Introduction

Varun Beverages is the second-largest bottling company for PepsiCo beverages in the world outside the United States. It manufactures, sells, and distributes all key brands for PepsiCo, like Sting, Mountain Dew, Mirinda, Tropicana, Aquafina, etc.

It is one of the largest beverage companies in India and is now expanding into food products as well. The company has multiplied investor wealth over the last seven years that it has been listed. Let’s try and understand the business better and assess its future performance.

Varun Beverages Overview

Varun Beverages Ltd (VBL) was incorporated on 16th June 1995 as a part of the RJ Corp group (a diversified business conglomerate with interests in beverages, quick-service restaurants, dairy, and healthcare). Varun Beverages is a key player in the beverage industry.

The company produces and distributes a wide range of carbonated soft drinks (CSDs) and a large selection of non-carbonated beverages (NCBs), including packaged drinking water. PepsiCo’s CSD brands produced and sold by VBL include Pepsi, Pepsi Black, Mountain Dew, Sting, Seven-Up, Mirinda Orange, Nimbooz Masala Soda, and Evervess.

PepsiCo’s NCB brands produced and sold by VBL include Tropicana Slice, Tropicana Juices (100% and Delight), Seven-Up Nimbooz, Gatorade, and packaged drinking water under the brand Aquafina. In addition, VBL has also been granted the franchise for the Ole brand of PepsiCo products in Sri Lanka.

VBL has been associated with PepsiCo since the 1990s and has over two and half decades, consolidated its business association with PepsiCo, increasing the number of PepsiCo licensed territories and sub-territories, producing and distributing a wider range of PepsiCo beverages, introducing various SKUs in their portfolio, and expanding their distribution network.

VBL has franchises for various PepsiCo products across 27 states and 7 union territories (except Jammu & Kashmir and Andhra Pradesh) in India. Although India is the largest market, VBL is the franchise for various PepsiCo products for Nepal, Sri Lanka, Morocco, Zambia, and Zimbabwe. VBL has 30 manufacturing plants in India and 6 manufacturing plants in international geographies.

Varun Beverages Journey

Varun Beverages Ltd (VBL) has had a long and illustrious history. Here are some of the critical milestones in the company:

Here is a timeline of Varun Beverages’ history:

- 1995: Varun Beverages Ltd was incorporated as a Public Limited company

- 1996: The Company started manufacturing operations in Jaipur

- 1999: The Company started operations in Alwar, Jodhpur, and Kosi

- 2004: DBL (Devyani Beverages Limited) was merged with VBL by the Order of Delhi High Court dated 6th Oct 2004

- 2012: VBIL (Varun Beverages International Limited) was merged with VBL by the Oder of Delhi High Court dated 12th Mar 2013

- 2013: Varun Beverages Ltd acquired the business of manufacturing and marketing of soft drink beverages in Delhi

- 2015: VBL acquired PepsiCo’s India business of manufacturing, marketing, selling, and distributing soft drink beverages and syrup mix in the Indian States of Uttar Pradesh, Uttarakhand, Himachal Pradesh, Haryana, and the union territory of Chandigarh

- 2015: VBL acquired PepsiCo’s India business of manufacturing, marketing, selling, and distributing soft drink beverage and syrup mix in Bazpur, Jainpur, Satharia, and Panipat

- 2015: VBL acquired the business of selling and distributing soft drinks beverages and syrup mix in one district undertaking situated in Punjab

- 2015: Varun Beverages (Zimbabwe) (Private) Ltd was incorporated

- 2016: VBL acquired the entire Shareholding of Arctic International Private Ltd in Varun Beverages (Zambia) Ltd

- 2016: VBL was listed on Indian Stock Exchanges – NSE and BSE

- 2017: Varun Beverages (Zambia) Ltd reached 90% from 60% after an increased stake in Zambia Subsidiary

