Today, the financial services and public sector banks lead the stock market. The investors seem hopeful as the second quarter’s results are being announced. The market has been filled with positive sentiments, leaving behind the worries of geopolitical turmoil in the Middle East.

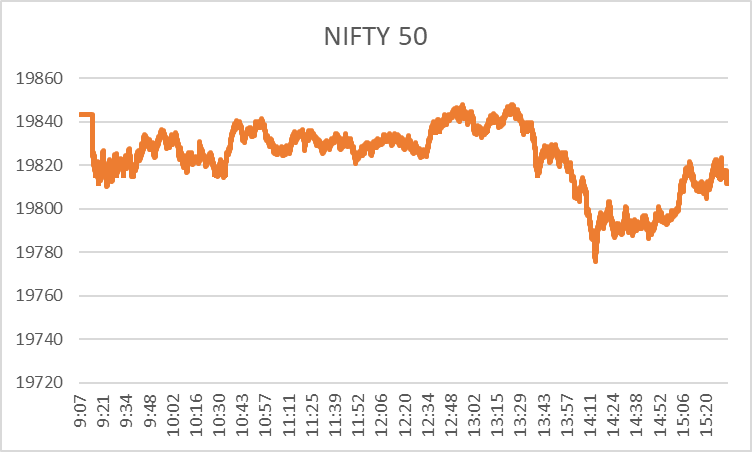

The Nifty 50 ended in the green with a rise of around 0.40% from its previous day’s closing price of 19731.75. It also reclaimed the 19800 mark today. The top gainer stocks today include banks, financial services, power and energy stocks, and oil and gas stocks mostly. Let’s look at the top seven gainer stocks of the day.

NSE Top 7 Gainer Stocks Today

| Stocks | Previous Closing Price | LTP | Change (%) |

| BPCL | 347.25 | 354.8 | 2.17 |

| POWERGRID | 203.05 | 207.25 | 2.07 |

| COALINDIA | 312 | 317.5 | 1.76 |

| SBILIFE | 1,322.20 | 1,345.35 | 1.75 |

| HDFCLIFE | 630.05 | 641 | 1.74 |

| KOTAKBANK | 1,749.75 | 1,774.80 | 1.43 |

| BAJAJ-AUTO | 5,076.70 | 5,143.00 | 1.31 |

- BPCL: This Oil and Gas stock made the highest progress today. It gained 2.17% during today’s market session following the stability in crude prices. The stock has been moving from 340 to 350 for the 3 weeks.

- Power Grid Corporation: Today’s next top gainer stock is a power company – Power Grid Corporation of India Ltd. This stock grew 2.07% today by the end of the day’s session, mainly due to the surge in demand due to the festive season.

- Coal India: Today’s third top gainer is from the oil, gas, and consumable fuel sectors. This coal giant gained 1.76% from the previous day’s closing price of Rs. 312. The stock was on the list of top gainers yesterday as well. The continuous price surge is primarily due to the increase in its revenue from supplies to the power sector. Its supplies increased by 6% during this month’s first two weeks.

- SBI Life: This stock has been gaining throughout the day and finally closed at a high of 1.75% compared to the previous day’s closing. The price rise can be linked to today’s positive market sentiment, especially in the financial services sector.

- HDFC Life: Another insurance company has made it to the top gainers today, and this stock has increased by 1.74% during the day. The stock has been moving up the ladder as the company released its earnings call details with SEBI last Friday.

- Kotak Bank: This private sector bank has also increased as it announced the release date of its earnings calls on the 21st of this month. The stock gained 1.43% during the day, reaching 1774.80 from its previous closing price of 1749.75.

- Bajaj Auto: While the auto sector was flat during the day, one auto stock made it to the top gainer stocks today. Bajaj Auto’s price rose as the investors seemed positive about the company’s upcoming results scheduled for release tomorrow. The auto stock has gained 1.31% during the day and closed at 5143, up from yesterday’s close at 5076.70. While the upcoming result is a reason for the price surge, one cannot miss that festive demands are picking up, which can be another reason for this stock to go up today.

The market has been volatile since the spike in the Middle East issue. However, today, the investors seem to be on a positive note, which pushes the market upward. It has also been linked to the stability of crude prices until now. Apart from the global cues, the domestic stock market is also driven by the festive demands and corporate results in the pipeline.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/