Ever check your phone and see a news alert about a massive stock sale? It can be head-turning, especially involving a big name like Tata Consultancy Services (TCS). This week, the Tata Group, the parent company of TCS, announced plans to sell a portion of its stake in the IT giant. So, what’s going on? Let’s break it down.

Tata Sons, the investment arm of the Tata Group, has announced plans to sell up to 23.4 crore (234 million) shares of TCS through block deals. In simpler terms, they’re offering a large chunk of their TCS ownership to institutional investors in one big transaction, aiming to raise a cool ₹9,362.3 crore (approximately $1.1 billion). That’s a hefty sum, but it only represents about 0.65% of TCS’s outstanding shares.

The Impact on TCS

Following the announcement, shares of TCS dropped by 3% in the early hours of trading today. Selling such a small percentage of shares shouldn’t majorly impact the company’s day-to-day operations. TCS remains a titan in the IT industry, and its long-term prospects are generally considered strong. However, some investors might be watching the situation closely. A large block sale can sometimes create temporary volatility in a stock’s price.

Tata Sons hasn’t exactly been shy about selling TCS shares. They’ve used similar block deals to raise funds before. This could simply be another instance of them optimizing their portfolio and freeing up capital for other ventures within the Tata Group.

Why Is Tata Sons Selling?

For Tata Sons, the success of this deal depends on attracting investors willing to pay a premium for such a large block of shares. Negotiating a reasonable price will be vital to maximizing their return. Tata Sons derives its income mainly from dividends and buybacks in group firms, which it uses to invest in emerging segments or support weaker businesses. TCS, the group’s primary funding source, has been generous.

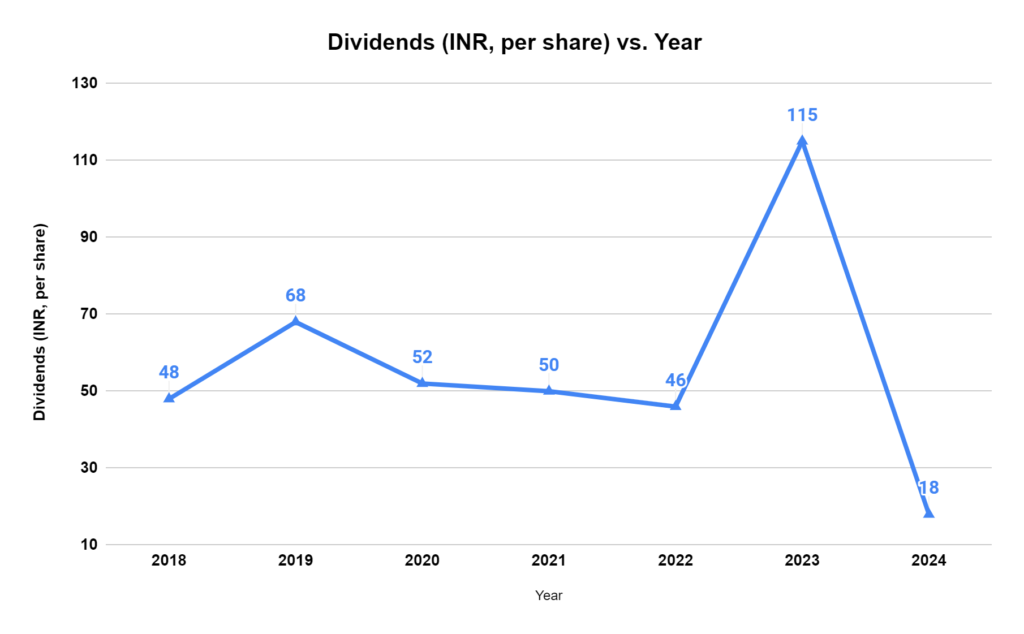

TCS has a history of paying dividends to shareholders for the past 6 years. While they recently declared a very high dividend, 11500% or ₹115 per share for the year ending March 2023, this is likely a one-time increase. Typically, the average dividend per share is around ₹52.8 (resulting in a 2.77% yield at the current share price). It’s important to note that the current dividend only covers January 2024, and more dividends are expected throughout the year, potentially increasing the overall yield for 2024.

Over the years, it has increased dividend payments from ₹29,148 crore in FY19 to ₹42,079 crore in FY23, an increase of 44.4%. It has also conducted several buybacks worth ₹67,000 crore since 2018, at prices ranging from ₹2,100 per share in June 2018 to a whopping ₹4,500 per share in January 2022. Most recently, in November 2023, it announced a ₹17,000-crore buyback at ₹4,150 per share. In 2021, TCS returned about 95% of free cash flow to shareholders. Last year, it handed out an even more staggering 108.2% of its free cash flow!

What Will Be The Long-term Impact on Tata Sons?

The long-term impact is a bit more uncertain. It’s important to remember that Tata Sons still holds a significant stake in TCS – around 72.4% after this sale. So, they’re still very much invested in the company’s success. However, this move raises some questions about their plans for TCS ownership. Will they continue to reduce their stake over time? Only time will tell.

Also Read: Top Semiconductor Stocks in India

What Does This Mean for Investors?

In the short term, there could be some fluctuations in TCS’s stock price as the block deal is executed. However, historically, TCS has proven to be a resilient company with solid fundamentals. So, a temporary dip shouldn’t necessarily be a reason to jump ship.

Tata’s Ambitious Plans

The Tata Group has some big dreams. They want to expand their airline business, set up semiconductor plants, and build a super app. These are ambitious ventures, and in the past three fiscal years (FY21, FY22, and FY23), they’ve already given $9 billion to Tata Sons to bankroll them. Selling a portion of their TCS stake could be a way to raise additional capital to fuel these ambitious plans.

So, What Should You Do?

Don’t make any rash decisions based on this news alone. Do your research, consider your investment goals, and talk to a financial advisor if needed.

The Tata Group selling a portion of its TCS stake is undoubtedly a significant move. But it’s essential to keep it in perspective. This might just be a chapter in the Tata Group’s ongoing story, not the end of the book.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Know more about

IPOs | Current IPOs | Upcoming IPOs| Listed IPOs

How useful was this post?

Click on a star to rate it!

Average rating 3.4 / 5. Vote count: 9

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/