It’s time for that new Financial Year feeling—fresh starts, clean slates, and maybe even a touch of optimism. The Indian stock market seems to be embracing that spirit, too!

On the first trading day of FY25 (1 April), we witnessed a stellar performance, with the Sensex and Nifty 50 scaling new all-time highs. So, what’s behind this celebratory market mood, and what can we expect moving forward?

Breaking Records

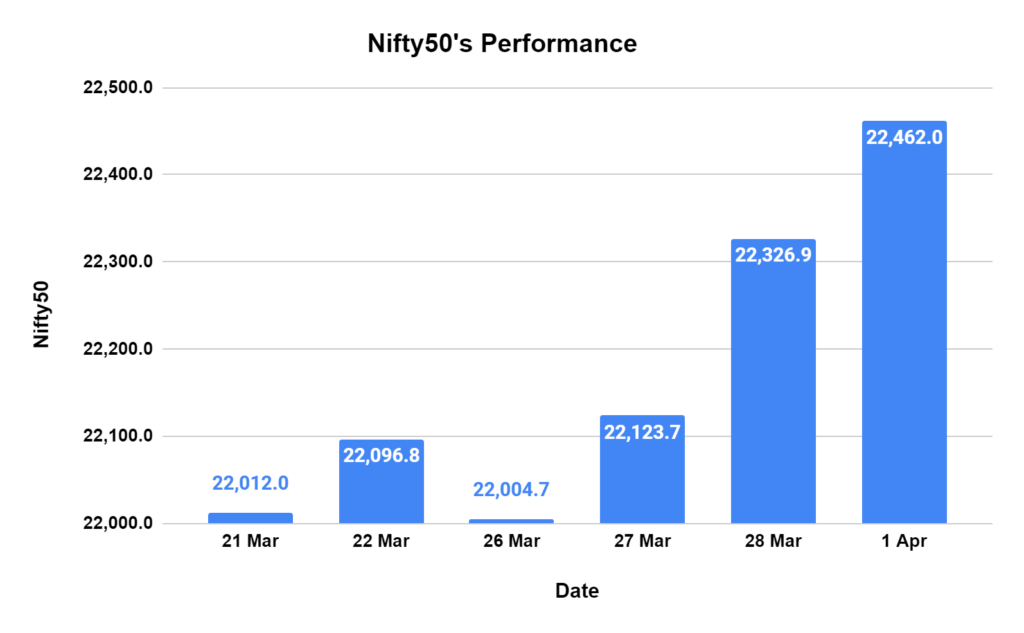

- The Nifty 50, a key benchmark index, opened strong at 22,455, a jump of 128 points compared to the previous close. The index didn’t stop there, surging throughout the day to touch a record high of 22,529.95 – a whopping 2023 points above the last closing! While it settled slightly at 22,462 by the end of the day, the gain of 135 points (0.61%) was still impressive.

