Introduction

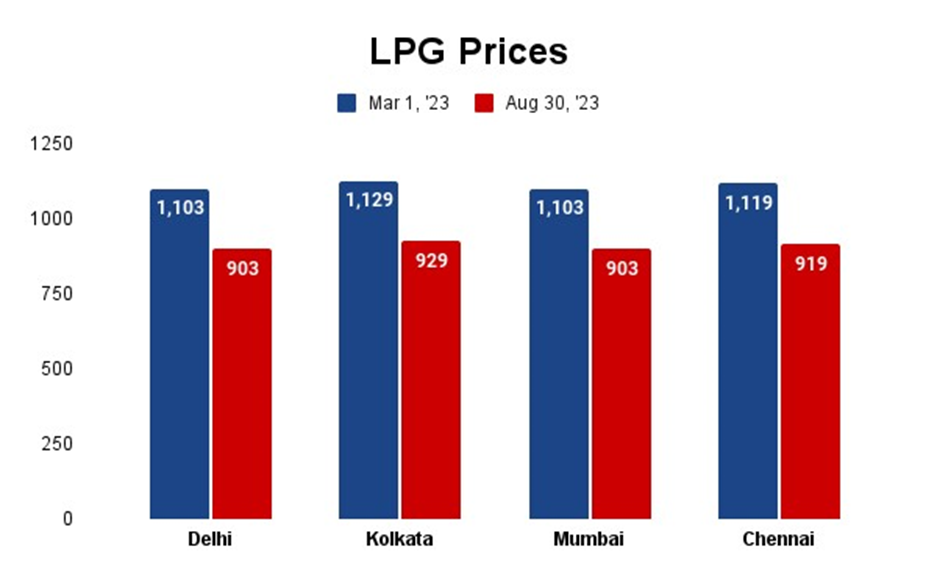

In a recent turn of events, the government has taken a noteworthy stride by announcing a substantial reduction in the prices of domestic LPG cylinders, effectively cutting costs by Rs 200. This strategic move is a relief for Indian households grappling with the challenges posed by the surging inflation in the country.

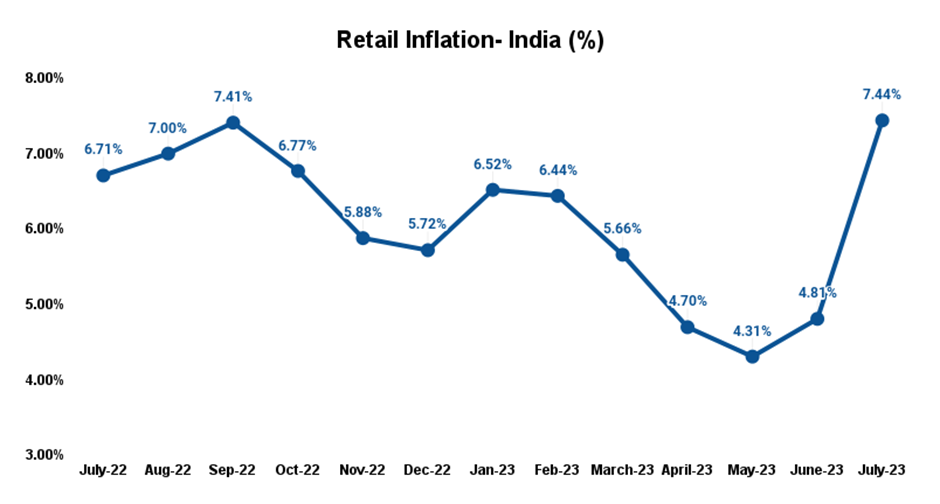

The latest consumer price index data for July has unveiled a staggering inflation rate of 7.44%, surpassing the already concerning 4.81% recorded in June. The primary driving force behind this inflation surge has been the exponential rise in the prices of essential food commodities such as cereals, onions, and tomatoes.

Battling High Inflation: A Glimpse into the Current Scenario

As the nation witnessed a consistent surge in consumer prices, concerns about the financial stability of households, especially those with lower incomes, have escalated. The inflationary pressures have significantly impacted the affordability of basic necessities, posing a direct challenge to the overall economic well-being of the population.

Unveiling July’s Consumer Price Reading

The consumer price index (CPI) is a critical indicator of inflation and economic stability. The CPI reading for July sent shockwaves across the nation, recording an alarming 7.44% inflation rate. This notable spike from the previous month’s 4.81% indicates the growing economic challenges individuals and families face.

Easing the Burden: Government’s Move to Slash LPG Cylinder Prices

In a strategic bid to provide some respite amidst the mounting inflation, the government has proactively reduced the prices of LPG cylinders by Rs 200. This significant reduction is set to benefit a staggering 330 million users nationwide, encompassing a broad spectrum of households.

Aiding Low-Income Families: Key Takeaways

The far-reaching implications of this decision are particularly significant for low-income families disproportionately affected by the rising cost of living. The reduction in LPG cylinder prices holds the potential to alleviate some of the financial burden they have been grappling with.

