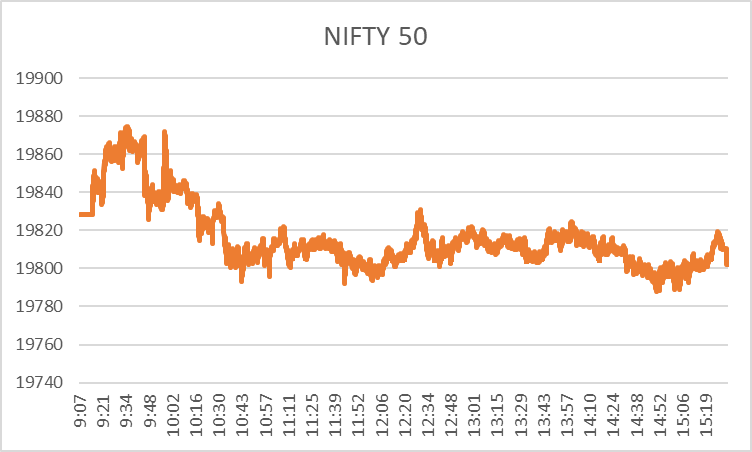

Indian stock market was flat today, with most of the sectors gaining marginally except the realty sector gaining and the pharma and healthcare sector losing significantly. Nifty 50 ended at a low of 0.05% from yesterday’s closing price of 19811.85 and closed today around 19802.

With the upcoming holidays in the West, the markets globally are having mixed sentiments and fear over further rise in crude prices. It also affects the domestic markets, which have been sluggish throughout the day.

However, the constituents of the Nifty 50’s broad market index formed a unique symmetry today, with 25 nifty gainers and the remaining 25 nifty losers.

Look at the top five nifty gainers and losers today on NSE.

Top 5 Nifty Gainer Stocks Today

| Stocks | Previous Day’s Closing Price | LTP | Change (%) |

| HEROMOTOCO | 3,413.60 | 3,568.00 | 4.52 |

| BAJAJ-AUTO | 5,751.55 | 5,932.00 | 3.14 |

| BPCL | 402.1 | 411.05 | 2.23 |

| INDUSINDBK | 1,470.40 | 1,487.00 | 1.13 |

| EICHERMOT | 3,833.80 | 3,875.00 | 1.07 |

- Hero Moto Corp: India’s favorite automobile company today jumped 4.52% and became the top nifty gainer of the day. The stock price has been rising constantly for the past month due to the surge in demand for the festive season. Behind the surge of the stock, there has also been an influence of the overall auto sector, which has gone up today and ended in the green.

- Bajaj Auto: The second top nifty gainer today, is the second-most favorite two-wheeler company in the country after Hero, which is Bajaj Auto. This stock rose by 3.14%, and its investors’ meeting is due tomorrow. While the auto sector’s upswing is a reason here as well, the decreasing crude prices across the globe are also behind the surge of these auto stocks.

- BPCL: The next top nifty gainer is an oil & gas company, which increased by 2.23% following the OPEC’s postponing its meeting. The crude prices declined 4% during the early hours of the day, which boosted this domestic oil & gas company.

- IndusInd Bank: This private sector bank also made it to the top Nifty gainer today. The stock gained 1.13% during today’s session, which is a result of its promising Q2 results released two days back. The financial sector, though, was sluggish, ending flat today.

- Eicher Motor: Another auto stock on this list of nifty gainers that gained 1.07% following the drop in oil prices and surge in the auto sector.

Top 5 Nifty Loser Stocks Today

| Stocks | Previous Day’s Closing Price | LTP | Change (%) |

| CIPLA | 1,271.50 | 1,174.40 | -7.64 |

| ULTRACEMCO | 8,759.90 | 8,604.55 | -1.77 |

| SBILIFE | 1,430.10 | 1,408.10 | -1.54 |

| LTIM | 5,553.65 | 5,470.35 | -1.5 |

| LT | 3,082.30 | 3,051.15 | -1.01 |

- Cipla: As the pharma sector tanked today, Cipla was the most affected company. The stock tanked by 7.64% following the release of the warning letter received by the firm for the inspection carried out in its Pithampur manufacturing unit by the USFDA.

- Ultratech Cement: While the realty sector was up during today’s session, this cement manufacturing company’s stock price dipped 1.77% following its investors’ meeting and the release of the Q2 results yesterday. However, the company’s domestic sales have grown by 15% on a YoY basis, and EBITDA has increased by 17.6%.

- SBI Life: The financial service company operating in the insurance space lost 1.54% during the day, purely based on the sluggish market movement, especially in the financial service sector.

- LTIM: After consecutive rise in the IT sector, this IT stock fell from Rs. 5553.65 to Rs. 5470.35, a decline of around 1.50%. However, the company launched its Quantum-Safe VPN Link in the UK today.

- L&T: The IT segment of L&T, the leading infrastructure or construction company, dipped by 1.01% following the sluggish market sentiments.

Today’s domestic market was divided, with both nifty losers and gainers. As crude prices tumbled, most gainers were from the auto sector or oil & gas. The losers are from different sectors, but the most significant blow came from the pharma sector in the form of Cipla.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/