Introduction

India is the top offshoring destination for IT companies, and Tata Consultancy Services is among the biggest beneficiaries of this outsourcing trend. Having proven its capabilities in delivering on-shore and offshore services to global clients, emerging technologies offer various opportunities for top IT firms in India. An Amazon Web Services (2021) survey believes India may have nine times more digitally skilled workers by 2025.

, which has created massive wealth for shareholders while providing job opportunities to more than 6 lac individuals worldwide. Let us try to understand how the company is doing right now and also try to assess the long-term growth prospects of TCS’s share price.

Tata Consultancy Services Overview

Tata Consultancy Services (TCS) is an Indian multinational information technology (IT) services and consulting company. It is a subsidiary of the Tata Group, one of India’s largest and most respected business conglomerates. TCS was founded in 1968 and is headquartered in Mumbai, India.

TCS is considered one of the “Big Four” IT services companies globally, along with Accenture, IBM, and Cognizant. It provides various services, including IT consulting, software development, system integration, infrastructure management, and business process outsourcing. The company operates across multiple industry sectors, such as banking and financial services, manufacturing, retail, telecommunications, and healthcare.

With a global footprint, TCS has offices and delivery centers in over 46 countries. It has a diverse workforce of over 6,14,795 employees representing over 150 nationalities. TCS has consistently been recognized for its excellence in IT services and has received numerous awards and accolades.

TCS leverages technologies such as artificial intelligence, machine learning, cloud computing, blockchain, and the Internet of Things (IoT) to help its clients transform their businesses and stay ahead in the digital era. The company delivers innovative solutions and drives digital transformation for its clients across industries.

In recent years, TCS has invested heavily in research and development (R&D) to develop cutting-edge technologies and stay at the forefront of the industry. It also strongly emphasizes employee training and development, ensuring its workforce has the necessary skills and expertise to deliver high-quality services.

Overall, Tata Consultancy Services is a global leader in IT services and consulting, known for its expertise, innovation, and commitment to delivering value to its clients.

Tata Consultancy Services Company Journey

Here is a timeline of Tata Consultancy Services’ history:

- 1968: Tata Consultancy Services (TCS) is established as a division of Tata Sons, the flagship company of the Tata Group. Initial assignments include bank reconciliation services, payroll, and accounting for several Indian companies, including the Tata group

- 1971: Wins a project from an electric company in Iran, the first overseas assignment

- 1973: Partners with Burroughs Computer to sell and service its systems in India and to develop software for its machines worldwide

- 1976: Crosses $1 million in revenues

- 1979: Sets up the New York office, the first sales office overseas

- 1981: Sets up Tata Research Development and Design Centre in Pune, India’s first software research center

- 1989: Signs the Swiss Securities Corporation deal for the world’s first real-time securities clearing and settlement system

- 1992: Sets up the core banking platform for India’s newly created National Stock Exchange

- 2001: Sets up the first nearshore development center in Budapest, Hungary

- 2003: Crosses $1 billion in revenues, the first Indian IT services company to achieve the milestone; articulates vision statement of Global Top 10 by 2010

- 2004: Issues an IPO; lists on Indian bourses and becomes the third-most valuable company immediately

- 2005: Wins $847 million deal to provide insurance back-office transaction processing services to the UK-based Pearl Group (later renamed as the Phoenix Group)

- 2008: Partners with the Government of India to reimagine passport services; also acquires Citigroup’s back office operations in India for $505 million

- 2009: N Chandrasekaran takes over as CEO and Managing Director; achieves Global Top 10 goal, a year ahead of target

- 2012: Crosses $10 billion in annual revenue

- 2018: Completes 50 years; ranks among the top 3 most valuable brands in the global IT services sector and named the fastest growing IT services brand by Brand Finance

- 2022: TCS is named the second most valuable global IT services brand by Brand Finance

Tata Consultancy Services Management Profile

Mr. Natarajan Chandrasekaran (Chairman), also known as Chandra, served as the Chairman of TCS until he was appointed the Chairman of Tata Sons, the holding company of the Tata Group, in 2017. Under his leadership, TCS experienced significant growth and global expansion.

