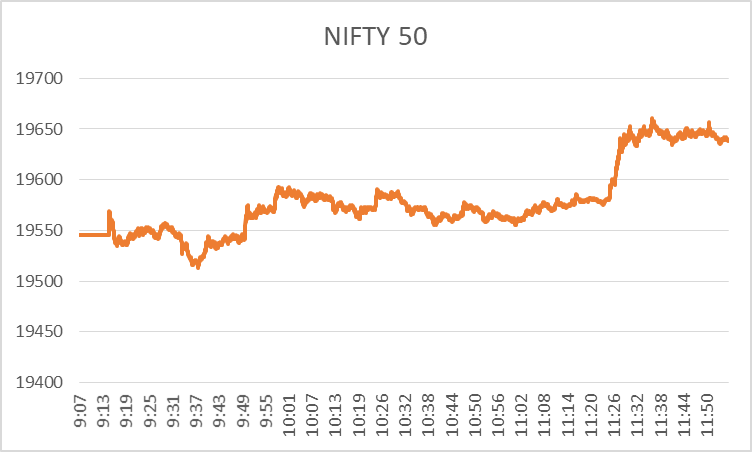

Another sluggish day for the domestic market as it gets negative cues from its global counterparts. The Nifty 50 already has fallen by 0.53% during the first two hours of the market session in the share market today.

The index not only fell but it breached the 19550 level and touched down to 19512.35 during these two hours of the market session. This drastic fall can be attributed to the rising tension in the Middle East and crude price volatility. The prices of crude oil spiked yesterday after a fresh round of attacks by Israel on Gaza, however, today the oil prices tracked back as OPEC didn’t respond to Iran’s oil embargo call on Israel [Source: TimesNow].

Except for the automobile sector, all the sectors are declining in the share market today. Let’s take a closer look at the sectoral performance.

NSE Trending Sectors Today

Auto Sector Stocks Today

Only the automobile sector is gaining today though by a tiny margin. The Nifty Auto Index has gained 0.13% until 11.23 a.m. In a market led by negative sentiments, this sector is rising as the festive demand has picked up and the two stocks driving this sector are the favourite of every India.

- Bajaj Auto is the top stock in this sector gaining 4.65% following the release of its results for the second quarter. The PAT has gone up on both YoY and QoQ basis. From Rs. 1719.44 crores during the corresponding quarter in the previous financial year, in Q2 2023, it has gone up to Rs. 2020.05 crores.

- Hero Moto Corp.: The next stock in this sector to go up is India’s favourite two-wheeler brand Hero. The stock gained 2.02% until 11.37 a.m. following the announcement of its GIFT scheme and of course festive season-induced sales.

NSE Stock Market Sectors in the Red Today

While most of the sectors are in the red, but metals, realty and oil & gas sectors have primarily dragged the share market today.

Metal Sector Stocks Today

The sectoral index for metal, Nifty Metal has plunged 1.03% until now mainly dragged by –

- APL Apollo Tubes is dragging the sector heavily as it has tanked by 2.87% as of 11.47 a.m. following negative global market cues, and overall negative performance of the sector.

- JSL, whose share price has fallen by 2.50% as the investors are waiting for the results for the second quarter to be declared today.

Realty Sector Stocks Today

The realty sector has been also performing negatively in the share market today as is clear by the fall of 0.47% in the Nifty realty Index. The stocks that have declined to most include –

- Brigade Enterprise has dropped by 1.50% until now owing to the negative market setup today.

- The Realty Giant DLF has also fallen by 1.29% as of now due to the negative market sentiments.

Oil & Gas Sector Stocks Today

The fall in this sector has been inevitable now as the global markets are under threat and oil prices are highly volatile. The Nifty Oil & Gas index has fallen by 0.46% until now.

- IGL has been the biggest loser in this sector as of 11.55 a.m. losing 4.25% after the announcement of its upcoming board meeting and quarterly results as of the first of November.

- Oil India Ltd.’s share price has declined by 1.10% following the crude prices worldwide.

Conclusion

The share market today is highly driven by global cues and volatile oil prices. The geopolitical issues have taken over the festive vibes in the market, as investors are afraid of the situation and its effect on the market. Moreover, the corporate results, which are coming up, are also affecting the prices of the equities listed on the NSE.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/