After a bit of a slow period, the IPO market is finally waking up this May, with many companies lining up to go public. Leading the pack is the Indegene IPO, which opened for subscription today, May 6th. This is a big deal because historically, May during election cycles has been a no-deal zone for IPOs. But this year, things are different. The JNK India IPO kicked things off, and now Indegene is following suit, proving that elections don’t have to put the brakes on growth.

Indegene IPO Breakdown:

The offering will be a mix of new shares and an Offer for Sale (OFS). Indegene is looking to raise a significant ₹1,841.76 crore. This includes ₹760 crore through fresh issuance, which signals the company’s plans for future growth. The remaining ₹1,081.76 crore is allocated for the OFS, allowing existing shareholders to cash out a portion of their holdings.

Let’s check out the details of this IPO and see what all the buzz is about.

Indegene IPO Details

| Offer Price | ₹430 – ₹452 per share |

| Face Value | ₹2 per share |

| Opening Date | 6 May 2024 |

| Closing Date | 8 May 2024 |

| Total Issue Size (in Shares) | 40,746,891 |

| Total Issue Size (in ₹) | ₹1841.76 Cr |

| Issue Type | Book Built Issue IPO |

| Lot Size | 33 Shares |

Indegene IPO GMP:

According to market observers, the Indegene IPO is generating some heat, with shares trading at a premium of ₹246 in the grey market. This “grey market premium” (GMP) reflects the unofficial price investors are willing to pay for the stock before it hits the exchange. Think of it as a temperature gauge for investor interest.

Company Overview

Indegene is a company that provides contract research services (CRS) and contract development and manufacturing organization (CDMO) services to the biopharmaceutical industry. They help biopharma companies develop and commercialize their drugs and other products. This can involve various activities, from clinical trial design and execution to regulatory filings and market access strategies.

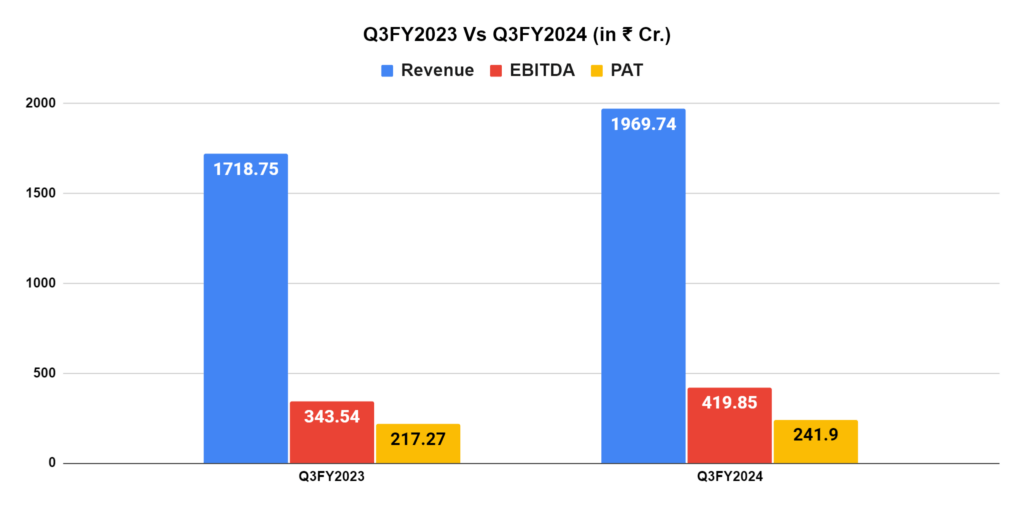

Indegene Limited Financials

As per the DRHP filed by the company with SEBI, the Q3 results have shown significant growth. Compared to the same period last year, there was a jump in revenue from ₹1718.75 Cr. to ₹1969.74 Cr., and profit after tax (PAT) also rose from ₹217.27 Cr. to ₹241.90 Cr. This is good news! However, their return on equity (ROE) dipped slightly from 21.48% to 18.23%. While revenue and profit are growing, this potential use of profits for reinvestment is worth noting.

SWOT Analysis of Indegene Limited

| STRENGTHS | WEAKNESSES |

| Industry Growth: Indegene operates in the biopharmaceutical services sector, which is expected to grow significantly in the coming years. This is due to factors like the increasing demand for new drugs, rising healthcare spending, and a focus on innovation in the pharmaceutical industry. Strong Clientele: The company boasts a strong client base that includes some of the world’s leading biopharmaceutical companies. This gives them a solid foundation for future growth. Proven Track Record: Indegene has a proven track record of success, with a history of delivering value to its clients. This experience should inspire confidence in potential investors. | Dependence on the Biopharma Industry: Indegene’s fortunes are closely tied to the performance of the biopharmaceutical industry. Any downturn in this sector could negatively impact the company’s business. Limited Geographic Reach: Indegene’s operations are concentrated in a few key markets, so expanding into new geographies could be a challenge. Competition: The biopharmaceutical services sector is competitive. Indegene faces competition from established players as well as new entrants. |

| OPPORTUNITIES | THREATS |

| Growing Demand for Outsourced Services: Biopharmaceutical companies are increasingly outsourcing their development and commercialization activities, which presents a significant opportunity for Indegene. Expansion into New Markets: As mentioned earlier, Indegene has the potential to expand its reach into new geographic markets. This would help them diversify their client base and reduce dependence on any single market. Focus on Emerging Therapies: Indegene can capitalize on the growing demand for treatments in areas like gene therapy and cell therapy. | Regulatory Changes: The biopharmaceutical industry is heavily regulated. Any changes in regulations could impact Indegene’s business. Pricing Pressure: Biopharmaceutical companies are constantly under pressure to reduce costs. This could lead to pricing pressure on Indegene’s services. Talent Acquisition and Retention: Attracting and retaining qualified personnel is critical for Indegene’s success. This could be a challenge in a competitive talent market. |

The final word

The company has a strong business model and is positioned to benefit from the growth of the biopharmaceutical industry. However, some risks, such as its reliance on a few clients and the market’s competitive nature, must also be considered.

The slight dip in ROE is something to be aware of, but it might be part of their growth strategy. Overall, Indegene’s financials paint a picture of a company growing its revenue and profit. As always, research and consider all the factors before making investment decisions.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.6 / 5. Vote count: 16

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/