The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) meeting concluded today, and Governor Shaktikanta Das unveiled the much-awaited decisions. Let’s break down the key takeaways of the RBI MPC meeting that will impact your wallet, economic growth, and future banking trends.

Shifting Gears: Growth Up, Rates on Hold (For Now)

This 6-member RBI MPC meeting saw a significant shift in voting patterns. While the benchmark repo rate remained 6.5% for the eighth consecutive time, the majority vote changed from 5-1 to 4-2. Interestingly, two members even advocated for a 25 basis point rate cut and a shift to a neutral stance. This hints at a potential change in direction in the future, with a focus on growth alongside inflation control.

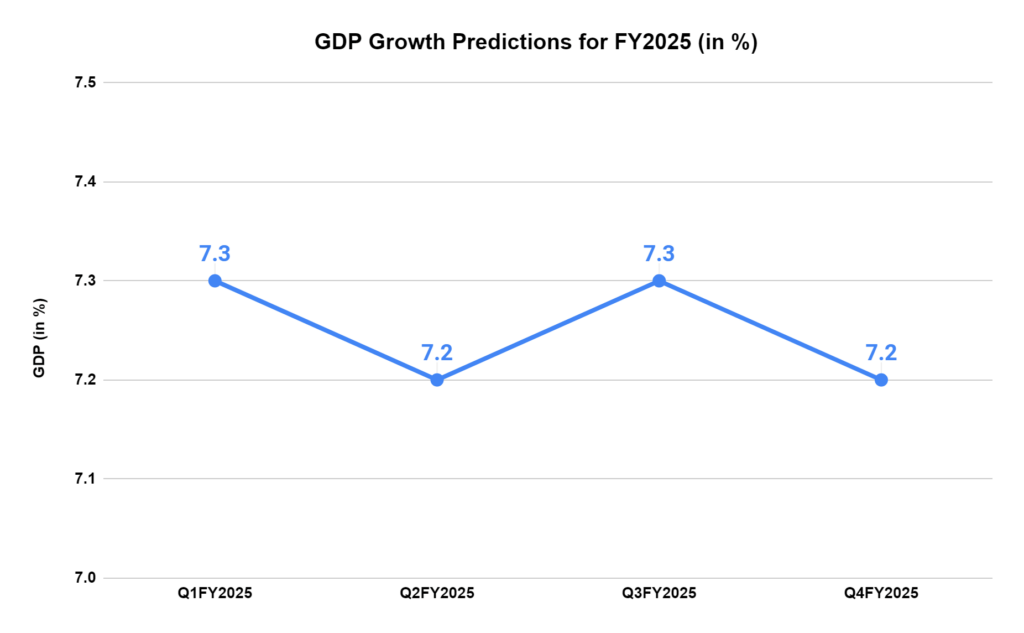

RBI MPC: Growth Forecast Revised Upward

Despite holding rates steady, the RBI is optimistic about the future. They’ve revised their GDP growth forecast for FY25 upwards to 7.2%, citing strong manufacturing activity and a rebound in services. However, this projection isn’t set in stone – any unexpected economic downturns could lead to adjustments.

RBI Keeping a Watchful Eye on Inflation

The RBI maintained its FY25 inflation forecast at 4.5%. This cautious stance reflects concerns about persistent food inflation, fueled by rising global food and industrial commodity prices. A successful monsoon season is crucial for lowering food prices and achieving the projected inflation target. It’s important to note that the RBI won’t simply follow the US Federal Reserve’s rate cuts but prioritize India’s unique growth-inflation dynamics.

Retail Inflation: A Mixed Bag

While retail inflation has dipped slightly to 4.83%, the specter of rising food prices, particularly items like garlic and ginger, still looms large. Although vegetable and pulse prices remain stubbornly high, the positive news is that overall inflation is on a downward trend.

UPI Lite Gets a Boost

The RBI plans to introduce an auto-replenishment feature to encourage wider adoption of UPI Lite, a simplified digital payment platform. This feature will allow users to automatically top up their wallets when the balance falls below a set threshold, streamlining small-value transactions.

Easing Trade Practices

Recognizing the evolving global trade landscape, the RBI proposes simplifying the existing Foreign Exchange Management Act (FEMA) guidelines for exports and imports. It will make things easier for businesses and provide greater flexibility for authorized dealer banks.

Redefining Bulk Deposits

The MPC meeting also saw a revision to the definition of bulk deposits. It is now “a single rupee term deposit of ₹3 crore and above” for scheduled commercial banks (excluding regional rural banks) and small finance banks. Local area banks will have a revised limit of “₹1 crore and above,” aligning with the existing rule for regional rural banks.

Foreign Investment: A Shifting Tide

In the past year, we have witnessed a surge in foreign portfolio investments (FPI), with net inflows of around $41.6 billion. However, the trend reversed in the first part of FY25, with foreign investors pulling out a net of $5 billion by June 5th. It highlights the dynamic nature of foreign investment in the Indian market.

Potential Uses for RBI’s Large Dividend

The central bank transferred ₹2.11 lakh crore to the union government as a dividend. The central board decided to keep the contingent reserve buffer of 6.5%. This risk provisioning of CRB will further strengthen RBI’s balance sheet. The RBI’s substantial income transfer raises the question: how will it leverage these funds to promote healthy economic growth? Here are some possibilities:

- Transfer to Government: The RBI transfer will provide additional resources for infrastructure development or social welfare programs, which can indirectly stimulate growth.

- Open Market Operations: The RBI could engage in Open Market Operations (OMO) by buying government bonds. This injects liquidity into the banking system, potentially lowering interest rates for businesses and households, thereby boosting investment and economic activity.

- Strengthening Reserves: The RBI might also prioritize building its foreign exchange reserves. This provides a buffer against external shocks and enhances confidence in the Indian economy, ultimately aiding long-term growth prospects.

How RBI and Growth Strategies Bridge the Fiscal Gap

The government aims for a fiscal deficit of 4.5% by March 2026. Here’s how the RBI and recent events might impact this:

- RBI Dividend Boost: The recent large dividend from the RBI provides a fiscal cushion for the government, potentially making it easier to achieve the deficit target.

- Policy Decisions and Growth: If today’s policy decisions promote economic growth, it could increase tax revenues, further aiding deficit reduction. However, if growth falters, reaching the target could become more challenging.

What Does The Unchanged Repo Rate Mean for You?

The unchanged repo rate translates to existing loans remaining benchmarked against the 6.5% rate. While a future rate cut could lower EMIs, fixed-interest loans won’t be impacted. However, borrowing costs might increase if rate cuts are delayed.

On the flip side, banks might offer competitive interest rates on Fixed Deposits (FDs) to attract more depositors. This could be an excellent time to lock in higher returns on your savings. Governor Das also hinted at measures to moderate unsecured loans and advances, promoting responsible lending practices.

Conclusion

The RBI’s latest policy decisions offer a glimpse into India’s economic trajectory. While growth projections remain optimistic, inflation and external factors are monitored closely. The digital payment innovation and trade facilitation proposal indicates the RBI’s commitment to fostering a robust and inclusive financial ecosystem. Monitor future developments as the MPC navigates the dynamic economic landscape.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 1.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/