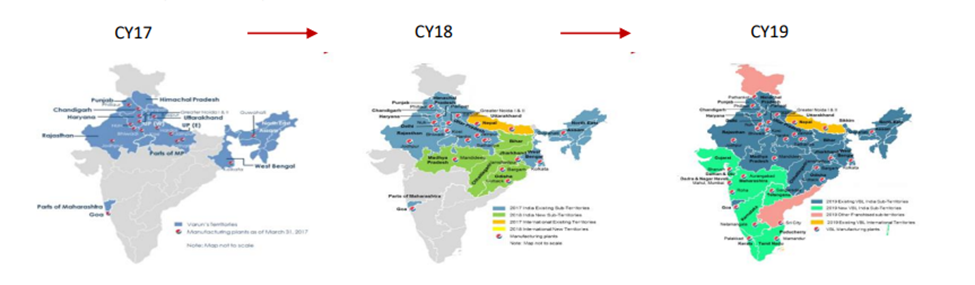

- 2017: Concluded acquisition of PepsiCo India’s previously franchised territories of the State of Odisha and parts of Madhya Pradesh, along with two manufacturing units at Bargarh (Odisha) and Mandideep (MP)

- 2018: Concluded acquisition of PepsiCo India’s previously franchised territory of the States of Chhattisgarh, Bihar, and Jharkhand, along with two manufacturing units at Cuttack (Odisha) and Jamshedpur (Jharkhand)

- 2018: Entered into a strategic partnership for selling and distribution of the larger Tropicana portfolio that includes Tropicana Juices (100%, Delight, Essentials), Gatorade, and Quaker Value-Added Dairy in territories across North and East India

- 2018: Greenfield production facility was established in Zimbabwe

- 2019: Concluded the acquisition of PepsiCo India’s previously franchised sub-territories of the State of Maharashtra (designated parts), Karnataka (designated parts), and Madhya Pradesh (designated parts).

- 2019: Concluded the acquisition of West and South India sub-territories from PepsiCo

- 2021: Incorporated a new subsidiary – Varun Beverages RDC SAS, in the Democratic Republic of Congo

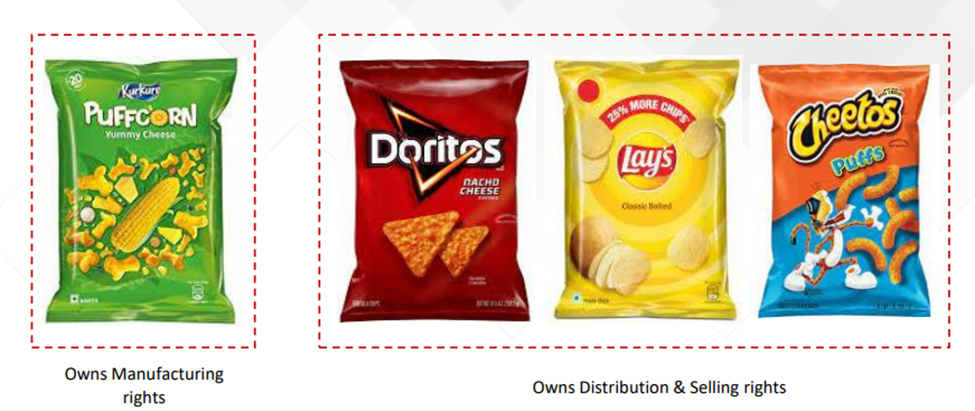

- 2022: Entered into an agreement to distribute and sell Lays, Doritos, and Cheetos for PepsiCo in the territory of Morocco

- 2022: Commenced commercial production of Kurkure Puffcorn at the Kosi, Uttar Pradesh manufacturing plant for PepsiCo.

Varun Beverages Management Profile

Mr. Ravi Kant Jaipuria is the founder of Varun Beverages Ltd and RJ Corp. He is also the promoter and Chairman of the company. He has over three decades of experience conceptualizing, executing, developing, and expanding South Asia and Africa’s food, beverages, and dairy business. He is the only Indian bottler who got the PepsiCo “International Bottler of the Year” award in 1997. Under his leadership, Varun Beverages Ltd experienced significant growth and global expansion.

Mr. Varun Jaipuria is the promoter and Executive Vice Chairman of Varun Beverages Ltd. He joined the company in 2009. Varun has been instrumental in the comprehensive development of the Company’s business, including acquisitions and integration of acquired territories. Under his leadership, Varun Beverages was awarded PepsiCo’s Best Bottler in AMESA (Africa, Middle East, and South Asia) sector in 2021 in recognition of the Company’s operational excellence, governance practices, and sustainability initiatives.