PM Ujwala Scheme: Doubling the Relief

Adding another relief layer, the government has extended its support to users enrolled under the PM Ujwala scheme. Those currently availing a subsidy of Rs 200 will now be entitled to an additional subsidy of Rs 200, effectively totaling a subsidy of Rs 400. This move ensures that the benefits of reducing LPG cylinder prices are maximized for those in need.

Key Takeaways

The government’s decision to lower LPG cylinder prices addresses the immediate economic concerns of households and carries a strategic significance in the political landscape. This move comes ahead of crucial state elections and the general elections, underscoring the government’s commitment to addressing the needs and concerns of the population.

As the government takes a proactive stance in the face of soaring inflation, reducing domestic LPG cylinder prices by Rs 200 marks a significant stride towards providing much-needed relief to households nationwide. This move offers financial respite to individuals and serves as a testament to the government’s dedication to mitigating its citizens’ economic challenges.

FAQs

How will the reduction in LPG cylinder prices impact consumers?

Reducing prices will financially relieve consumers, particularly those with lower incomes, making essential cooking fuel more affordable.

Will the subsidy under the PM Ujwala scheme be increased for all beneficiaries?

Yes, users under the PM Ujwala scheme will receive an additional subsidy of Rs 200, effectively doubling their relief.

How does the recent inflation rate compare to previous months?

The recent inflation rate of 7.44% for July is significantly higher than the 4.81% recorded in June, highlighting the growing economic challenges.

What motivated the government’s decision to reduce LPG cylinder prices?

The decision aims to relieve households grappling with high inflation and showcases the government’s commitment to addressing economic concerns.

How does this move tie into upcoming elections?

The reduction in LPG cylinder prices resonates positively with the population, enhancing the government’s image ahead of crucial state and general elections.

Bank Deposit Growth: A Six-Year High at 13.5%

Introduction

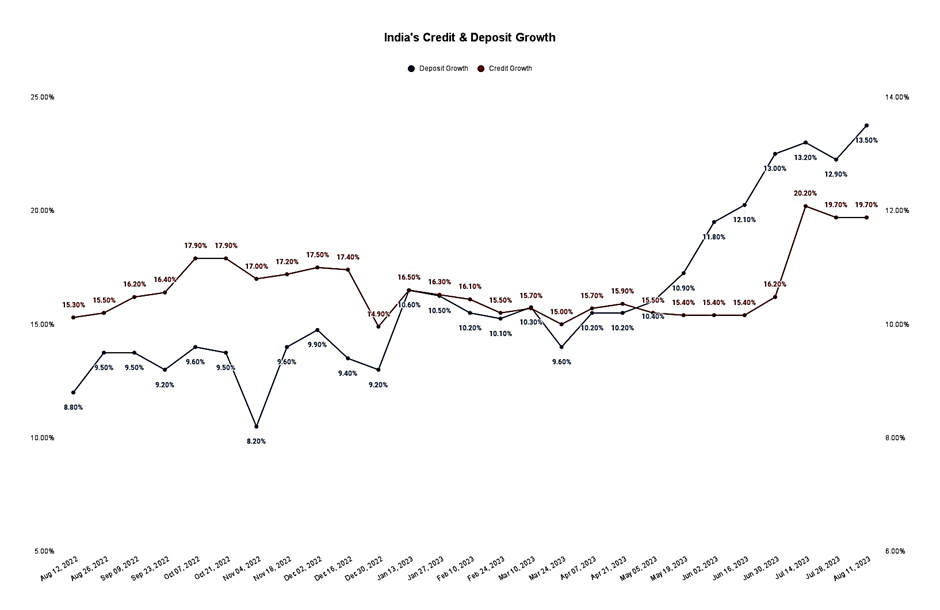

A remarkable surge in credit growth has recently taken center stage, illuminating a positive trajectory for the economy’s overall health. Yet, a concerning dissonance has emerged – deposit growth appears to be trailing behind the brisk pace of credit expansion. This discrepancy raises alarms about potential impediments to the expansive journey of loans and economic development.

