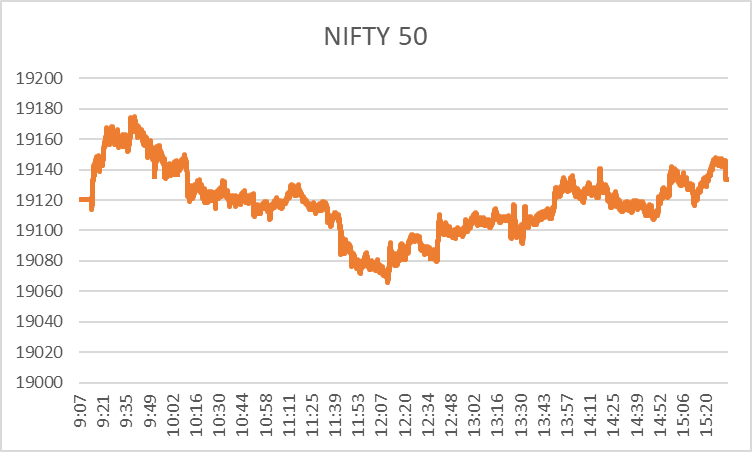

As the Fed kept rates unchanged in yesterday’s policy meeting, the market felt relieved. The domestic market ended in green after its weeklong decline. Nifty 50, the equity broad market index of NSE, ended with a gain of 0.76% and again went above the 19000 level, which was breached yesterday due to the consistent fall of the market.

Nifty 50’s 42 stocks went up today, pulling the index and the market above. However, eight stocks ended in the red, and a few decreased significantly. Let’s take a look at top gainers stocks and top losers today.

Top 5 Gainer Stocks Today

| Stocks | Previous Day’s Closing Price | LTP | Change (%) |

| BRITANNIA | 4,397.30 | 4,528.00 | 2.97 |

| HINDALCO | 462.7 | 475.1 | 2.68 |

| INDUSINDBK | 1,432.60 | 1,462.75 | 2.1 |

| APOLLOHOSP | 4,796.55 | 4,890.00 | 1.95 |

| EICHERMOT | 3,282.25 | 3,339.90 | 1.76 |

- Britannia Industries Ltd.: With a rise of 2.97% during today’s market session, it is the top gainer stock today. The stocks closed at 4528, up from its previous close at 4397.30. In the past two market sessions, the stock lost significantly, which has been again made up with today’s gain. This rise can be linked to the Q2 results, which have a 21% rise in the company’s operating profits.

- Hindalco Industries Ltd.: This stock has gained for the past two market sessions. Today, it gained 2.68% following the announcement of its scheduled meeting for a board meeting and Q2 results on 10 November 2023. The investors seem optimistic about the company’s results for the quarter, pouring money into its shares.

- IndusInd Bank: This financial services stock has gained 2.10% from its previous close of 1432.60 and closed today at 1462.75. As the company witnessed growth in Q2, as discussed in yesterday’s analyst and investors call, the price surged today. This private sector bank’s net interest income for the quarter grew by 18% on a YoY basis.

- Apollo Hospitals Enterprise Ltd.: This healthcare stock has gained 1.95% today in the positive trading session. The investors are waiting for its board meeting and Q2 results, which have been scheduled to be announced on 9 November.

- Eicher Motors Ltd.: After a long time, this automobile stock is on the list of top gainer stocks today. The stock gained 1.76% during today’s market session following its monthly business data release. On a YoY basis, the total sales surged by 3% in October, while the sales on a YTD basis have risen by 13%. However, the international business has suffered in October and since the start of this year.

Top 5 Loser Stocks Today

| Stocks | Previous Day’s Closing Price | LTP | Change (%) |

| HEROMOTOCO | 3,092.45 | 3,060.55 | -1.03 |

| BAJAJ-AUTO | 5,344.35 | 5,319.00 | -0.47 |

| HDFCLIFE | 620.05 | 619 | -0.17 |

| ONGC | 186.7 | 186.4 | -0.16 |

| ADANIENT | 2,217.30 | 2,214.00 | -0.15 |

- Hero Moto Corp.: This favorite company of every Indian has plunged by 1.03% today, even though it reported a 47% growth in its profits for Q2, and the report came out yesterday. Not only quarterly profits but also half-yearly profits have also surged by 40% as per the report.

- Bajaj Auto Ltd.: Another automobile stock has plunged today to become a top loser stock. Bajaj Auto has declined by 0.47% again following the monthly report of October. However, the monthly report displays a growth of 19% in its total sales. The auto stocks might be declining even after positive Q2 and monthly results, as the oil prices have surged today.

- HDFC Life: This insurer has declined today by 0.17% after gaining in the previous session. The Q2 results and board meeting are to be held in the coming week, which is probably increasing the volatility of the stock.

- ONGC: This oil & gas stock has declined by 0.16% following the rise in oil prices pos the dovish move by the Fed. Moreover, there has been a change in its top management, and Shri Birendra Kishore Das has been appointed as the Executive Director – Chief Well Services.

- Adani Enterprise: This metals and mining stock has declined by 0.15% due to the price rise of crude oil, as it seems the company has come up with its Q2 results yesterday, which are promising. The EBITDA increased by 43% on a YoY basis in Q2.

Wrapping up

All the sectors were green today, pulling the board market index upward as the global cues turned positive after the Fed did not increase the interest rates. However, the same has pushed the oil prices up, which led to a decline in the domestic automobile sector, especially the two-wheeler giants.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/