Mr. K. Krithivasan is the Chief Executive Officer and Managing Director of Tata Consultancy Services (TCS). In his prior role, Krithi was the Global Head of the Banking, Financial Services, and Insurance (BFSI) Business Group. He was vital in building deep customer relationships, mindshare, and market positioning across geographies. He has been with TCS for over three decades, helping customers with their growth and transformation journeys and technology strategies.

Mr. N. Ganapathy Subramaniam is the Chief Operating Officer of TCS. He has been associated with TCS for over three decades. As the COO, he oversees the company’s global delivery, operations, and business units, ensuring operational excellence and client satisfaction.

Mr. Milind Lakkad is TCS’s Executive Vice President and Global Head of Human Resources. He is responsible for TCS’s global human resources strategy and initiatives. He focuses on talent acquisition, employee engagement, and fostering a culture of innovation and learning within the organization.

Mr. Samir Seksaria took over as the CFO of Tata Consultancy Services on 1st May 2021. Samir started his career at TCS in 1999 and spent his early years in consulting assignments involving regulatory compliance, and M&A spin-offs, amongst others. In his earlier responsibilities, he played a crucial role in the Initial Public Offering of TCS in 2004 and subsequently in various financial transformation journeys involving simplification, straight-through processes, early closures, and better cash management.

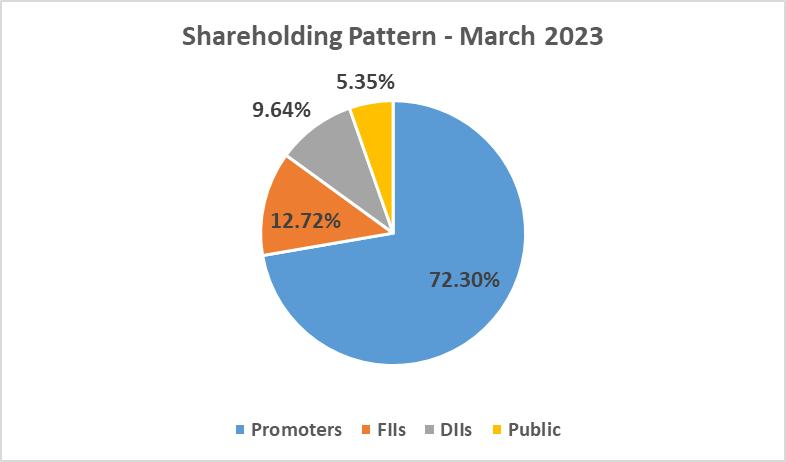

Tata Consultancy Services Shareholding Pattern

Tata Consultancy Company Analysis

TCS has a global presence, deep domain expertise in multiple industry verticals, and a complete portfolio of offerings – grouped under consulting and service integration, digital transformation services, cloud services, cognitive business operations, and products and platforms.

