Introduction

In 2023, promoters and PE/VC investors have seen a remarkable sell-down surge, surpassing previous years’ figures. This trend has significant implications for the financial landscape, indicating shifts in investment strategies and market dynamics.

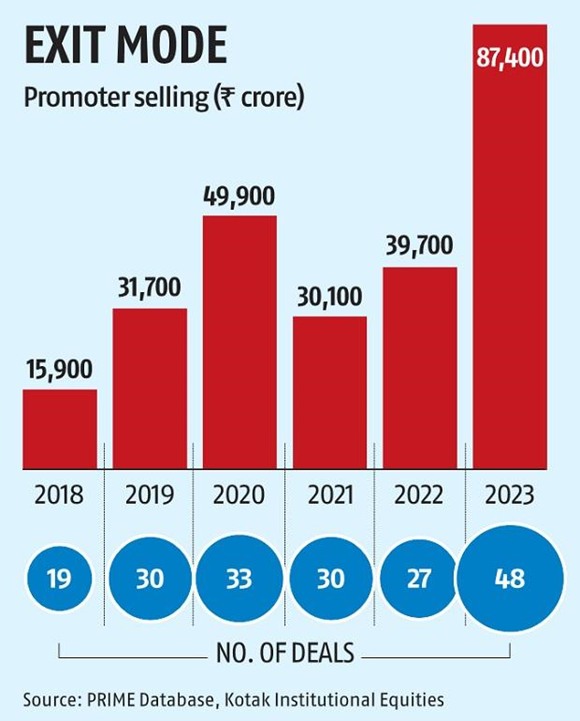

Offloading Equities: A Staggering ₹87,000 Crore (~$10 Billion)

Promoters have made a substantial move by offloading nearly ₹87,000 crore, which translates to approximately $10 billion in equities. This marks the highest sell-down in the past six years and is an astonishing 2.2 times more than the preceding year.

A closer look reveals that most promoter selling activity has been concentrated in key sectors. These include automobiles, components, capital goods, electric utilities, IT services, and transportation. Notably, from 2018 to 2023, insurance and IT services stood out as the primary sectors in which promoters opted to sell their holdings.

The Debt Management Factor

Many of these promoter sell-offs can be attributed to holding companies striving to raise funds for debt management within their promoter holding companies. This has been observed in prominent companies like Adani Group and Vedanta.

Strategic Exits: Portfolio Optimization in Focus

Another compelling aspect is the strategic exits undertaken by promoters for reasons such as portfolio optimization. A striking example is HDFC Life, where one of the promoters chose to exit the company for strategic purposes.

Favorable Market Conditions Driving Accelerated Exits

PE/VC investors, too, have been swift in their exits, a phenomenon influenced by favorable conditions in the secondary market. These conditions have provided them with an opportune moment to sell their holdings to a diverse set of foreign and domestic institutional investors and retail investors.

Market Valuations and Exit Timing

Private equity investments often span over multiple years, with exits strategically timed to coincide with periods of above-average market valuations. This synchronization of factors has contributed to the current surge in PE/VC investor sell-downs.

Key Takeaways

Promoter Ownership: A Decline in the BSE-200 Index

The sell-down surge has led to a noticeable decline in promoter ownership within the BSE-200 Index. This ownership has dipped from 50.3% in the December 2022 quarter to 48.8% in June 2023.

Domestic Investor Uptick: A 90 Basis Points Increase

Contrarily, domestic investors have displayed a noteworthy uptick. Their combined holdings have increased by 90 basis points, reaching 23.5% by the end of the June 2023 quarter.

FPIs: A Modest Uptick of 26 Basis Points

Foreign portfolio investors (FPIs) have witnessed a modest uptick of 26 basis points, bringing their ownership to 21.7% over the same period. Other investors, such as AIFs and PMS, have joined the upward trend, increasing their holdings by 31 basis points to 6%.

Implications for Indian Markets: Depth and Liquidity

These recent divestments by promoters and PE investors signal a growing depth and liquidity within Indian markets. This development enables the execution of large block deals with minimal discounts, signifying a maturing financial landscape.

The surge in sell-downs in 2023 reflects a dynamic shift in investment strategies and market dynamics. Promoters and PE/VC investors have seized opportunities in favorable market conditions. This trend has impacted ownership patterns and underlined the growing depth and liquidity of Indian markets.

FAQs

Why have promoters chosen to offload their holdings in 2023?

Promoters have been prompted to offload holdings primarily for debt management within their holding companies and for strategic portfolio optimization.

What sectors have seen the highest concentration of promoter sell-downs?

Sectors such as automobiles, capital goods, electric utilities, IT services, and transportation have witnessed the highest concentration of promoter selling activity.

What are the key takeaways from the surge in sell-downs?

The surge has led to shifts in ownership patterns, with domestic and foreign portfolio investors increasing their holdings, reflecting a maturing financial landscape.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.