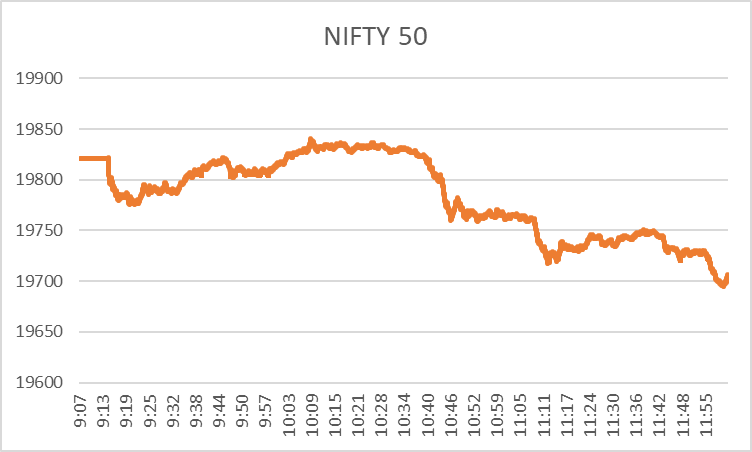

As the global stock markets have again come under threat with the escalation in the Israel-Hamas war, the effect can also be felt in the domestic market. Nifty 50 fell by 0.25% during the first hour of today’s market session, with most of the sectoral indices in the red. The broad market equity index has again fallen below the 19800 level and is currently at around 19726.35 as of 11.19 a.m.

Another fear of the investors is becoming true: the rising price of crude oil. Internationally, the oil prices have surged after the new attacks by Israel. The Brent futures have risen to $91.7 per barrel. However, the Indian government reduced taxes on petroleum products effective today, which has kept little stability in the domestic share market until now.

Sectors in the Green

The share market today can be said to be driven by the pharma and healthcare industry. These two sectors have gained the most until now. Let’s see what’s working for them.

NSE Pharma Sector Today

The pharma sector has become the shield for the stock market today as it is the best-performing sector until now. The Nifty Pharma index has gained around 0.96% until 11.25 a.m. The stocks that are helping the sectoral index to move up include –

- Cipla has gained 3.43% during the day and is one of the top gainers on NSE. The stock has surged as the investors are waiting for the earnings report for the quarter and half-year, as announced to be released on the 27th of this month.

- Sun Pharma is the next stock, pulling the pharma sector upward. It has gone up by 1.99% until 11.28 a.m. Again, the announcement of the release of quarterly results of the business is the prime reason behind the surge in the stock price. The company announced yesterday that they would come up with the results on 1 November 2023.

NSE Healthcare Sector Today

The healthcare sector has been in the share market today, which can be understood by the rise of 0.79% in the Nifty Healthcare index. The stocks, which are the primary force behind this increase, are the same as those of Pharma sector stocks – Cipla and Sun Pharma. Apart from these two, there are –

- Dr Reddy has gained 1.97% until now, and again, the prime reason is the upcoming release of its quarterly and half-yearly results as of the 27th of this month.

- Metropolis Healthcare is the next on the list, which has gained 1.68% due to an overall sectoral upswing.

Sectors in the Red

The share market today is highly volatile. This can be easily understood as the sectors that were the top performing sectors yesterday are down today. Financial services and PSU banks are amongst the worst performers.

NSE Financial Services Sector Today

The Financial Services sector is in the red today. The Nifty Financial Services Index has dropped by 1.09%, and it is mainly pulled down by –

- ICICI Prudential Life tanked by 3.41% during the first two hours of the day. The price is going south even though the company posted growth in its profit for the second quarter of FY24 and half-yearly results for the FY.

- Bajaj Finance lost 2.14% until now after announcing the preferential share issue and acquisition news.

NSE PSU Bank Sector Today

After gaining in the previous session, PSU Banks are witnessing a blood bath today. Almost all the Nifty PSU Bank index stocks are in the red except Indian Bank, which has gained a little until now in the share market. The index has fallen by 1.19% as of 11.59 a.m., and the stocks that are pulling it down the most include –

- Central Bank, which fell by 3.18% until now. The corporate results of this public sector bank for the September quarter are due on the 21st of this month.

- UCO Bank is also down by 2.79% today due to overall market sluggishness and the sectoral downfall.

The markets are highly volatile and filled with mixed sentiments today. As the global market is in turmoil, so is the domestic market. The gains generated yesterday by the domestic market have been washed away today as there is an upsurge in the ongoing tension in the Middle East.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/