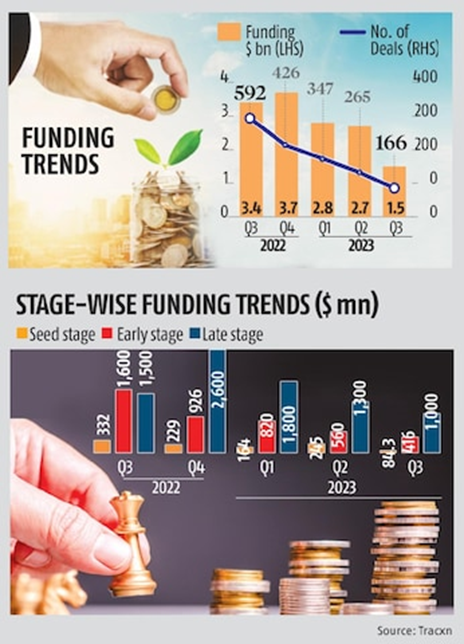

Startup funding in India has taken a sharp turn, leading to repercussions that have left many in the industry grappling with uncertainty. The third quarter of 2023 witnessed a staggering decline in investments, plunging to a five-year low, with funding plummeting by a significant 54 percent year-on-year, reaching a mere $1.5 billion. These startling statistics have been revealed in a comprehensive report by Tracxn, a leading market intelligence platform.

The Plummeting Investment Landscape

A Five-Year Low

Early indications suggest that Indian startups are facing a funding crisis. In the third quarter of 2023, investment in Indian startups hit a five-year low, with the total funding amounting to a mere $1.5 billion. This represents a significant decline from previous years and has sent shockwaves through the industry.

Early-Stage and Seed-Stage Funding

The situation looks even bleaker when we consider early-stage and seed-stage funding, which have both plummeted by a jaw-dropping 74 percent and 75 percent, respectively, compared to the previous year. This severe drop in early-stage investments has left many budding entrepreneurs facing an uphill battle to secure the necessary capital to kickstart their ventures.

Late-Stage Funding

Late-stage funding rounds have not been immune to the challenges either. While the decline hasn’t been as steep as in early-stage funding, late-stage investments still witnessed a notable 33 percent drop. This trend suggests that even more established startups grapple with the funding crunch.

Key Takeaways

Startup Funding’s Shining Stars

Remarkably, amidst the funding woes, a handful of Indian startups have secured significant investments. Companies like Perfios, Zepto, Ola Electric, Ather Energy, and Zyber 365 have defied the odds by raising over $100 million each during this turbulent period. Zepto and Zyber 365, in particular, have ascended to unicorn status, distinguishing themselves as the only two unicorns added during the challenging third quarter of 2023.

Navigating the Startup Funding “Winter”

Looking ahead, the funding “winter” is likely to persist. This will undoubtedly make it increasingly difficult for startups to attract investments from overseas. As a result, existing startups will face mounting pressure to streamline their budgets and operate with greater efficiency. This will necessitate a fundamental shift in how startups strategize and prioritize their spending.

India’s Resilience in the Global Arena

Despite these funding challenges, it’s essential to recognize that India remains the fifth-highest funded country in the third quarter of 2023 and holds its fourth-place position year-to-date. This resilience underscores the adaptability and determination of India’s tech startups, who continue to thrive despite the adverse funding environment.

As the funding landscape evolves, Indian startups must innovate, adapt, and explore new avenues for securing investments. The challenges are undeniably significant, but the indomitable spirit of entrepreneurship remains a driving force in the Indian startup ecosystem.

FAQs

How did the funding crisis impact early-stage startups?

The funding crisis hit early-stage startups the hardest, with investments plummeting by a staggering 74 percent, making it extremely challenging for them to secure capital.

How does India rank in terms of global startup funding despite the challenges?

India maintains its fifth-place ranking in funding for the third quarter of 2023 and holds the fourth-place position for the year-to-date, showcasing the resilience of its tech startup ecosystem.

What should startups do to navigate the funding challenges effectively?

Startups must adapt, innovate, and explore new avenues for securing investments while focusing on efficiency and budget management. As the funding landscape evolves, Indian startups must remain agile and resilient to thrive in adversity.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.