Introduction:

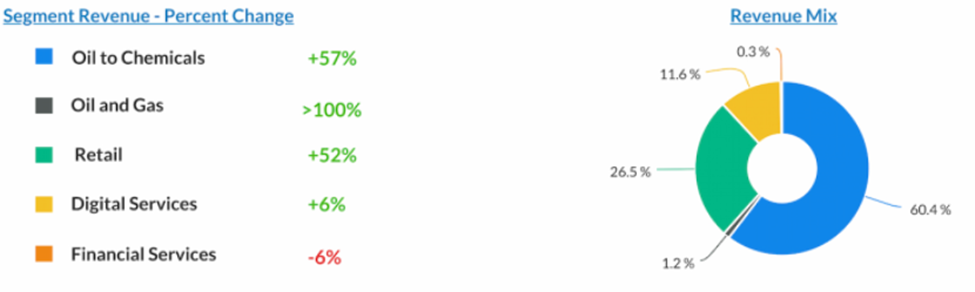

Reliance Industries has been causing a stir in the market lately. Let’s delve into the reasons behind this buzz. As a conglomerate, Reliance operates across diverse industries under one corporate group. These verticals include O2C (oil to chemicals), oil and gas exploration, retail, digital, and financial services.

Demerger of Reliance Industries’ Financial Services: In a recent development, Reliance Industries has announced the demerger of its financial services vertical. This significant move is captured in the image below and is slated to take effect on the 20th of July.

Jio Financial Services: A New Listing: Previously known as Reliance Strategic Investments Ltd, the financial services arm will now be listed on the stock exchanges as Jio Financial Services Ltd.

Key Highlights of the Demerger and Takeaways:

- Ratio: The demerger ratio is set at 1:1. For every share of Reliance Industries (RIL) held, shareholders will receive one share of Jio Financial.

- Record Date: Investors holding Reliance shares before the 20th of July will be eligible to receive Jio Financial Services shares.

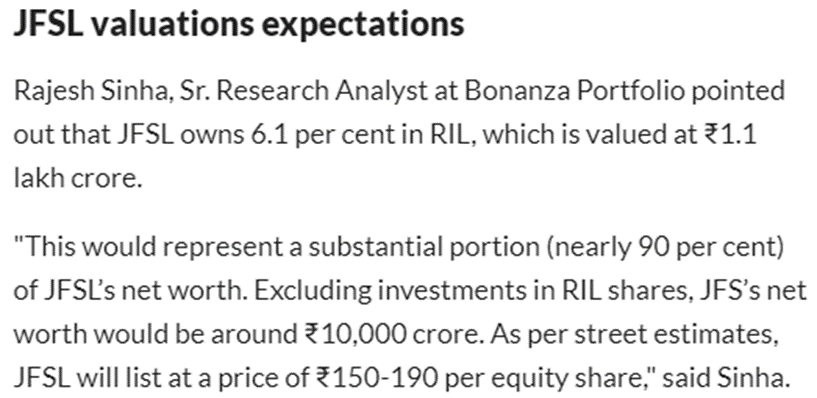

- Jio Financial’s Stake: Jio Financial will possess 413 million treasury shares of Reliance, equating to a 6.1% stake in Reliance Industries.

Special Pre-Open Session: To minimize volatility and determine the opening price after the demerger, the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) will conduct a special pre-open session from 9 am to 10 am on the 20th of July.

Jio Financial Services in Indexes:

Once the demerger takes effect, Jio Financial Services will become the 51st entity in the Nifty 50 index and will feature in 18 other indexes for a period of three days. Its inclusion in these indexes will continue until Reliance Industries announces the allotment and listing date for Jio Financial Services. During this period, shares of the demerged entity will not be tradable.

As per sources, the JFSL will list at a price of 150 -190 per equity share through the price discovery method which will happen during the pre open session and this price would be reduced from Reliance Industries once de-merger is successful.

The demerger of Reliance Industries’ financial services vertical marks a significant development for the conglomerate. Jio Financial Services’ emergence as a separate entity brings new opportunities and potential benefits for Reliance Industries and its shareholders. Stay tuned for further updates on the allotment and listing date as Jio Financial Services paves into the financial landscape.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 25

No votes so far! Be the first to rate this post.