Introduction

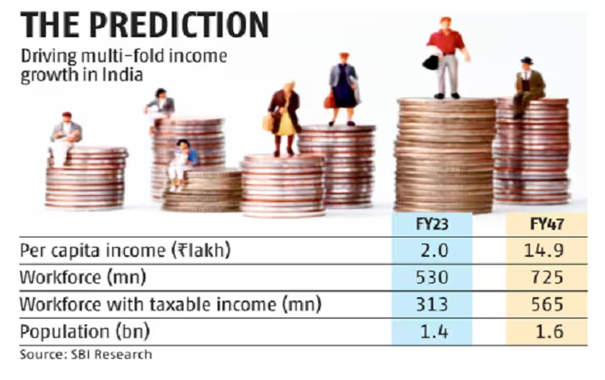

In a notable revelation, a recent report by the State Bank of India (SBI) has illuminated a remarkable prospective shift in India’s economic landscape. The report anticipates a substantial leap in the per capita income of Indians, forecasting a surge from the current 2 lakhs to an impressive 14.9 lakhs by the fiscal year 2047. The basis for this projection is rooted in a meticulous analysis of emerging patterns witnessed during the latest income tax returns filing cycle.

Decoding the Per Capita Income Metric: A Glimpse into the Report

Per Capita Income, a pivotal economic gauge, measures the average earnings attributed to each individual within a nation or specific geographical zone. The recently disclosed SBI report anticipates a robust escalation in this metric, with the per capita income projected to ascend to a noteworthy Rs. 14.9 lahks (equivalent to $12,400) by the fiscal year 2047. This remarkable uptick is attributed to the instrumental contribution of India’s burgeoning middle-income demographic, which is anticipated to play a pivotal role in bolstering the nation’s overall economic trajectory.

Shifting Trends and Positive Implications

A pivotal observation emphasized in the report is the projected shift in the taxpayer landscape. The report predicts a substantial 25% migration of taxpayers from the lower-income stratum to the middle and upper-income brackets. This notable trend underscores a positive paradigm shift in income distribution patterns, reflecting encouraging economic progress.

Moreover, the report sheds light on an anticipated exponential surge in individuals actively participating in the income tax return filing process. A staggering 588% forecasted growth is projected to result in a tally of 48.2 crore (482 million) tax filers by FY47. This upward trajectory is seamlessly aligned with the anticipated expansion of the Indian workforce, set to elevate from 53 crore (530 million) to 72.5 crore (725 million) individuals.

Key Takeaways

The prospect of attaining a per capita income of 14.9 lahks by FY47 presents a substantial milestone for India’s economic journey. This accomplishment is impeccably timed to coincide with India’s celebration of 100 years of independence, signaling an emblematic shift towards a developed financial status.

According to the SBI report, an unmistakable trend has already commenced, with 13.6% of the populace effectively transitioning away from the lower-income strata. This transition marks a promising development, reflecting the nation’s forward trajectory.

The encouraging course of India’s economic growth is underpinned by its inherent capabilities, abundant resources, and demographic advantage, all poised to synergistically contribute to its burgeoning prosperity. As India charts its course toward the centenary mark, the projected rise in per capita income is a testament to the nation’s economic dynamism and steadfast dedication to a thriving future.

FAQs

What does “Per Capita Income” signify?

Per Capita Income is a statistical measurement that quantifies the average earnings attributed to each individual within a specific nation or geographic region.

What is the foundation for this optimistic projection?

The projection of a per capita income of Rs. 14.9 lahks by FY47 is grounded in a meticulous analysis of emerging trends evident during the most recent income tax returns filing process, as elaborated in the SBI report.

What factors contribute to this projected surge?

The upward trajectory of per capita income is primarily attributed to the substantive contribution of India’s burgeoning middle-income class, which is anticipated to significantly bolster the overall economy.

Does the report outline any alterations in income distribution?

The report underscores a notable trend indicating an estimated 25% shift of taxpayers from the lower-income stratum to the middle and upper-income brackets, signifying a positive change in income distribution patterns.

Are there projections concerning the number of individuals participating in income tax filing?

The report predicts a remarkable 588% growth in individuals engaged in the income tax return filing process, reaching an estimated 48.2 crore (482 million) by FY47. This growth trajectory aligns harmoniously with the anticipated workforce expansion, forecasted to elevate from 53 crore (530 million) to 72.5 crore (725 million).

Navigating Change: Transforming India’s Banking Sector in the Wake of Crisis

In a recent evaluation that took center stage during our deliberations in the third umpire session, the pivotal role of credit rating agencies like Fitch, Moody’s, and S&P in assessing countries’ creditworthiness was meticulously examined. These agencies wield significant influence in shaping our comprehension of financial stability, an aspect that can’t be overlooked.

Fitch’s Vision for India’s Banking Sector

Drawing the spotlight onto the domain of credit rating agencies, Fitch, a prominent player in this arena, has illuminated a heartening evolution within India’s banking landscape post-pandemic. These financial institutions have displayed remarkable resilience, bolstering their capital reserves and streamlining their financial portfolios. In a unique twist, the gross non-performing asset ratio witnessed a striking drop to an impressive 3.9% by March 2023, marking its lowest point in a decade. This achievement speaks volumes about the sector’s commendable progress.

Anticipating a Positive Trajectory

Yet, Fitch’s strategic outlook for India’s banking sector captures our attention even more profoundly. Given the nation’s formidable economic prowess and a demographic dividend, the horizon appears ripe with opportunities for banks to cultivate lucrative avenues while expertly navigating the dynamics of risk and revenue. The potential that lies within this landscape is undoubtedly captivating.

Fitch’s forecast extends to the gradual formalization of the Small and Medium-sized Enterprises (SME) sector, orchestrated through transformative initiatives like the Goods and Services Tax (GST) and the rapid integration of digital systems, encompassing payment mechanisms. These endeavors are poised to enhance service quality and mitigate risk exposure while catering to this substantial market segment.

Key Takeaways

Summing up, the trajectory of India’s banking sector is undergoing a profound shift, fueled by a potent blend of post-pandemic financial fortification, the harnessing of the nation’s economic might, and a deep dive into the evolving SME landscape. The stage is unequivocally set for these financial institutions to flourish within the dynamic realm of ever-changing fiscal landscapes. As India’s banking sector continues to metamorphose, these institutions seem poised to seize the opportunities ahead, elevating their role in driving the nation’s economic narrative.

FAQs

What role do credit rating agencies like Fitch play in the financial landscape?

Credit rating agencies such as Fitch, Moody’s, and S&P are pivotal in evaluating countries’ creditworthiness, significantly influencing our understanding of financial stability.

What positive changes has Fitch identified in India’s banking sector post-pandemic?

Fitch’s evaluation highlights a resilient banking sector that has bolstered capital reserves and achieved a remarkable drop in gross non-performing asset ratio to 3.9% by March 2023, the lowest in a decade.

How does Fitch see the future for India’s banks?

Fitch envisions a promising trajectory for Indian banks, capitalizing on the nation’s economic strength and demographic advantages. The evolving Small and Medium-sized Enterprises (SME) sector, propelled by initiatives like GST and digitalization, is expected to offer new growth avenues while managing risk exposure.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.