a significant component of the current account deficit.

What is the role of service exports in India's current account deficit?

Service exports have shown positive growth, counterbalancing the decline in merchandise exports. However, concerns exist regarding the sustainability of this trend.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.