The market crash yesterday was quite a shocker, won’t you agree? It feels like everyone’s holding their breath and wondering what’s next. Thankfully, there’s a ray of sunshine in the form of Nova Agritech’s IPO!

This agri-input company’s stock offering was so hot it got fully booked in just one hour, and by the end of Day 1, it was subscribed nearly 10 times over! Let’s find out what the big story behind Nova Agritech is.

Nova Agritech IPO Details

| Offer Price | ₹39 – ₹41 per share |

| Face Value | ₹2 per share |

| Opening Date | January 23, 2024 |

| Closing Date | January 25, 2024 |

| Total Issue Size (in Shares) | 35,075,693 |

| Total Issue Size (in ₹) | ₹143.81 Cr |

Subscription Status

Retail and non-institutional investors (NIIs) drove the Nova Agritech IPO’s phenomenal first day. This enthusiastic response led to a total subscription of 9.75 times by the end of Day 1. Notably, the retail investor portion saw an impressive 12.77 times subscription, while NIIs subscribed 14.68 times. In contrast, the Qualified Institutional Buyers (QIB) portion remained relatively calm, with only 62% booked at the close of Day 1.

| Subscription Status | ||

| Bids Received | Shares on Offer | |

| Retail Investors | 16,30,36,740 | 1,27,66,799 |

| Non-institutional investors | 8,03,35,770 | 54,71,486 |

| Qualified Institutional Buyers | 44,18,690 (booked) | 71,76,461 |

| Total | 24,77,91,200 | 2,54,14,746 |

Nova Agritech GMP

Adding fuel to the IPO fire, Nova Agritech’s shares were already trading at a premium of Rs 20 in the grey market before the official listing. This unofficial market signifies investor anticipation, and for Nova Agritech, it suggests a potential listing price of Rs 61 per share, a whopping 48.78% higher than the upper end of the IPO price band (Rs 41). However, it’s important to remember that the grey market is unregulated and does not guarantee the actual listing price.

What’s Driving the Buzz?

Several factors are contributing to the excitement surrounding Nova Agritech’s IPO

Market Growth: The Indian agri-input sector is projected to reach Rs 85,900 crore by 2027, fueled by:

- Government initiatives: Increased spending on irrigation, soil health, and farmer welfare programs.

- Rising food demand: A growing population and higher disposable incomes necessitate efficient and productive agri-inputs.

- Shift towards sustainable agriculture: Nova Agritech’s focus on organic and bio-based products aligns with this trend.

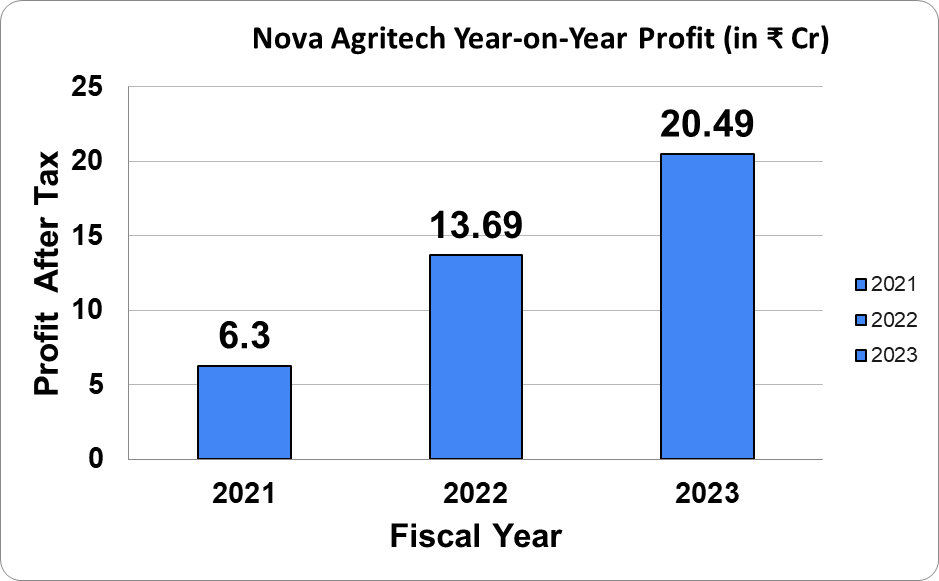

Strong Company Performance

- Extensive distribution network: 11,722 dealers across 16 Indian states and 2 in Nepal, with expansion plans for Bangladesh, Sri Lanka, and Vietnam.

- Consistent growth: 13% revenue increase to Rs 211 crore in FY23 and 43% net profit surge to Rs 20.49 crore.

Profitability: 10.06% PAT margin and 18.75% EBITDA margin in the first half of FY24.

“One-Stop Solution” Vision: Nova Agritech aims to become a comprehensive provider for farmers’ needs, offering a wide range of crop protection and nutrition products. This vision matches with the evolving demands of the agricultural sector.

Experienced Leadership: The company is led by a seasoned management team with a proven track record in the industry.

Focus on Research and Development: Nova Agritech invests heavily in developing innovative products to cater to emerging needs and stay ahead of the curve.

To get a clearer picture, here’s a SWOT analysis of Nova Agritech:

| STRENGTHS | WEAKNESSES |

| Strong brand presence in the South Indian market Wide product portfolio catering to various crops and needs Experienced management team with a proven track record Focus on research and development of innovative productsWeaknesses: | Limited presence in the North and East Indian markets High dependence on a few key distributors Relatively small scale compared to established players in the industry |

| OPPORTUNITIES | THREATS |

| Expanding its geographical reachLaunching new products and entering new market segments Capitalizing on the growing demand for organic and bio-based products | Intense competition from established players Fluctuations in raw material prices Regulatory changes in the agri-input industry |

The Final Word

The Nova Agritech IPO has generated a lot of excitement, and for good reason. The company operates in a promising sector with solid growth potential. Most analysts are optimistic about the company, considering its impressive financial records. However, it’s important to remember that the IPO is priced at a premium, reflecting the bullish investor sentiment. As with any investment, careful consideration of the risks and rewards is essential.

Know more about: JOYALUKKAS INDIA IPO

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/