Mr. Rajesh Chawla is the Chief Financial officer of Varun Beverages Ltd. He started his career at Varun Beverages in 2021 and has over 25+ years of experience in the Finance sector. Before joining VBL, he worked with reputed organizations like Whirlpool & SIS group. He is also a qualified Chartered Accountant.

Mr. Ravi Batra is the Chief Risk Officer and Group Company Secretary of Varun Beverages Ltd. He is also a member of the Institute of Company Secretaries of India and the Institute of Chartered Secretaries of London. He has a rich experience of 25 years in the field of Corporate Governance, Listing Regulations, FEMA, ESOPs, Policy framework, POSH, Inspection, and Investigations. He heads the administration, compliance, and Secretarial functions in the company. Under his leadership, VBL has won various awards for following the Best Corporate Governance practices.

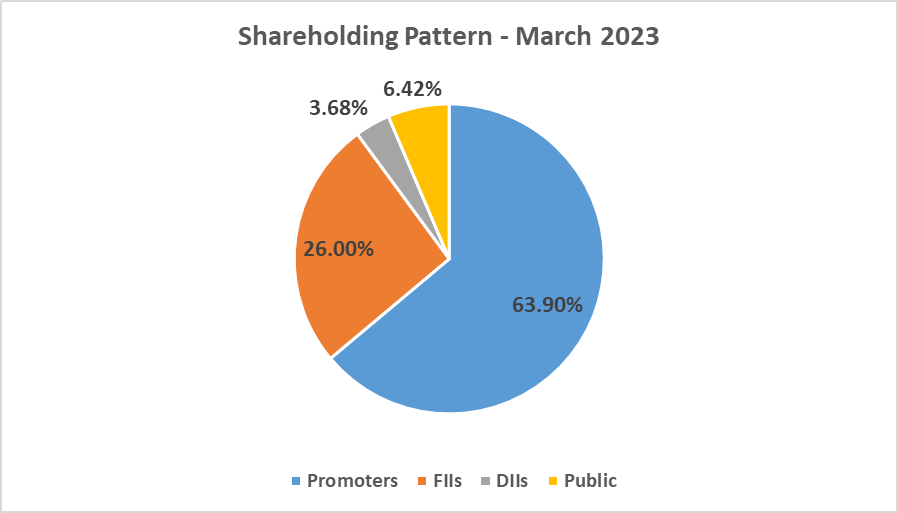

Varun Beverages Shareholding Pattern

Varun Beverages Company Analysis

Varun Beverages is into the following business segments:

In Beverages following brands have been licensed to VBL:

- Carbonated Soft Drinks – Pepsi, Mountain Dew, 7UP, etc.

- Carbonated Juice-based Drink – 7UP Nimbooz Masala Soda

- Energy Drink – Sting

- Fruit Pulp/ Juice Based Drinks – Tropicana, Slice, Tropicana Delight, etc.

- Club Soda – Evervess, Duke’s

- Ice Tea – Lipton Ice Tea

- Sports Drink – Gatorade Sports Drink in different flavors

- Packaged Water – Aquafina, Aquavess

Dairy-Based Beverages – Mango Shake, Cold Coffee, Kesar Badam, etc

In Snacks following brands have been licensed to VBL in certain geographies like Morocco: Lays, Kurkure, Cheetos, Doritos