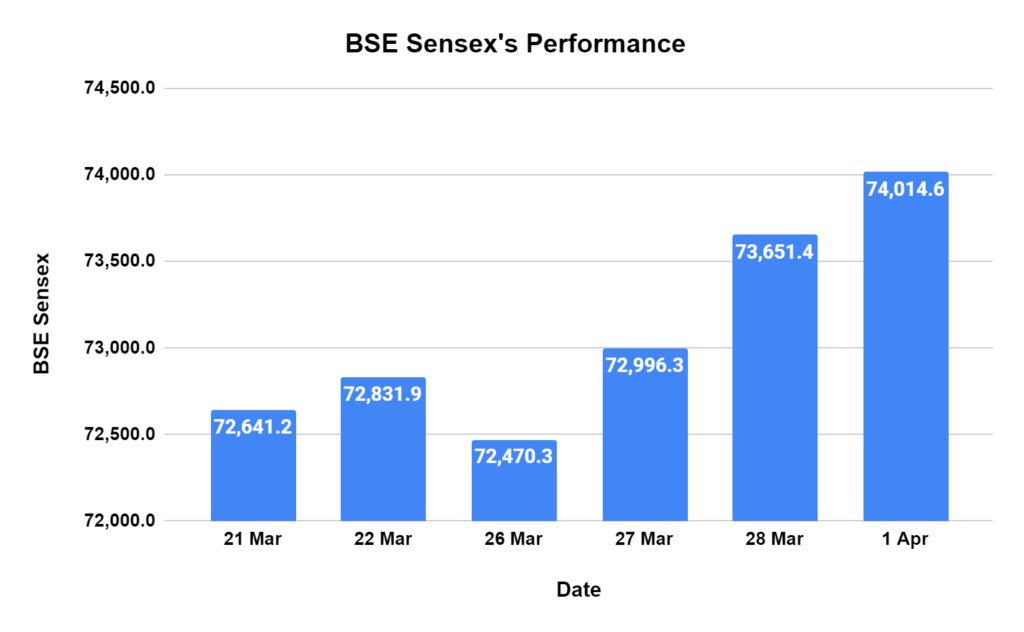

- The story was similar for the Sensex, another primary market index. It opened 317 points higher and climbed throughout the session, reaching a new all-time high of 74,254.62. Although it closed at 74,014.55, a gain of 363 points (0.49%), the bullish sentiment was undeniable.

Biggest Gainers

- Steel companies like Tata Steel and JSW Steel witnessed early gains of 1-2%, along with banking giants like Kotak Mahindra Bank and HDFC Bank. The major IT company, Infosys, also joined the party with a positive opening.

- Beyond these big names, Bajaj Finserv, L&T, HCL Tech, and Tata Motors also contributed to the market’s rise. Even companies like Hindustan Aeronautics and RVNL saw significant early surges.

- Looking at broader trends, sectors like Nifty Bank, Financial Services, Media, Realty, and Consumer Durables all opened over 1% higher.

- Nifty Oil & Gas, IT, Healthcare, Pharma, and Auto also contributed gains of around 0.9%. This widespread participation across sectors highlights the overall market optimism.

6 reasons for the Upward Market Trend as per Experts

- There’s a sense of optimism surrounding the Indian economy’s prospects. Combined with expectations of interest rate cuts by the RBI in the coming months, this has instilled confidence in investors. The recent market correction seems to have presented a good buying opportunity for those with a medium to long-term view.

- Reports suggest that some mutual funds restrict redemptions in small-cap schemes due to concerns about overvaluation. This could increase investment flows into large-cap stocks, further boosting their performance.

- A historical pattern suggests that the stock market tends to bottom out in the first quarter and rally toward the general election results during election years. This pattern has held over the past three decades in each of the seven observed instances.

- Positive cues arrived from global markets. Chinese shares led a rally in most of Asia, while US markets also pointed upward after a holiday weekend. The release of data from the Federal Reserve indicating easing inflation pressures in the US further fueled optimism. This data strengthens the possibility of a US interest rate cut in June, adding another layer of support to the global market sentiment.

- Foreign institutional investors (FIIs) also contributed to the positive momentum by buying equities worth Rs 188.31 crore on Thursday. While this figure might seem modest, it reflects continued foreign interest in the Indian market.

- Oil prices — a key concern for investors, remained relatively stable. Global benchmark Brent crude saw a slight rise of 0.37% to USD 87.32 a barrel. While oil prices remain high, the lack of significant spikes comforted the market.

Looking Ahead To A Year of Opportunities

The Sensex and Nifty 50 delivered stellar performances in the previous financial year, clocking gains of 29% and 25%, respectively. Despite ongoing challenges, experts remain optimistic about their potential for continued robust growth in FY25.

Conclusion

The market’s strong start on the first day sets the tone for an exciting year ahead. However, it’s important to remember that the market is dynamic, and unforeseen factors can always influence its direction. Staying informed and following sound investment principles will be crucial for navigating the opportunities and challenges that lie ahead.

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 6

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/