Introduction

For a very long period, the fast-moving consumer goods business for the Tatas largely comprised just iodized salt and branded tea. Over the past decade, however, it has taken significant steps in numerous new categories, from pulses to breakfast cereals and branded coffee to fortified water—a number of them through acquisitions.

The company is ready to expand further, with plans to acquire several more companies when FMCG companies face challenges from rising input costs and slowing consumption.

Let us try to understand what changes are happening in Tata Consumer Products and how they will affect its future performance.

Tata Consumer Products Overview

Tata Consumer Products (TCPL) is the flagship FMCG Company of the Tata Group and was born out of the merger between Tata Global Beverages and the consumer products business of Tata Chemicals in the year 2020.

TCPL offers a portfolio of foods, beverages, and retail, comprising marquee brands like Tata Tea, Tetley, Tata Salt, Sampann, Eight O’Clock Coffee, Himalayan Natural Mineral Water, Starbucks, etc. Over the years, the company has not just managed to grow organically but has also not shied away from inorganic growth.

TCPL’s beverages portfolio comprises tea, coffee, water, and ready-to-drink (RTD) beverages, whereas its food portfolio encompasses salt, pulses, spices, ready-to-cook mixes, breakfast, snacks, and mini meals. Out-of-home retail comprises premium cafes in partnership with Starbucks in India.

The Tata Group has made several acquisitions in the consumer goods space over the past couple of decades, most notable among them being the British tea company Tetley. Its other significant acquisitions included US-based Good Earth Teas and Eight O’Clock Coffee.

More recently, it acquired Kottaram Agro, the maker of the “Soulfull” brand of breakfast cereals, in 2021. In November 2021, it bought 100 percent equity shares of Tata SmartFoodz from Tata Industries, helping Tata Consumer expand into the growing ready-to-eat foods category under the Tata Q brand.

It has also strengthened its bottled beverages business by acquiring PepsiCo’s stake in NourishCo Beverages, a 50-50 joint venture between the two companies. In March this year, Tata Consumer also announced plans to merge the businesses of Tata Coffee, such as extraction and branded coffee, into itself.

The company has a presence across ~40 countries, with US, UK, and Canada being critical international geographies. It has a reach of 200+ million households in India and a distribution network covering 3.8 million retail outlets.

Tata Consumer Products Company Journey

Tata Consumer Product Ltd has a long and illustrious history. Here are some of the critical milestones in the company.

- 1964: Tata creates an alliance with Indian tea giant James Finlay to form Tata Finlay

- 1983: Tata salt, India’s first iodized vacuum-evaporated branded salt, is launched

- 1985: Tata Tea introduces the revolutionary poly pack, which helps seal its presence in India

- 1991: Tata Tea enters the business of brands

- 2000: Tata Tea acquires Tetley

- 2005: Tata Tea acquires Good Earth in the USA

- 2006: Tata Tea acquires Eight O’Clock Coffee in the USA

- 2006: Tata Tea acquires stake in Joekels tea in South Africa

- 2007: Tata Tea acquires Mount Everest Mineral Water, which owned Himalayan Water

- 2007: Tata Tea acquires Vitax, a well-known Polish tea brand

- 2010: The Company was renamed Tata Global Beverages

- 2011: Nourishco is formed through a joint venture with PepsiCo India

- 2012: Tata Global Beverage enters into a joint venture with Starbucks

- 2015: Tata Sampann is launched

- 2020: Tata Consumer Products is formed by merging the consumer products business of Tata Chemical with Tata Global Beverages

- 2020: Tata Consumer buys the entire stakes of PepsiCo in Nourishco

- 2021: Tata Consumer acquires Kottaram Agro Foods in India, owner of the brand “Soulfull.”

- 2021: Acquired Tata SmartFoodz Ltd., owner of the brand Tata Q. Marks, entry into the ready-to-eat segment in India.

Throughout its journey, Tata’s consumer product has faced numerous challenges and demonstrated resilience and commitment to innovation and sustainability. The company continues to evolve and adapt to changing market conditions while focusing on delivering high-quality products and services to its customers.