Varun Beverages Fundamental Analysis

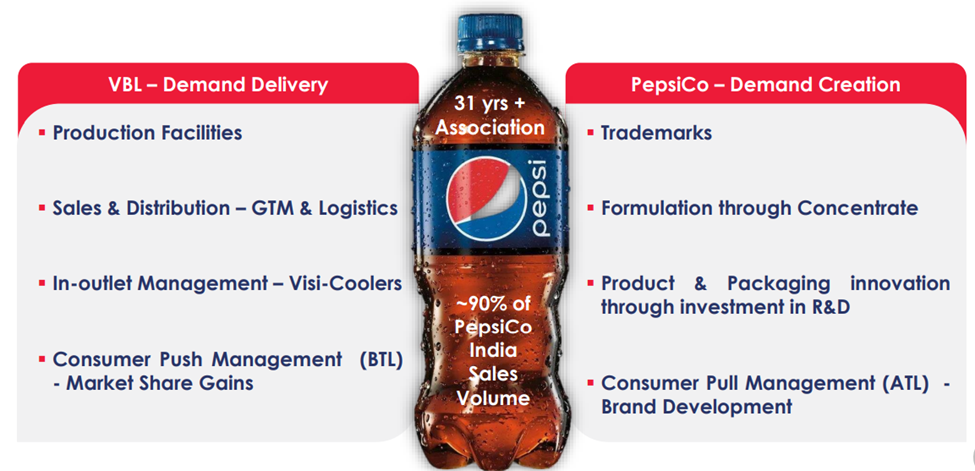

As per the agreement with PepsiCo, the responsibilities of both players are clearly pre-determined. VBL focuses on end-to-end execution, including Below the Line (BTL) marketing, whereas PepsiCo offers brand, concentrates, packaging R&D, and Above the Line (ATL) marketing support.

VBL’s expertise in sustainably scaling its existing and new territories made it easier for PepsiCo to aptly transfer most of its India’s business to them (VBL did 90%+ of the total beverage volume sold by PepsiCo in India in CY22 compared to 45%+ in CY17). Over the years, VBL has expanded its operations in India organically and inorganically. Through the in-organic route, they have acquired additional and previously franchised territories from PepsiCo.

Revenue and Profitability

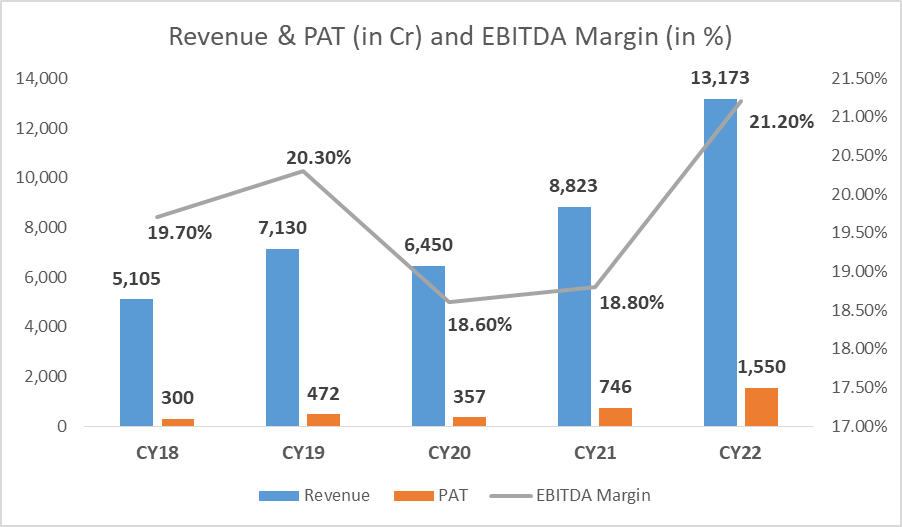

VBL grew its sales at a CAGR of ~27% from CY18 to CY22. The company has improved its EBITDA margin to 21.2% in CY22 against 19.7% in 2018.

Profit after tax has also jumped ~ five-fold from CY18 to CY22, driven by high growth in revenue from operations, improvement in margins, and transition to a lower tax rate in India.

Return on Capital Employed and Return on Equity:

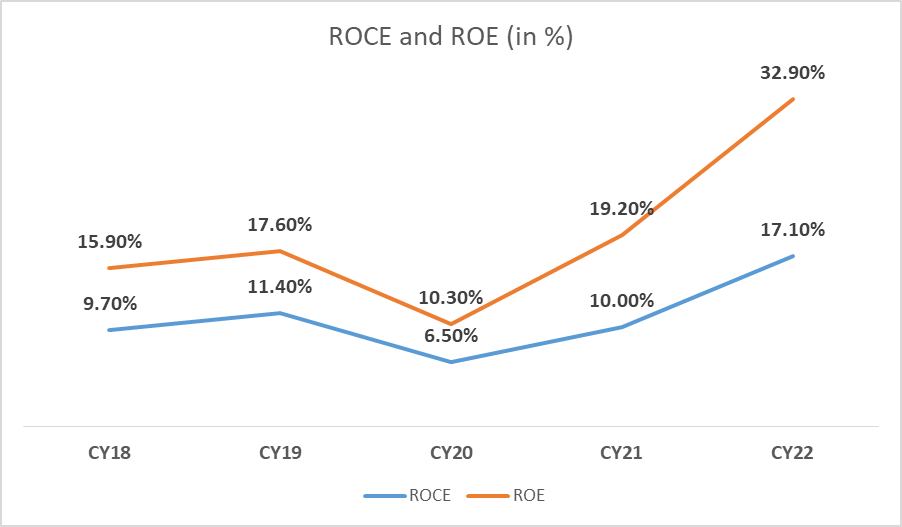

Bottling is a capital-intensive business, due to which VBL sees a stable total asset turnover of ~1x. Still, the Company can sustain an ROE greater than 15% due to backward integration in manufacturing and packaging.

