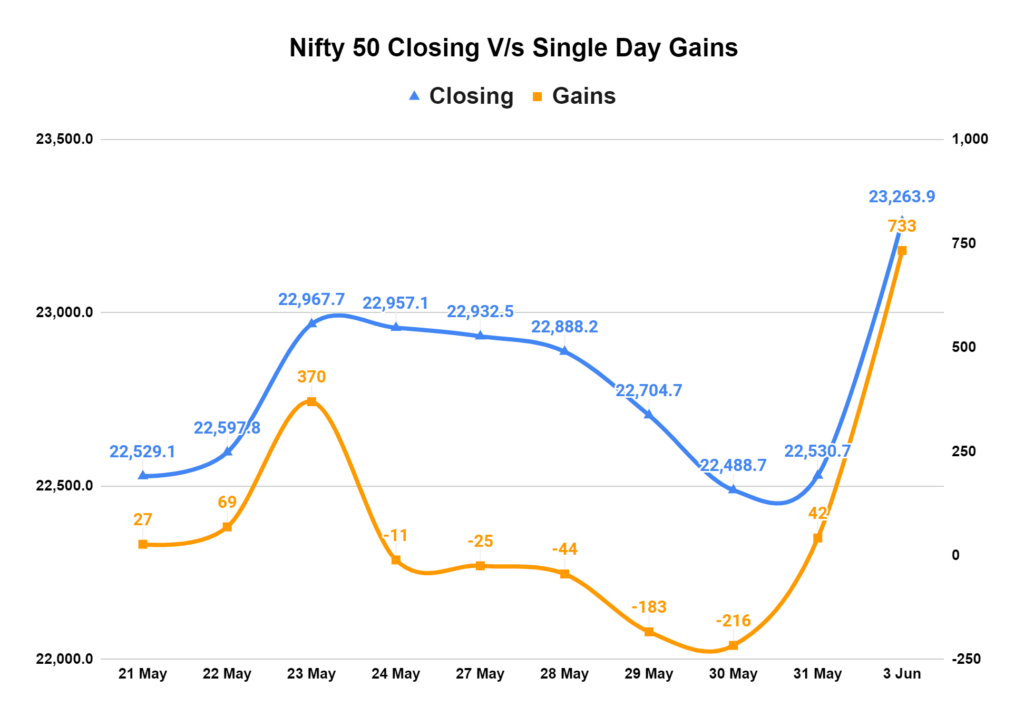

When did you remember that the stock market felt particularly energetic? Yesterday, on June 3rd, the Sensex and Nifty surged to new highs, marking the strongest single-day gain in over three years. Unbelievable, isn’t it? Could it be the anxiety of the election results today or something else?

Let’s dive into the factors fueling this market rally and see what it means for investors.

Green Across the Board

The closing bell on June 3rd painted a rosy picture. The Sensex jumped 2,507 points (3.4%) to settle at 76,468, while the Nifty 50 wasn’t far behind, soaring 733 points (3.3%) to close at 23,263. This wasn’t just a handful of stocks driving the surge – all 13 sectoral indices were in the green! Financial services, oil & gas, and power sectors led the charge, showcasing a broad-based rally.

Five Factors Fueling the Fire

Several key drivers contributed to this market upswing.

- It was the eve of the election results. As per the exit polls, the NDA government is looking to score a hat-trick. Analysts predict that the upswing might continue even today.

- India’s strong economic performance played a significant role. Remember that impressive 8.2% GDP growth for FY24 released last Friday? That and a reduction in the fiscal deficit definitely boosted investor confidence.

- The arrival of the monsoon season earlier than usual brought a sigh of relief, particularly for agriculture-dependent sectors.

- A 10% rise in GST collections to a staggering Rs 1.73 lakh crore in May added another layer of optimism to the market sentiment.

- It’s not just the big players driving this rally. Increased participation from retail investors is a key factor. More and more people are recognizing the potential of the stock market and are actively investing, and this surge in retail participation adds further momentum to the market.

Nifty Standout Gainers and Losers

While most sectors enjoyed the market upswing, there were some standouts. NTPC, SBI, and Adani Ports emerged as the top gainers in the Nifty 50, witnessing impressive jumps of 9.3% to 10.6%. Interestingly, SBI also achieved a significant milestone, becoming the seventh Indian company to cross a market capitalization of Rs 8 lakh crore!

On the flip side, a few stocks like HCL Tech, LTIMindtree, and Eicher Motors witnessed some decline, although the losses were relatively modest.

PSU Banks and Nifty Bank on a Roll

Public sector undertakings (PSUs) experienced a phenomenal rally, likely fueled by expectations of continued reforms. This optimism led Nifty PSU Bank to surge a whopping 8.6%, making it the best-performing sectoral index of the day.

Nifty Bank also crossed a significant milestone, breaking past the 51,000 mark for the first time. This index, focused on banking stocks, closed at 51,097, a significant 4.3% gain from the previous day. Banks like Bank of Baroda, SBI, and Axis Bank all witnessed strong gains, showcasing investor confidence in the banking sector.

Rupee Strengthens Too

After the exit polls suggested a third consecutive win for the NDA alliance, a new wave of positive sentiment has swept through. The Indian rupee enjoyed a good day, recording its best intraday performance since December 2023. The rupee closed at 83.1425 against the US dollar, appreciating by nearly 0.4%. This strengthening of the rupee further bolstered investor confidence.

What Does It All Mean?

This strong market surge is certainly exciting news for investors. However, it’s important to remember that market movements can be volatile. While the current trends are positive, long-term investors should maintain a disciplined approach and avoid getting caught up in the euphoria. As always, thorough research and a diversified portfolio are key to successful investing.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/