Tata Consumer Products Management Profile

- Mr. N. Chandrasekaran is the Chairman of Tata Sons, the holding company and promoter of all Tata Group companies. His appointment as Chairman of Tata Sons followed a 30-year business career at TCS, which he joined from university. Mr. Chandrasekaran rose at TCS to become the CEO and Managing Director of the leading global IT solution and consulting firm.

- Mr. Sunil D’Souza has been the Managing Director (MD) & Chief Executive Officer (CEO) of Tata Consumer Product Ltd. since Apr 2020. He started his career with Hindustan Unilever in 1993 and has 29 years of extensive experience in the consumer products sector with a strong emphasis on strategy, growth, and execution. Sunil worked earlier as Whirlpool India’s CEO and worked with PepsiCo for almost 15 years.

- Mr. L. Krishnakumar is the Executive Director & Group CFO of Tata Consumer Products. In 2000, he joined The Indian Hotels Company Limited, a Tata Group company in the hotels business, as Vice President – Finance. Four years later, he was appointed Senior Vice President – Finance of Tata Tea Limited in India in 2004. While at Tata Consumer Products, Mr. L. Krishnakumar held several leadership and strategic roles in the Company’s operations in India and its international business. He is also a director on the board of several of Tata Consumer product overseas subsidiaries.

- Mr. Ajit Krishnakumar is the Chief Operating Officer at Tata Consumer Products and is responsible for business integration and transformation as well as the integrated India operations and B2B businesses. Before this, Ajit was a Senior Vice President in the Chairman’s Office at Tata Sons, responsible for strategy, corporate finance, and M&A for the consumer and other business verticals.

- Mr. Tarun N P Varma is the Global Chief Human Resource Officer in Tata Consumer Products. Tarun has over two decades of experience, having joined Tata Consumer Products from Shell Plc, where he last served as VP – HR for the Global Technology division. He earlier led the HR function for Shell Group of Companies in India. Before this, he held multiple HR leadership roles across leading multinational corporations such as Vodafone, Coca-Cola, and Nestle.