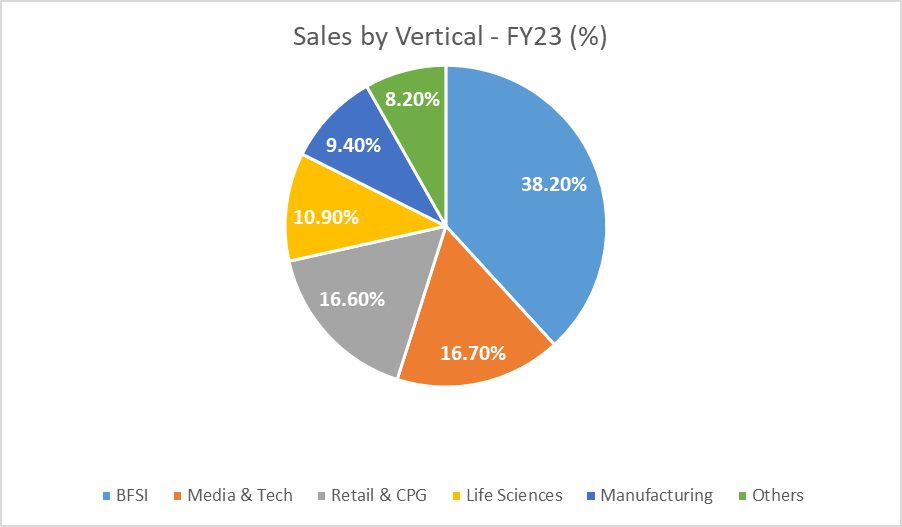

The company derives its revenue from the following major verticals:

- BFSI

- Retail and Consumer Products

- Life Sciences & Healthcare

- Manufacturing

- Technology & Services

- Communication and Media

The breakup of revenue between various segments is shown below. BFSI alone contributes more than 30% of the total revenue.

Tata Consultancy Fundamental Analysis

TCS boasts of clients from nearly half the Fortune 500 companies – in industries ranging from banking and financial services to retail, life sciences, healthcare, manufacturing, and travel.

As shown in the table below, the company has 60 clients contributing more than INR 830 Cr+ (USD 100 m+) each in annual revenue. Similarly, there is 133 clients in the INR 415 Cr+ (USD 50 m+) bucket, and the number of clients in each bucket keeps growing each year as more and more companies look to outsource their technology upgradation/digital transformation work to Indian IT companies like TCS.

| Clients Contribution | Q4FY22 | Q4FY23 |

| US$ 1 m+ Clients | 1182 | 1241 |

| US$ 5 m+ Clients | 638 | 665 |

| US$ 10 m+ Clients | 439 | 461 |

| US$ 20 m+ Clients | 268 | 291 |

| US$ 50 m+ Clients | 120 | 133 |

| US$ 100 m+ Clients | 58 | 60 |

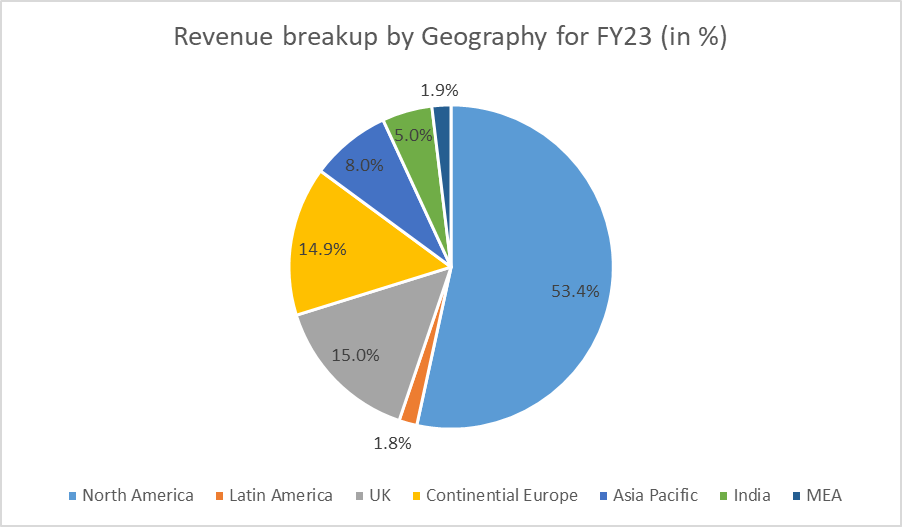

Regarding the geographical breakup, North America & Europe (including the UK) contributes most of the revenue for TCS, as shown in the chart below.

In FY23, North America grew 24.2%, the UK grew 11.4%, and Continental Europe grew 9.2%. Among emerging markets, Latin America grew 24.8%, India grew 14.9%, Middle East & Africa grew 12.5%, and Asia Pacific grew 7.1%.

