Introduction

In today’s global financial landscape, an interesting trend has emerged, indicating a shift in investor sentiment towards China and other emerging markets in Asia. A recent article highlights how China’s investor optimism is waning, with overseas investments flowing into other Asian markets, excluding China, for the first time in six years. This shift has been fueled by various factors, including economic challenges China faces post-COVID recovery, attractive opportunities in India, and AI-driven investments.

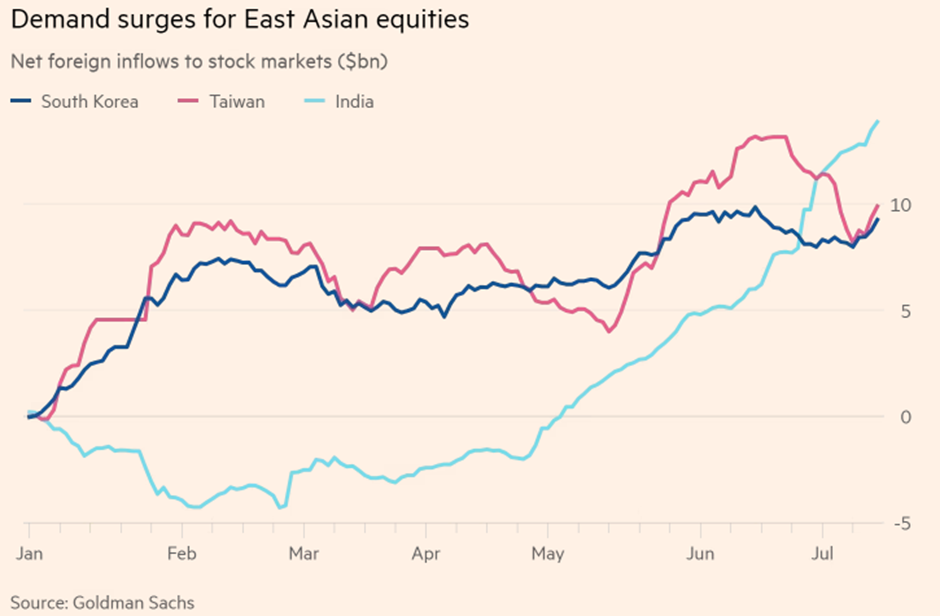

Foreign Funds Flow Shifts in Asian Emerging Markets: According to data compiled by Goldman Sachs, the past year has seen a significant change in foreign investment patterns in Asian emerging markets.

The chart below illustrates the inflow and outflow of funds over the last two years

- Outflow from Asian markets (excluding China): The region experienced an outflow of funds totaling $76.6 billion in the previous year. This negative trend was primarily driven by economic uncertainties and challenges in the aftermath of the COVID-19 pandemic.

- Inflow into Asian markets (excluding China): In contrast, the recent year witnessed a turnaround as foreign investors poured more than $41 billion into Asian markets, excluding China. This surge in investments indicates a growing interest in the region’s potential.

China’s Changing Economic Landscape: One of the primary reasons behind the shifting investor sentiment towards China is the changing economic landscape in the country. Previously, there were high expectations for China’s post-COVID economic recovery. However, recent economic data releases have painted a different picture:

- GDP Shortfall: China’s GDP fell short of expectations, indicating challenges in the country’s economic growth.

- Export Demand Decline: Export demand has been falling, posing additional headwinds to the country’s economic prospects.

- Property Sector Downturn: The property sector is experiencing a downturn, impacting investor confidence in the real estate market.

- High Unemployment: China’s persistently high unemployment rate raises concerns about the overall economic health.

Key Takeaways

Shift towards India and AI-Driven Investments: In light of China’s economic challenges, foreign investors have redirected their attention to other lucrative investment opportunities, betting on two key themes:

- Buy AI-Driven: The rise of Artificial Intelligence (AI) has spurred inflows into Taiwan and South Korean markets, where AI-driven technologies and innovations present attractive prospects.

- Buy India: India has emerged as an alternative to China, drawing foreign investors’ attention due to its robust economic growth and the expectation of benefiting from the ongoing shift in supply chains away from China.