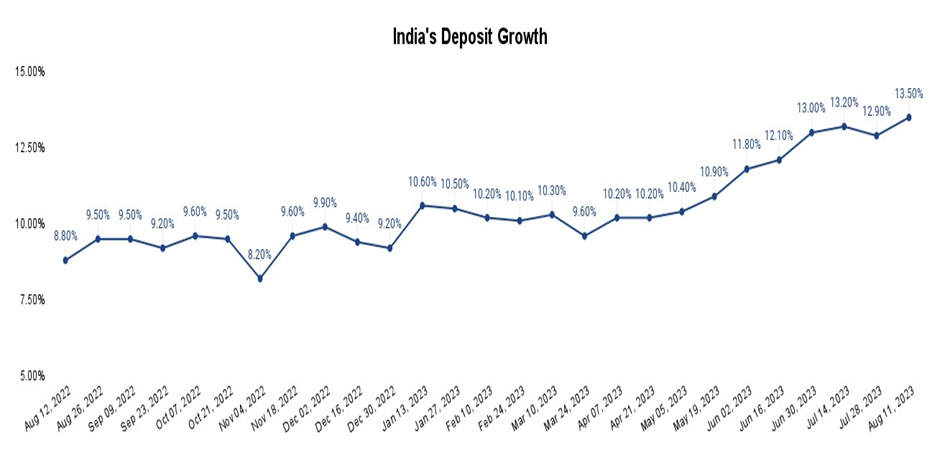

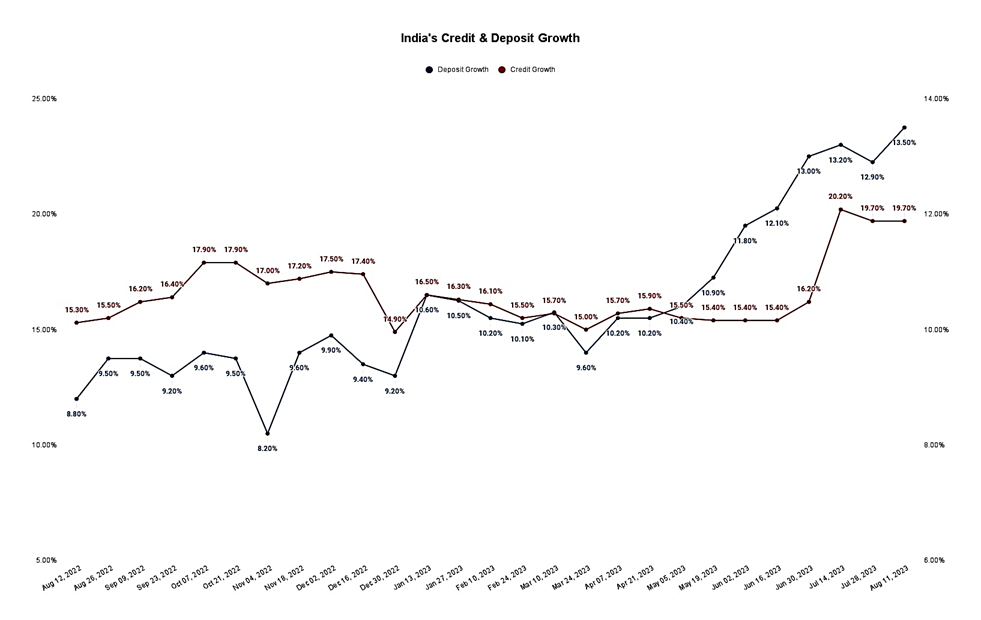

However, a glimmer of optimism prevails. The chasm between deposit and loan growth is narrowing, evoking a shift in the financial landscape. As evidenced by the chart below, deposits have surged by an impressive 13.5% year-on-year, culminating in the fortnight ending on August 11. Remarkably, this upswing catapults the deposit growth beyond the 12.5% threshold for the first time since 2017.

Factors Fueling Deposit Growth

The recent months witnessed deposit growth lagging behind credit expansion by nearly fifty percent. Fortunately, the winds of change are sweeping through the financial domain. The driving forces behind this surge in deposit growth are multifaceted:

1. Rising Interest Rates

Elevating interest rates on deposits plays a pivotal role in boosting deposit growth. Savvy depositors are enticed by the prospect of augmented returns on their funds, thus invigorating the overall deposit landscape.

2. Demise of Rs 2,000 Denomination Notes

The discontinuation of the Rs 2,000 denomination notes constitutes an unforeseen catalyst for deposit growth. As the circulation of these notes tapers, individuals and entities alike are prompted to channel their funds into deposits, contributing to the surge.

3. Unpacking Credit Growth

Shifting the spotlight to credit growth, non-food bank credit has witnessed an extraordinary surge of 19.7% year-on-year up to August 11. This meteoric rise is primarily attributed to the merger of HDFC and HDFC Bank Ltd. A noteworthy revelation arises – excluding this amalgamation, the credit growth figure would stand at 14.8%, according to the meticulous analysis by CARE ratings.

Key Takeaways

While credit growth maintains its supremacy over deposit growth, a narrowing of the gap has come into play over the past several quarters. This intriguing evolution underscores the dynamic nature of the financial realm, where growth patterns intertwine and influence each other’s trajectories.

The resurgence of deposit growth to a six-year high at 13.5% is a pivotal testament to the dynamic nature of the financial landscape. The orchestrated rise, influenced by factors such as interest rates and changes in currency circulation, signifies a promising stride towards a harmonious balance between credit and deposit growth.

FAQs

What is the significance of deposit growth for the economy?

Deposit growth reflects the influx of funds into financial institutions, directly impacting their lending capacity and contributing to overall economic growth.

How has the discontinuation of Rs 2,000 denomination notes affected deposit growth?

The discontinuation has nudged individuals and entities to divert funds from cash holdings to deposits, bolstering deposit growth.

What role does interest rate play in deposit growth?

Higher interest rates on deposits attract more depositors, incentivizing them to allocate their funds to bank deposits.

How does credit growth influence the economy?

Credit growth indicates increased borrowing and lending, which drives consumption, investments, and overall economic activity.

What implications does the narrowing gap between credit and deposit growth hold?

The narrowing gap suggests a potential equilibrium between borrowing and saving trends, which could translate to a more balanced financial landscape.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/