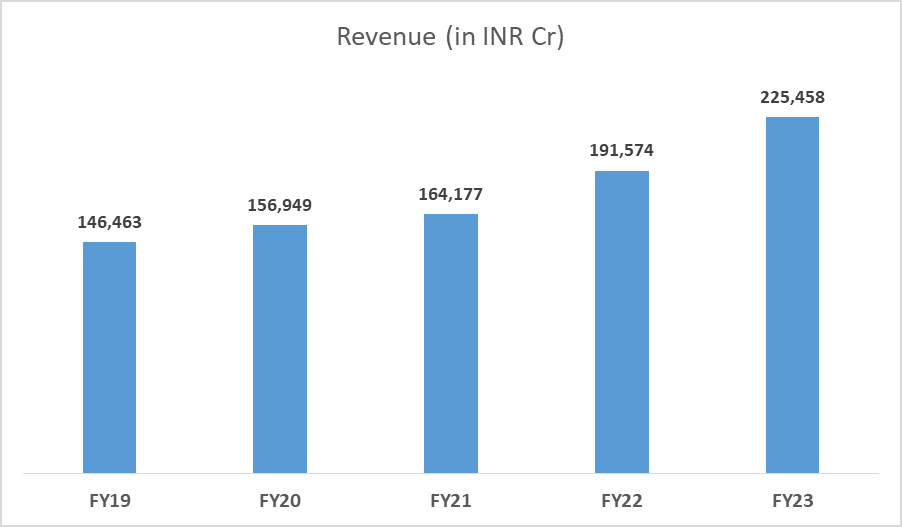

Revenue and Profitability

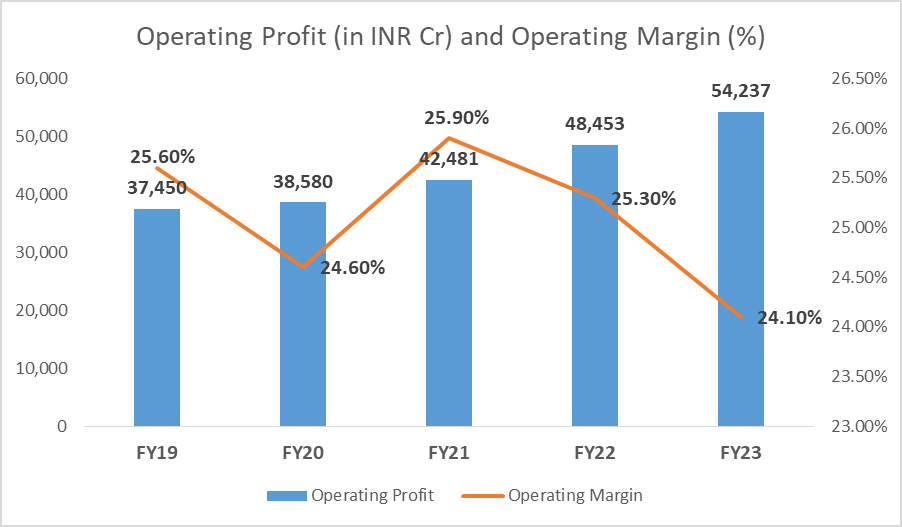

TCS posted a revenue of INR 225,458 crore for FY23, which is a growth of 17.6% over the prior year. Constant currency revenue growth for the entire year was 13.7%. The company has posted a revenue CAGR of 13% for FY18 – FY23.

The Company delivered an operating margin of 24.1% in FY23, a contraction of 1.2% over the prior year. Net Profit Margin was 18.7% for FY23 against 20% in FY22.

One of the biggest problems for TCS is the high level of attrition in the last two years during covid. TCS has limited attrition and its impact on expenses and margins. It has fared better than other large IT companies in India, and attrition is expected to normalize by FY24.

