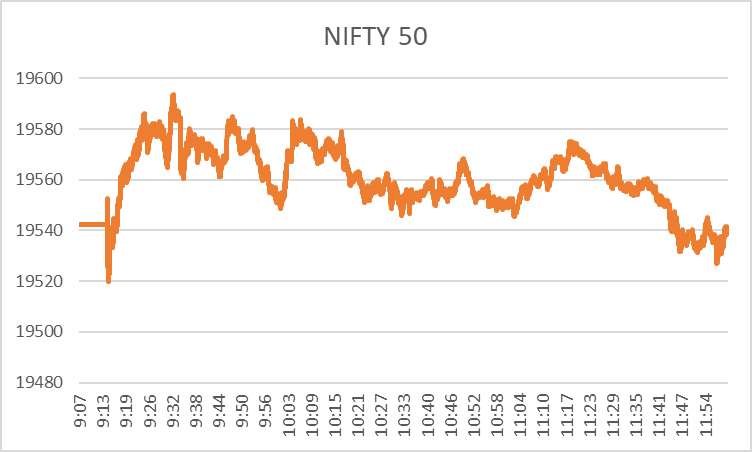

The situation in the Middle East has not improved, so there is potential for further escalation. The global market is filled with fear and confusion. This, in turn, took a toll on the domestic market, pulling Nifty 50, the broad market index in India, down by 0.34% during the first two hours of the share market today.

All the sectors are bleeding except marginal gains in the media sector. The geopolitical turmoil seems to beat up all the possible gains of this festive-driven market. Even the release of quarterly results cannot beat the tension around the Middle East and crude prices.

Let’s see the sectoral performance of the share market today until 11:06 a.m.

NSE Trending Sectors in the Green

NSE Media Sector Today

This is the only sector giving positive vibes in a market driven by negative sentiments. The Nifty Media Index has gained 0.13%, with two of these stocks gaining the most –

- D.B. Corporation Ltd. gained 2.78% until now after the announcement of investors and analyst conference call to be held on 26 October to release the quarterly results for the September quarter.

- The following company to push the sector upward is Zee Entertainment Ltd., which gained 1.73% until 11.24 a.m. due to the usual upsurge.

Sectors in the Red

While the festive season brings positive sentiments across the FMCG and consumer durables sectors, this year, due to the negative global cues and crude price rise, these two sectors have suffered since the last market session of the third week of October.

NSE FMCG Sector Today

The Fast Moving Consumer Goods sector has been the top loser until now, with the sectoral index – Nifty FMCG falling by 1.29% as of 11.35 a.m.

- ITC, which should have been a top gainer during the festive days, has fallen the most in the share market today. It has lost 2.59% even though it released its quarterly results yesterday, which show growth in its revenue and profits. Even the FMCG segment revenue has increased by 8.3% on a YoY basis.

- Hindustan Unilever is the next stock to fall the most. It has dipped by 2%, and this fall followed the second quarter’s results. The sales of this FMCG giant for the quarter ended 30 September 2023 increased by 3%.

NSE OIL & GAS Sector Today

The oil and gas sector is threatened due to the ongoing war between Israel and Gaza. The world remains divided between these countries, and the most significant effect is on crude oil prices. The Nifty Oil & Gas index dipped by 1.18% until now, with the most significant fall of –

- IGL fell by 10.14% as of 11.49 a.m. following the announcement of its quarterly results on 1 November 2023. It seems investors are not sure about the results that the company will come up with. In addition, the global cues strongly impact oil and gas companies’ prices.

- MGL is second on the list, falling 8.32%, primarily due to the overall sectoral negative movement.

NSE Consumer Durables Sector Today

As said above, the global cues have also adversely affected the consumer durables sector, and festive gains have been washed out. The Nifty Consumer Durables Index has fallen by 0.89% until now, which has been mainly impacted by –

- Havells India dipped by 3.76% even after posting 33% growth of PAT in the second quarter yesterday.

- Along similar lines, Crompton has fallen by 2.47% until now in the share market today.

So, the third week of October concludes on a negative note, with most of the sectors in the red. Until the cloud over the Middle East is clear, the volatility may remain high, as the investors aren’t sure about the price movements and the economic scenario.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 2.3 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/