World Bank President’s Perspective on India: World Bank President Ajay Bagga has offered an interesting perspective on India’s potential as an alternative investment destination. We’ll delve into his insights later, but it is evident that India is increasingly gaining favor among international investors.

China’s investor optimism is declining, with foreign funds flowing into other Asian markets, due to a few economic challenges in China and attractive opportunities elsewhere.

India’s growing significance as an investment hotspot, coupled with the rise of AI-driven technologies in Taiwan and South Korea, points towards a dynamic shift in the Asian investment landscape. As the global economic scenario continues to evolve, keeping an eye on these trends can offer valuable insights for investors and businesses alike.

India’s Economy Shows Resilience Amidst Global Headwinds: Investment Flows Soar

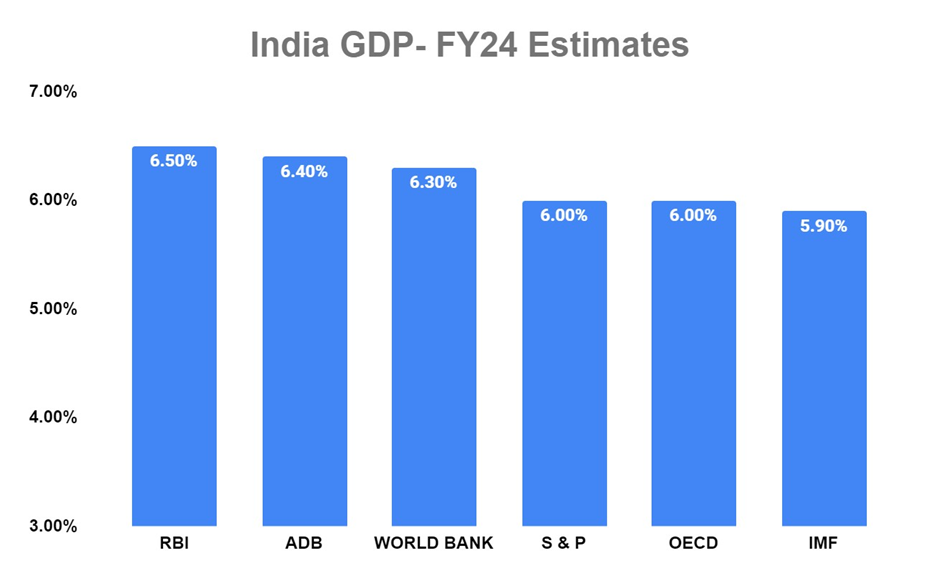

In the midst of various challenges, India’s economy has demonstrated remarkable resilience, attracting substantial investment flows into the country. Recent news from the Asian Development Bank (ADB) confirms this positive trend, as they maintain their economic growth forecast for India at 6.4% for FY23 (see chart below).

This projection comes in light of a recovery in consumption demand in rural and urban areas, although the ADB has also highlighted concerns about the ongoing global slowdown.

Several other reputable agencies have weighed in on India’s growth prospects, with estimates ranging from 5.9% to 6.5%. The International Monetary Fund (IMF) has set the least optimistic forecast at 5.9%, while the Reserve Bank of India (RBI) maintains the highest at 6.5%.

Although these growth figures may not seem extraordinary, it’s essential to acknowledge that they are achieved amid numerous global headwinds. Despite this, India is poised to become the fastest-growing major economy worldwide, a testament to its resilience and economic potential.

World Bank President Mr. Ajay Banga recently emphasized India’s unique opportunity to capitalize on the “China + 1” strategy. As companies seek alternatives to manufacturing in China, India has a 3 to 5-year window to attract these investments and become a preferred destination for setting up manufacturing facilities. If India can successfully leverage this opportunity, it could have a significant impact on driving economic growth.

The prospects for India’s economy look promising, given its ability to navigate challenging circumstances and capitalize on emerging opportunities. The sustained investment flows and a strong growth trajectory paint a hopeful picture for the country’s economic future.

As the world keeps a close watch on India’s performance, it remains to be seen how the nation will transform this potential into reality and maintain its position as a leading global economy.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.