What is the first thing you do when you plan to take a vacation or travel for work? Of course, like most of us, you search for hotels, flights, and trains on travel websites, don’t you? But what has become a norm today was impossible two decades ago.

How, then, did travel bookings become this quick and simple? One brand was the first to set off the digital revolution in travel, followed by the rest.

Do you want to know how this brand went from losing a chunk of its $2 million investment to a market cap of $6.61 billion today? Keep reading

Failing – The First Step to Success

Born in Hyderabad, he is an alumnus of St Stephen’s College and IIM Ahmedabad.

He quit his high-paying job at ABN AMRO Bank and launched AMF Bowling in India to tap into the family entertainment boom.

However, concept adoption was low, so the venture did not work, and he was back to square one.

An Entrepreneur and the Birth of a Brand

Deep started working at GE Capital after his first venture failed, but he wanted to do more. So, he quit his job and took a year-long sabbatical.

During this year, he traveled a lot and found travel planning extremely tedious, with nosy travel agents and double-sided brokers.

The travel planning was messier, and Deep thought the Internet could organize this industry better. That’s when he started Make My Trip.

MMT’s Launch and Growth

In 2000, Deep, with three of his friends, Keyur Joshi, Rajesh Magow, and Sachin Bhatia, established Make My Trip. In 2001, India was still understanding the Internet, so Deep started catering to foreigners for their US-India trips.

Customers flocked to this website to book their trips. With an e-Ventures investment of $2 million, Deep and his friends took on the old-school travel agents to make travel planning easy and cheap. But soon, it came crashing down.

A Dream Start and A Dot-Com Bust

MMT’s initial journey mirrored a rollercoaster ride. A promising $2 million investment, with another million upon reaching a milestone, fueled a dream start. But then came the dot-com bust, leaving the promised million out of reach.

To make matters worse, investors demanded a portion of their initial investment back to repay their limited partners. When most companies collapsed, MMT chose to fight.

The team size shrunk from 40 to 20, the expensive office space became a cramped mezzanine floor, and eVentures wound up its business while Deep used his life savings to buy back his company. Senior management, including Deep, took a massive pay cut, and the rest of the team put their salary hikes on hold.

Relaunching with Renewed Hope

For the next three years, Deep focused on Indo-US customers while trying to maintain profitability. Their rough bootstrapping laid the foundation for the future.

At the same time, IRCTC launched online train tickets, helping Indians become comfortable planning travel online, which led to more Internet users. Five years after setting up the business, MakeMyTrip started operations in India again.

First Mover Advantage And Expansion

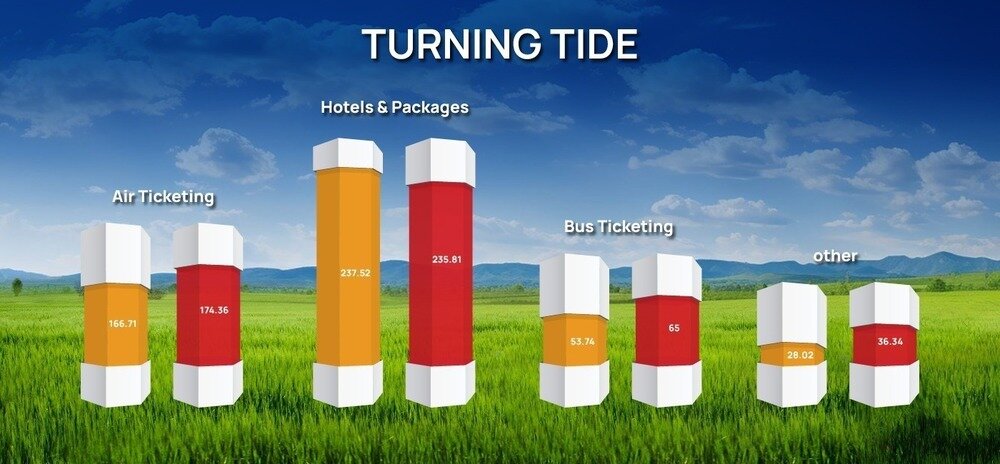

Their successes and first-mover advantage brought in more Venture funds. With the money, Deep expanded, and MMT sold online flight tickets, riding the wave of secure online payments (thanks to IRCTC) and the rise of budget airlines offering attractive fares.

MMT built direct connections between users and airlines, allowing Indian travelers to plan trips directly.

In 2008, MMT’s revenue reached 1,000 crores, and it served over 20 lakh customers. It became the most visited travel website in India after IRCTC. MMT launched new storefronts and crossed a remarkable milestone—the ₹1,000-crore mark.