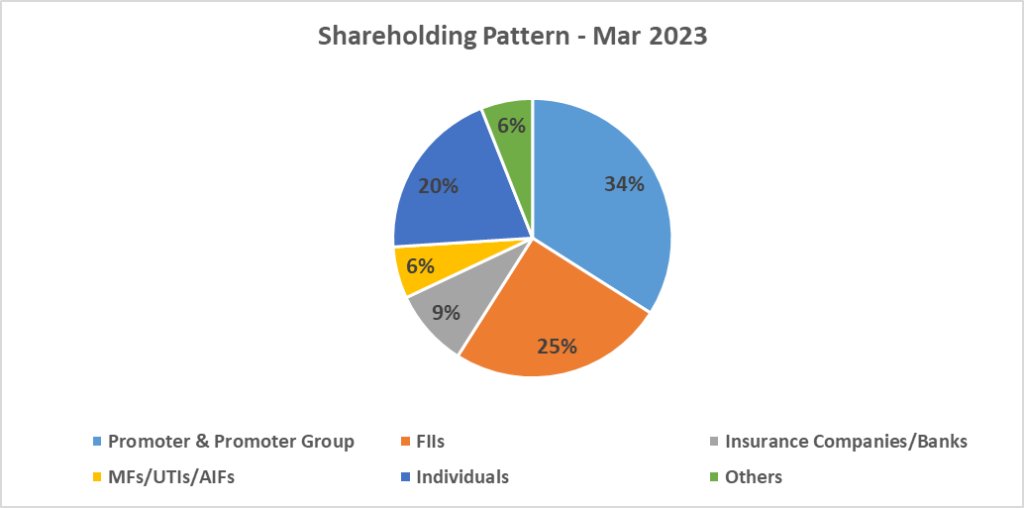

Tata Consumer Products Shareholding Pattern

Tata Consumer Products Company Analysis

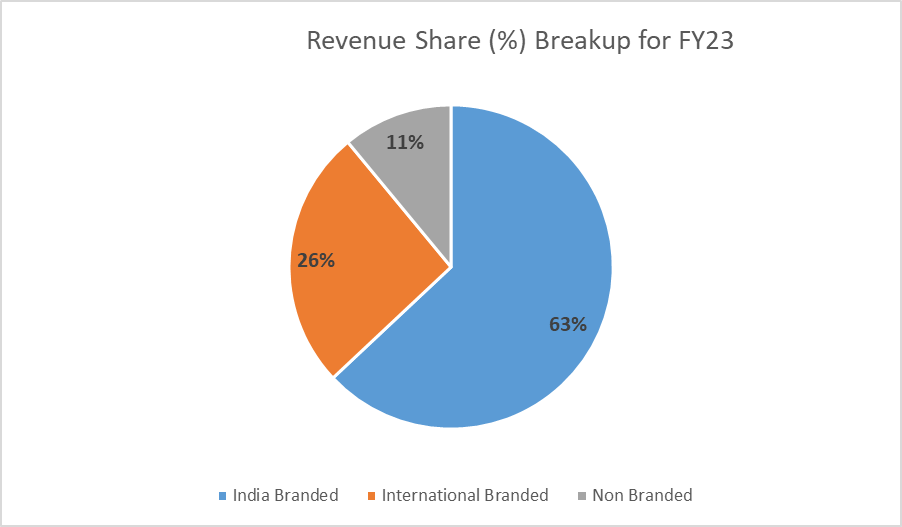

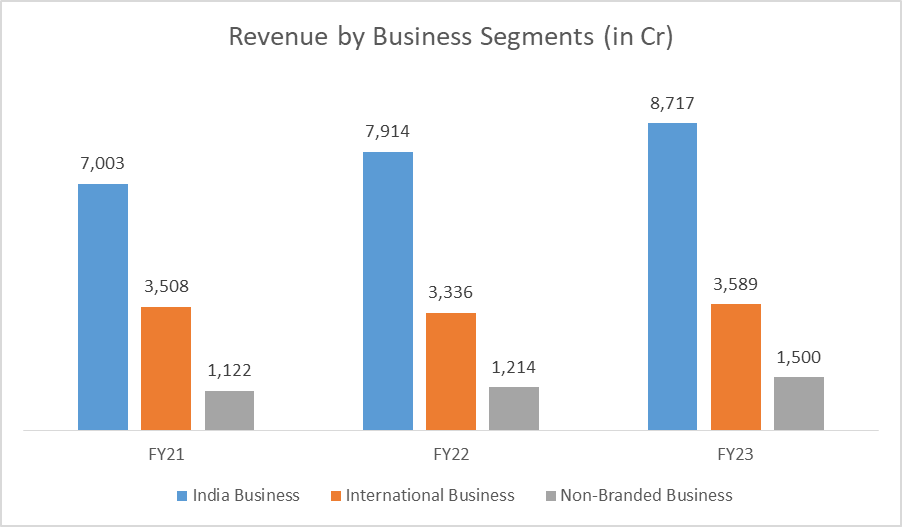

Tata Consumer Products Ltd segregates its businesses into India-branded, International-branded, and Non-branded segments. The branded division is engaged in the sale of coffee, tea, water, and other packaged food products. The other Non-branded business segment includes the plantation and extraction of tea, coffee, and other products.

The revenue contribution of various business segments is as follows:

Tata Consumer Products Fundamental Analysis

Tata Consumer Products has gone beyond its core and is now focusing on building new F&B platforms. It has taken a strategic approach to identify critical media it wants to operate in and has accordingly narrowed the universe down to five key platforms:

- Current core (tea, coffee, salt),

- Pantry (pulses, spices, staples, RTCs, dry fruits),

- Liquids (water, RTD),

- Mini meals (breakfast cereals, RTEs, snacks), and

- Protein platform (plant-based meat, plant protein powder)

Growth Businesses driving future growth:

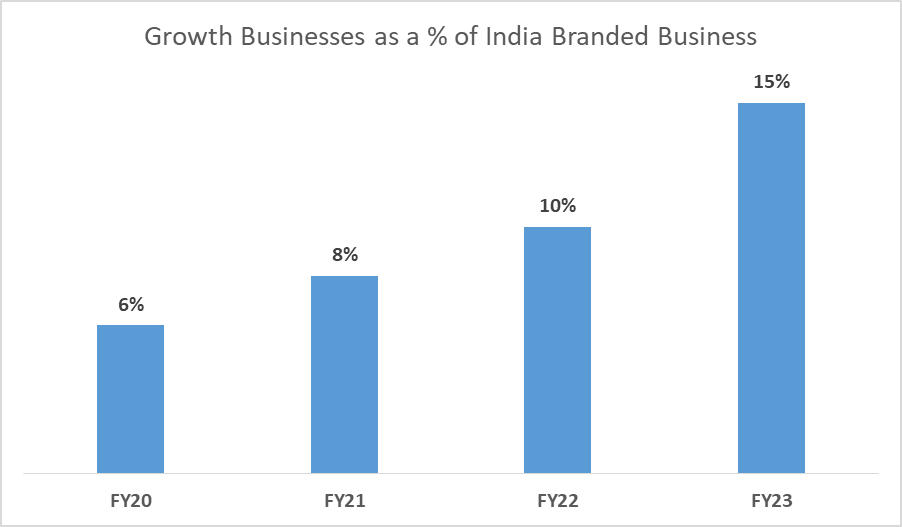

TCPL has yielded remarkable success from its growth businesses (which include NourishCo, Tata Sampann, Tata Soulfull, and Tata Smartfoodz), registering 53% y-o-y growth in FY23 and now contributing ~15% to the total India business of the company. It is further expanding its portfolio by adding new vectors of growth to sustain the robust growth trajectory.

Tata Consumer Products Financial Analysis

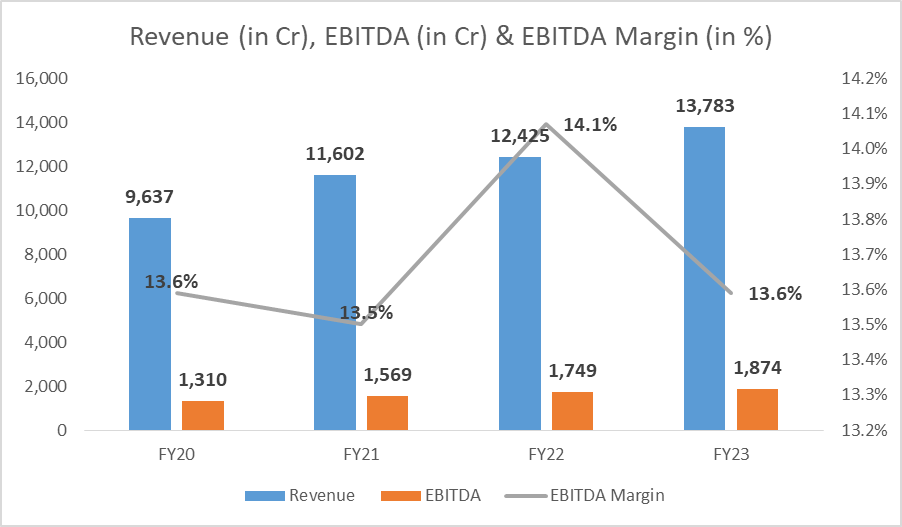

TCPL reported a total income of INR 13,783 Cr during the Financial Year ended March 31, 2023, compared to INR 12,425 Cr during the Financial Year ended March 31, 2022, an increase of 11%.

The company has posted an EBITDA of INR 1,874 crores for the Financial Year ended March 31, 2023, as against an EBITDA of INR 1,749 Cr for the Financial Year ended March 31, 2022.

EBITDA margin has remained in the 13.5% to 14% range for the last three years, even with high inflation rates.

Suppose we have to look at the financial performance over the last five years. In that case, the company has posted a Revenue CAGR of 15% and PAT CAGR of 17%, which is relatively good compared to the performance of other large FMCG companies like HUL, P&G, Marico, Dabur, etc.

