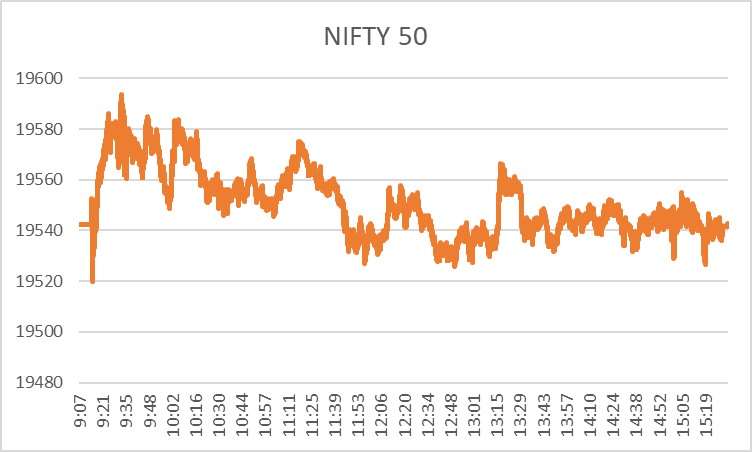

As the market was continuing its falling streak today, only 14 stocks of Nifty 50 ended in the green. The index itself lost 0.42% from yesterday’s closing price falling below the 19550 mark. While there are multiple reasons affecting the market adversely, the global cues played the ultimate role in dragging it down.

The quarterly results and festive vibes came to the rescue but could not help much. The top gainers today are mainly from the financial services sector. Let’s see seven top gainer stocks today, which helped the market from falling further.

Top 7 Gainer Stocks Today

| Stocks | Previous Day’s closing price | LTP | Change (%) |

| KOTAKBANK | 1,738.45 | 1,770.00 | 1.81 |

| INDUSINDBK | 1,450.35 | 1,469.00 | 1.29 |

| SBILIFE | 1,348.15 | 1,364.00 | 1.18 |

| TCS | 3,455.65 | 3,491.85 | 1.05 |

| NTPC | 239.5 | 241 | 0.63 |

| NESTLEIND | 24,132.35 | 24,282.00 | 0.62 |

| HDFCBANK | 1,514.95 | 1,523.40 | 0.56 |

- Kotak Bank: This private sector bank today gained around 1.81% to become the top gainer on NSE. The price rise came after the bank intimated about the acquisition of Sonata Finance Private Ltd., which will be a wholly-owned subsidiary of the bank post approvals and execution of the share purchase.

- IndusInd Bank: This next top gainer is again from the financial service sector and a private sector bank, which gained 1.29% today following the introduction of its banking app ‘INDIE’.

- SBI Life: This financial services stock is holding on to its gaining streak. Today it gained another 1.18% and finally closed at a price of 1364. The upswing in the financial services and the upcoming board meeting and quarterly results of the insurance company are primarily pulling it upward.

- TCS: This IT company has gained 1.05% today following the announcement of being titled as a leader in healthcare data and analytics services by Everest Group. Then it also won the National Intellectual Property Award for 2023. Also ranked as #1 for engineering services provider by Everest Group.

- NTPC: This power company rose 0.63% today following its announcement of the board meeting on the 28th of this month. They also intimated to the shareholders, that they can consider the interim dividend in this meeting for the year 2023-24. The stock has been gaining for the past 2 weeks constantly even in a volatile market condition.

- Nestle India: This FMCG stock has been rising against all the odds. While the FMCG sector was in red today, this stock from the sector managed to go up by 0.62%. The reason behind the upsurge in such a market condition is its strong fundamentals. The company also posted Rs. 5000 crore of turnover in the second quarter which is a significant factor to consider for the investors.

- HDFC Bank: Again back to the financial services, this private sector bank is the seventh top gainer today gaining 0.56%. The company came up with its second-quarter report four days back. During the September quarter, the private bank’s revenue grew by 114.8% on a YoY basis.

Wrapping up

The top gainers today being primarily from the financial services sector indicates that this sector is still not that affected by the global turmoil. While sectors like oil & gas, FMCG are highly affected during the day. The third week of October ends on a bit of a negative note however, the stocks above made the investors smile a bit.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/