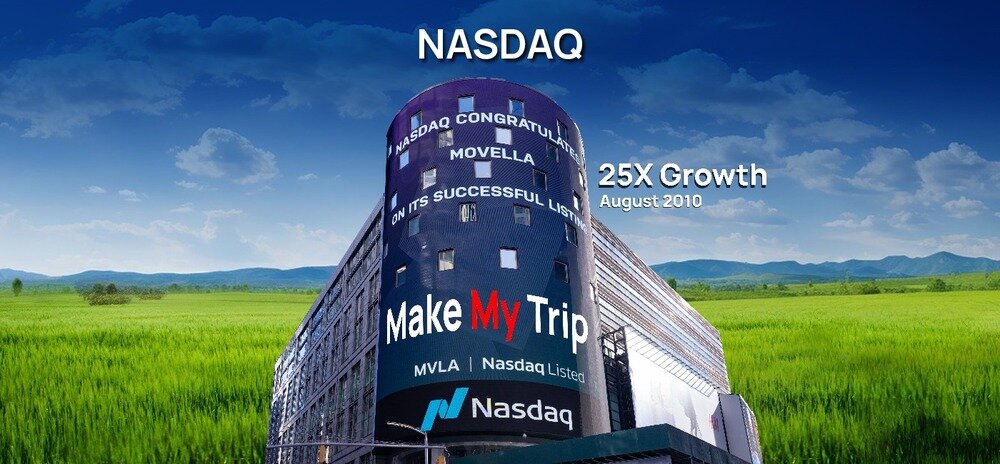

NASDAQ Listing and 25X Growth

The first four years post-relaunch saw MMT experience phenomenal growth. From a $20 million in topline growth and $2 million in revenue, they reached a valuation of $500 million at the time of their NASDAQ listing in August 2010.

That’s a 25X growth in just five years, with revenues reaching a staggering $60 million.

2011 and 2012 were the first years MMT finally turned a profit, leaving the red zone behind.

Breaking Even

After choppy runs, Deep announced a significant milestone in December 2018 – MMT was on track to break even in FY2020.

Business was booming, with record revenues between October and December 2019. The future looked bright. However, the pandemic had other plans.

And the Pandemic Blues

Travel screeched to a halt in March 2020, but MMT limited its losses even then. Lockdowns, however, meant their profit plans came crashing down, and losses piled up.

Revenues dipped dramatically—95% year over year and then 82% in the following quarters. MMT cut costs wherever possible, like marketing budgets, and hunkered down for the storm.

Through a Full-Service Experience

While the pandemic brought fresh challenges, it also allowed MMT to reinvent itself. As Deep Kalra and Group CEO Rajesh took another pay cut, the company made some strategic decisions.

MMT recognized the need to diversify beyond just flight bookings and hotel aggregation. This period saw the birth of several new platforms:

MyBiz: Tailored solutions for corporate travel needs.

MyPartner: A platform empowering travel agents to leverage MMT’s reach and technology.

MyAffiliate: An API platform allowing businesses to integrate MMT’s travel booking services.

Trip Money: A travel-focused fintech solution for seamless transactions.

Continuing on a New High

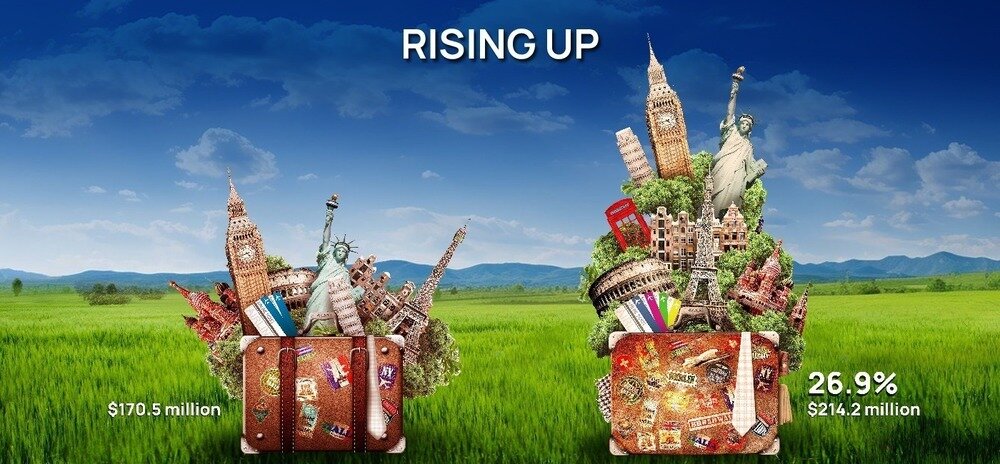

MMT has achieved its biggest growth quarter ever, with a net profit of $24.2 million, a way up from the previous year.

Total revenue also jumped by 26.9% to $214.2 million, compared to $170.5 million the previous year.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 14

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/