Have you ever considered switching banks or opening a new account online? If so, you might be familiar with the convenience of mobile and online banking. But what if those options were suddenly restricted at a major bank?

Yesterday on April 24th, the Reserve Bank of India (RBI) took a significant step with Kotak Mahindra Bank, limiting their ability to onboard new customers digitally, including issuing new credit cards. This raises questions about digital banking security and the future of Kotak Mahindra Bank. Let’s find out why the RBI took this action and what it means for existing and potential customers.

Why Did the RBI Take Action?

The RBI expressed concerns about Kotak Mahindra Bank’s IT systems not keeping pace with its rapid growth, particularly in digital transactions. Their examinations revealed deficiencies in several areas:

- IT Inventory Management: The bank lacked proper oversight of its IT infrastructure.

- Patch and Change Management: Processes for updating and modifying software were inadequate.

- User Access Management: Controls for who could access sensitive information were insufficient.

- Vendor Risk Management: The bank didn’t properly assess risks associated with third-party IT vendors.

- Data Security and Prevention: Weaknesses were found in data protection measures.

- Business Continuity: The bank’s disaster recovery plans were deemed inadequate.

These concerns and the bank’s deficient IT risk governance for two consecutive years prompted the RBI to act. The central bank’s primary goal is to prevent a potential IT system outage that could disrupt customer services and destabilize the digital banking ecosystem.

Impact on Kotak Mahindra Bank

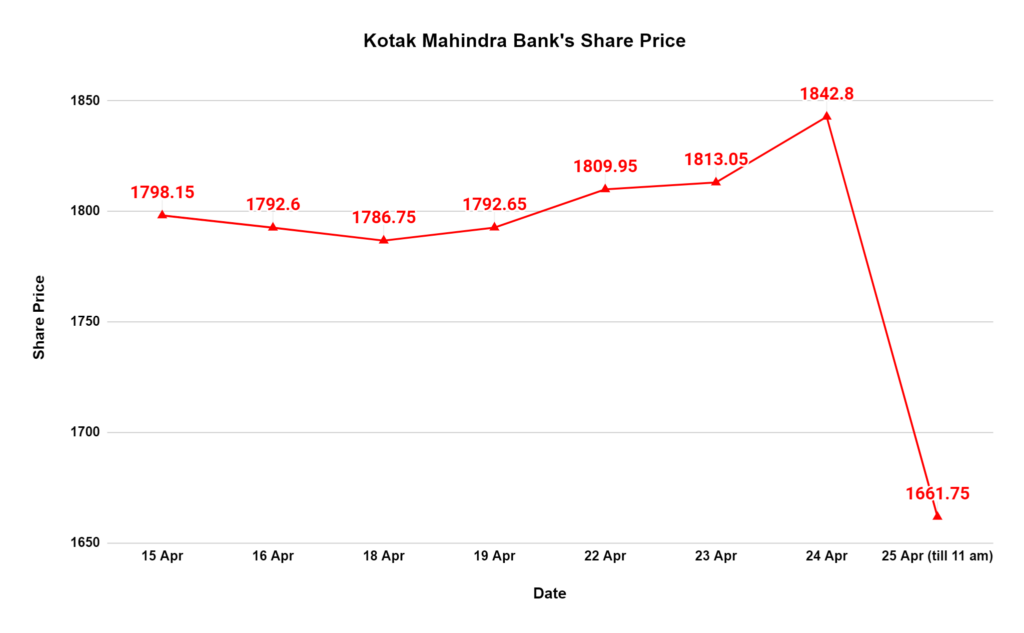

The RBI’s restrictions are a big blow to Kotak Mahindra Bank. The stock price dropped 10% after the announcement when it opened this morning at ₹1665. Analysts predict this will affect their retail business and customer sentiment. The bank’s limited branch network (less than 350 new branches in four years) and declining CASA ratio (a measure of low-cost deposits down 13 percent from its peak to around 48 percent)) further complicate the situation.

What are the Implications of the Ban?

The RBI invoked Section 35A of the Banking Regulation Act, which allows them to intervene when a bank’s practices pose a risk to depositors or the overall financial system. This “cease and desist” order carries significant weight. Any violation by the bank would result in harsh penalties from the RBI.

What Happens Next?

The restrictions under Section 35A will stay in place until Kotak Mahindra Bank addresses the RBI’s concerns. This likely involves a comprehensive external IT audit and implementing corrective measures to strengthen their systems and security. The restrictions will be lifted once the RBI is satisfied with their progress.

How Did Kotak Mahindra Bank Respond?

The bank acknowledged the RBI’s order and clarified that existing customers won’t be affected. They can continue using mobile and net banking services and their credit cards. Kotak Mahindra also assured that they’re taking steps to strengthen their IT systems and work with the RBI towards a swift resolution.

What This Means for Existing Customers

The good news for existing Kotak Mahindra Bank customers is that your accounts and services remain unaffected. You can continue using mobile and net banking, and your credit card services will not be interrupted.

So, Can I Still Open a New Account with Kotak Mahindra?

For now, not through online or mobile banking channels. However, you can still visit a physical branch to open a new account and access most banking services, except for new credit cards.

What About Other Banks?

This isn’t the first time the RBI has taken action against banks for IT deficiencies. HDFC Bank faced similar restrictions in December 2020, and Bank of Baroda’s mobile app limitations are unresolved (October 2023). However, the curbs placed on Kotak Mahindra Bank seem stricter, potentially taking longer to resolve than HDFC Bank’s two-year ordeal.

The Takeaway

The RBI’s action on Kotak Mahindra Bank highlights the importance of robust IT infrastructure and cyber security in today’s digital banking landscape. While existing customers can breathe a sigh of relief, the bank faces a period of improvement and rebuilding trust with customers and the regulator.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.8 / 5. Vote count: 6

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/