Tata Consumer Products Key Financial ratios

Return on Equity and Return on Capital Employed (ROCE):

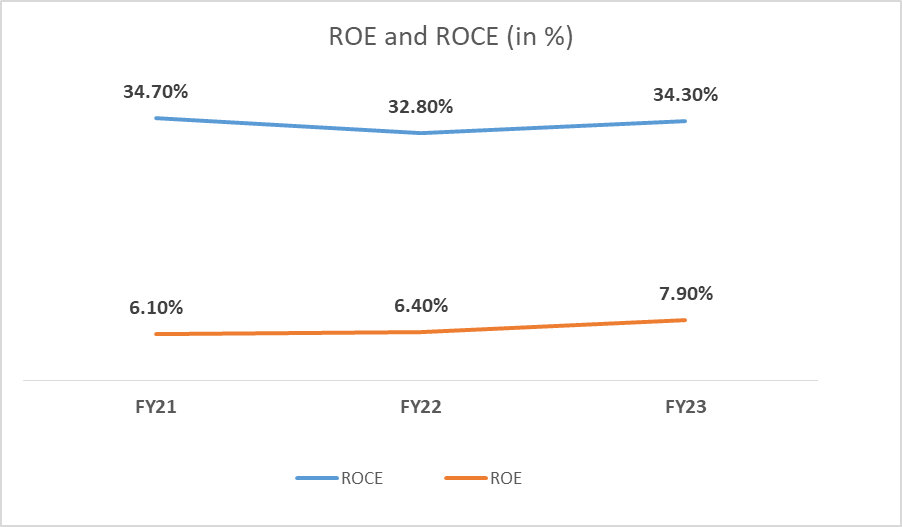

Tata Consumer Products has delivered a high ROCE of 30%+ over the last three years, while the ROE has been around ~8%. The discrepancy in the numbers is due to a significant amount of goodwill found on the balance sheet of TCPL due to acquisitions done in the recent past.

Tata Consumer Products Share Price History

Helped by the streamlining of the group companies and acquisitions, the company has become a strong player in the food and beverage business, and the market has given a big thumbs up.

Since the beginning of 2020, Tata Consumer shares have more than doubled to close at INR 865 on June 15, 2023, compared with INR 324 on Jan 1, 2020. In the same period, the Nifty FMCG index has gained 70%+.

The share price of Tata Consumer Products has delivered a three-year CAGR of 34% from 15th June 2020 to 15th June 2023 and a five-year CAGR of 27% from 15th June 2018 to 15th June 2023.

Tata Consumer Products Share Price Target Growth Potential

TCPL intends to strengthen core businesses, accelerate innovation, and unlock efficiencies to spur growth. The company plans to continue exploring new organic and inorganic growth opportunities, thus creating shareholder value. Some of the positive strategic steps being taken by the company include:

Focus on Innovation remains a key catalyst for growth: TCPL accelerated the pace of innovation during the year, focusing on health & wellness, convenience, and premiumization. The company launched 34 products in FY23 compared to 19 in FY22 and 14 in FY21, raising the innovation-to-sales ratio to 3.4% in FY23 from 0.8% in FY20. It entered new categories: plant-based meat, protein supplements, ready-to-eat (RTE), and ready-to-cook (RTC).

Sustained focus on wider reach: In FY23, the company increased its direct distribution network by 15% to 1.5mn outlets (more than double FY21 levels) and now has a total reach of 3.8mn outlets. TCPL remains focused on enhancing semi-urban and rural distribution.

Coffee is a fast-growing space: Tata Coffee focuses on branding in this segment with Tata Grand Classic and Tata Grand Premium. It plans to increase its market share from 3-4% to double-digit over the coming years.

Tata Starbucks JV continues to broaden its footprint: The Tata Starbucks JV opened 71 new stores in FY23 (against 50 in FY22) and clocked a revenue of INR 1,087 cr, growing 71% Y-O-Y and turning positive at the EBITDA level. The JV is now present in 41 cities in India and had a total store count of 333 at the end of FY23.

Potential Risks

- Continued inflation in international markets,

- Adverse currency movements, and

- Delayed rural recovery.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considerea d as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Is Tata Consumer Products good to buy for the long term?

Tata Consumer Products is transforming into a diversified FMCG play focusing on growing through organic/inorganic means. The company is also spending on innovating and launching new products that are expected to drive future growth.

What is the face value of Tata Consumer Products?

The face value of Tata Consumer Products is INR 1 per share.

Is Tata Consumer Products debt free?

Yes, Tata Consumer Products is net debt free, meaning the company’s cash reserves exceed long-term borrowings.

How useful was this post?

Click on a star to rate it!

Average rating 3.9 / 5. Vote count: 18

No votes so far! Be the first to rate this post.