Have you ever realized what happens when you meticulously plan your budget and save diligently? Your financial situation improves, right? That’s exactly what’s happening with India right now, according to S&P Global Ratings. After a decade of holding a “stable” outlook, S&P upgraded India’s sovereign rating outlook to “positive” on May 29th, 2024.

At the same time, it affirmed BBB- long-term and ‘A-3’ short-term unsolicited foreign and local currency sovereign credit ratings. It might sound like financial jargon, but it essentially means that S&P is more confident in India’s ability to repay its debts. Let’s figure out what this means for the Indian economy and all of us.

Who is S&P Global Ratings, Anyway?

S&P Global Ratings is a financial credit agency that assesses countries’ creditworthiness, just like your credit score reflects your ability to repay a loan. A higher rating from S&P means investors view India as a more reliable borrower, potentially leading to lower interest rates and increased investment.

Reasons for the Upgrade: A Strong Economy with Solid Fundamentals

S&P’s upgrade reflects their confidence in India’s robust economic performance. Here are some key factors driving this optimism:

Fast-Growing Economy:

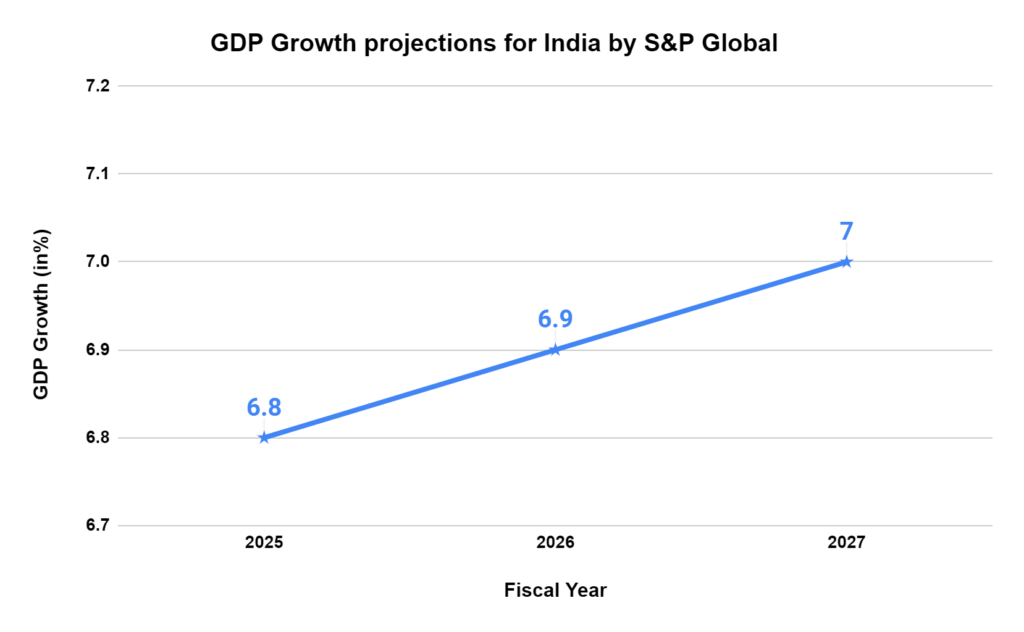

India is currently the world’s fastest-growing major economy, and S&P expects this momentum to continue over the next two to three years. Looking ahead, S&P anticipates solid consumer spending and increased government investment to further propel India’s real GDP growth.

They forecast a healthy 6.8% growth rate for fiscal year 2025 (ending March 2025), followed by an upward trend to 6.9% in FY26 and 7.0% in FY27. This sustained growth strengthens India’s position as a global economic powerhouse.

Improved Fiscal Discipline:

The government’s spending habits seem to be getting a little tighter. S&P acknowledges improvement in the quality of government spending, with more focus on infrastructure projects. This focus on infrastructure is crucial for long-term economic growth by removing bottlenecks that hamper development.

Commitment to Reforms:

Regardless of the outcome of the upcoming June 2024 elections, S&P expects economic reforms and fiscal consolidation efforts to continue. This political stability is another factor that reassures investors.

What are the Challenges Still on the Table?

While S&P is optimistic, they also acknowledge India’s challenges:

- High Debt Burden: India’s government debt remains a significant concern. However, with a recovering economy, the government has more room to maneuver and implement a gradual plan to reduce its debt burden.

- Inflation Management: Managing inflation effectively will be crucial for sustained economic growth. S&P suggests that demonstrating more robust monetary policy effectiveness could lead to a rating upgrade in the future.

What Does This Mean for You?

While a positive outlook doesn’t guarantee a credit rating upgrade, it’s a significant step in that direction. A potential upgrade in the future could translate to lower borrowing costs for the Indian government, potentially leading to more resources for public services and development projects. This can indirectly benefit businesses and individuals by fostering a more stable economic environment.

The Road Ahead: Keeping an Eye on the Future

Another factor to consider is the upcoming general election results in June 2024. S&P, however, expresses confidence that the new government will prioritize economic reforms and infrastructure investment regardless of the election outcome.

The Final Word

S&P’s positive outlook revision on India is a vote of confidence in the country’s economic trajectory. While challenges remain, the focus on growth, infrastructure development, and fiscal responsibility paints a promising picture for the future. As with any financial decision, staying informed and monitoring the situation unfolding is important. This upgrade is a positive step, but India’s economic journey continues.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 6

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/