The company has consistently improved its ROCE and ROE to 32.9% and 17.10%, respectively, as shown in the chart below from the lows of CY20.

Varun Beverages Share Price History

Varun Beverages had its IPO in Nov 2016, and since then, the company has delivered multibagger returns to its shareholders. It has delivered a five-year stock price CAGR of 49% (INR 109 on 10th July 2018 to INR 825 on 10th July 2023).

Last month in June 2023, the company’s board approved splitting its shares in the proportion of 1:2. The company decided to issue two equity shares with a face value of INR 5 each for one share with a face value of INR 10 each.

Varun Beverages Share Price Target Future Growth Potential

Varun Beverages has delivered stellar growth over the last couple of years. Going forward, there are enough new opportunities like:

- Strengthening position in new territories: VBL continues to improve its presence, product mix, and utilization levels. The Company is increasing its penetration in the newly acquired territories on the back of a robust distribution network, diversifying its product portfolio with an increasing focus on rural & semi-rural areas. Currently, VBL’s contribution to PepsiCo’s India sales Volume is 90%+ (in 2017, it was ~45%).

- Entering into manufacturing, selling, and distribution of food products: VBL got into a co-agreement to manufacture Kurkure Puffcorn, and in Q3 CY22, they commenced trial production in their Uttar-Pradesh plant for PepsiCo India Holdings Private Limited. Apart from this, in the testimony of a strong relationship with PepsiCo, VBL entered into an agreement to distribute & sell Lays, Doritos, and Cheetos in the territory of Morocco from January 2023. If VBL can decode the manufacturing & distribution of the food business like the beverage business, it will have a long runway for growth.

- Potential to add more visi-coolers: Currently, out of ~3 million retail outlets where VBL is present (out of the addressable market of ~10-11 million), ~60% don’t have a visi-cooler because of the non-availability of electricity or a competitor has already set up one of its visi-cooler. The company has a target to add 40,000-50,000 visi-coolers every year. Adding visi-coolers will help VBL gain customers’ attention, elevating volume growth. This creates a headroom for VBL to grow its volume organically.

Key risks:

- There is little room for further inorganic growth in domestic markets: VBL handles more than 90% of PepsiCo’s India business. The Company operates in all the Indian states except Jammu & Kashmir & Andhra Pradesh. Thus, there is little room for inorganic growth within India. VBL can only focus on organic volume growth through increased penetration and winning market share from competitors in the beverage industry.

- Change in contractual agreement with PepsiCo: VBL’s entire business depends entirely on its relationship with PepsiCo;. In contrast, the franchise agreement was extended till 2039, any future changes in the contractual arrangement could have major repercussions on VBL’s business dynamics.

- Changes in lifestyle: An emerging trend of a healthy lifestyle can impact the consumption of CSD drinks, which accounts for 70%+ volume sold by VBL. Multiple new ventures have been launched based on flavored water, infused with natural flavors and free from artificial additives. It can gradually lead to a reduction in the consumption of CSD drinks in the long run.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Is Varun Beverage good to buy for the long term?

Varun Beverages has created huge wealth for long-term shareholders in the past. The company continuously increases its product portfolio, distribution network, and geographical reach and hence should be able to deliver growth in the future. So, Varun Beverages can be a very good investment for long-term investors if purchased at the right valuation and held for the long term.

What is the face value of Varun Beverages Ltd. share?

The face value of Varun Beverages is INR 5 per share.

What is the Market cap of Varun Beverages?

The market cap of Varun Beverages is INR 10,721 crores as of 11th July 2023.

How useful was this post?

Click on a star to rate it!

Average rating 4.1 / 5. Vote count: 29

No votes so far! Be the first to rate this post.