Return on Equity & Return on Capital Employed:

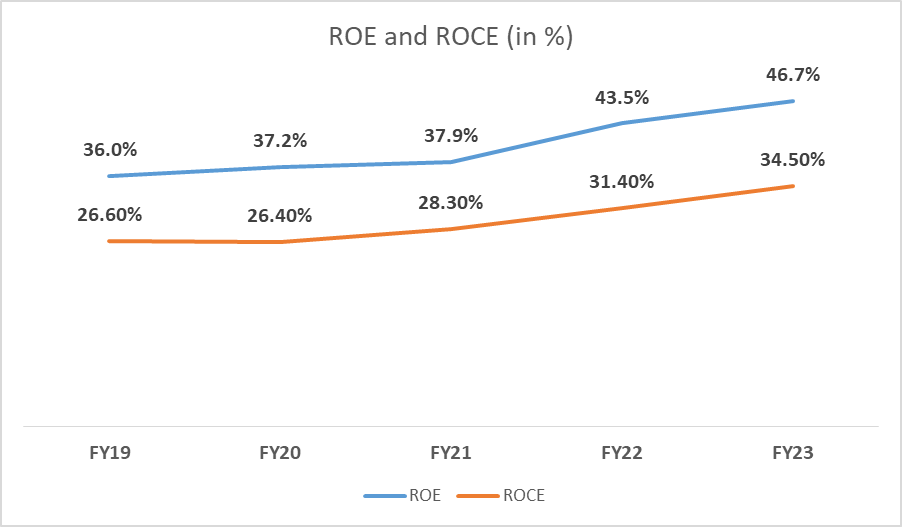

Being an asset-light company, TCS reports very high return numbers.

Return on Equity has improved to 46.7%, while the Return on Capital Employed has increased to 34.5% in FY23. ROE and ROCE have steadily increased year-on-year, from 36.0% and 26.6% in FY19, respectively.

Tata Consultancy Share Price History

TCS has been an enormous wealth creator for its shareholders since its IPO in 2004. The company has delivered a phenomenal return on investment of 3500%+ from 23rd August 2004 (INR 85 per share) to 10th June 2023 (INR 3,209 per share).

The company has delivered a 10-year price CAGR of 17.80% from INR 623.58 per share on 10th June 2013 to now trading at INR 3,209 on 10th June 2023.

Additionally, the company also pays handsome dividends to its shareholders every year. For example, the company distributed dividends amounting to INR 115 per share in FY23.

Tata Consultancy Share Price Target Future Growth Potential

TCS is a leading IT services company with a wide range of capabilities, robust digital competencies, strong platforms, and stable management. The company is the preferred partner of large corporates and is increasing its participation in sizeable digital implementation.

Hence, one can expect TCS to continue to gain market share in digital versus its large peers, given its superior execution capabilities on the digital front. Positives in favor of the company include sustainability of its revenue growth momentum in the medium term, given strong deal wins, broad-based service offerings, higher spending on digital technologies, and best-in-class execution.

Potential Risks TCS faces:

- The demand environment is uncertain because of the potential threat of recession from the world’s largest economies.

- The rising subcontracting cost and cross-currency headwinds may impact operating margins negatively.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considerea d as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Is TCS a good investment?

TCS has created huge wealth for long-term shareholders in the past. The company continues to benefit from outsourcing technology spending to India. This trend may continue to help TCS. The company may grow, given its market leadership and relationship with Fortune 500 companies. TCS may be a good investment for long-term investors if purchased after thorough evaluation and held for the long term.

Is TCS expected to do a share buyback soon?

There is no news of TCS doing a share buyback in 2023. The company’s last buyback was in March 2022, when it bought back shares for INR 4500 per share for a total buyback size of INR 18,000 Cr.

What is the face value of TCS shares?

The face value of TCS is INR 1 per share.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 7

No votes so far! Be the first to rate this post.