2024 is a leap year, meaning it has an extra day in February. While this may seem trivial, some investors are wondering if this year, too, the leap-year effect will affect stock market performance and cause a crash.

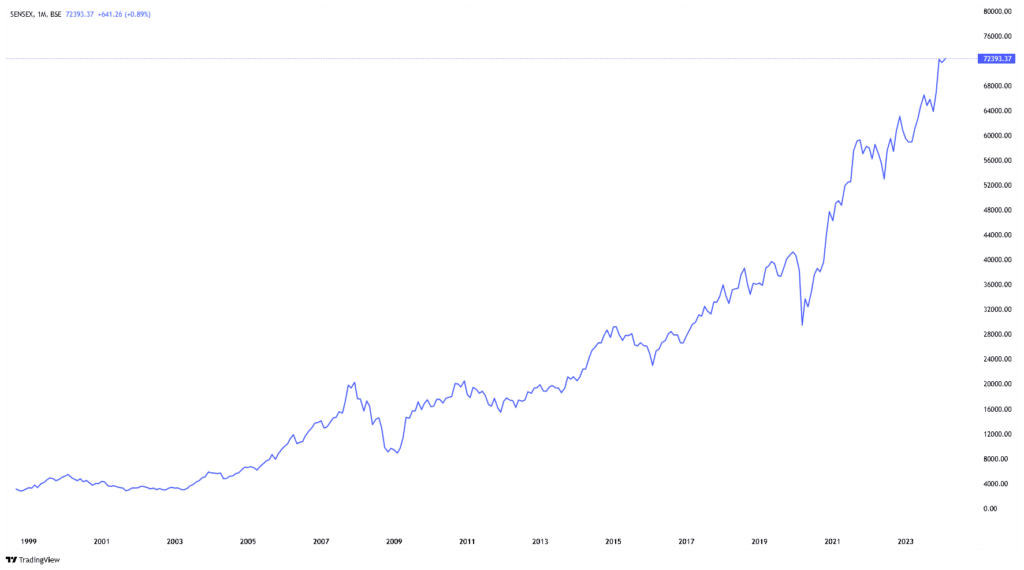

As seen in the graph below, all leap years have had a history of being associated with some of the worst market crashes in the past. The market starts to crash, or a downward trend begins that year.

The Leap Year Saga

Some of the most notable examples of leap-year crashes are:

- 1992: The Harshad Mehta scam, which exposed fraud and manipulation in the Indian stock market, led to a 50% drop in Sensex in a year. The index closed 42% lower from the calendar year’s high but ended the year with a 37% annual return.

- 2000: The dot-com bubble burst, triggering a global sell-off in technology stocks and causing a 24.86% loss in Nifty between years 2000 to 2001.

- 2008: The global financial crisis, sparked by the subprime mortgage crisis in the US, resulted in a 36% decline in the Nifty 50, while the Sensex fell 52% in 2008. The index plummeted from a record high of 21,206 in January to a low of 8,509 in October.

- 2020: The COVID-19 pandemic, which disrupted the global economy and caused unprecedented lockdowns and restrictions, led to a 16% fall in Sensex 2020, hitting a lower circuit limit and falling 12.71% in a single day on March 23, 2020. The Nifty 50 fell 23% from 11201 points in February to just 8597 by March.

These examples show that leap years have been marked by significant volatility and uncertainty in the stock market. However, does this mean 2024 will also witness a similar fate? Is there any causal relationship between leap years and market crashes?

Or Is It Just A Coincidence?

The answer is not so clear-cut. On one hand, there is no fundamental reason why the stock market should behave differently in a leap year. The extra day does not affect the companies’ earnings, growth, or valuation. The market is driven by investor demand and supply, which are influenced by various factors, such as macroeconomic conditions, corporate performance, geopolitical events, and investor sentiment. These factors are independent of the calendar and can change at any time.

On the other hand, there is some evidence of a seasonal effect in the stock market, which suggests that certain months or periods tend to have higher or lower returns than others.

The entire branch of technical analysis studies this nature of the market. For instance, some studies have found that January, April, and December are usually the best months for the stock market, while September and October are the worst. Similarly, some researchers have observed that the stock market performs better in the second half of the year than in the first half.

One possible explanation for this phenomenon is the behavioral bias of the investors, who may act differently depending on the time of the year. For example, some investors may sell their stocks at the end of the year to realize their losses for tax purposes and then repurchase them, creating a positive momentum. Alternatively, some investors may become more optimistic or pessimistic during certain seasons, affecting their risk appetite and trading decisions.

Conclusion

The bottom line is that there is yet to be a definitive answer to whether or not 2024 will escape the leap-year effect. The stock market performance in 2024 will depend on how the various factors that affect the market unfold and how the investors react to them.

Leap years may have some correlation with market crashes, but they do not cause them. Investors should invest not on the calendar but on the fundamentals and market trends. As the famous investor Warren Buffett once said, “Be fearful when others are greedy, and be greedy when others are fearful.”

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

FAQ

What is the leap-year effect on the stock market?

The leap year effect is a phenomenon that suggests that the stock market tends to perform poorly or experience crashes in leap years, which are years with an extra day in February.

What are some examples of leap-year crashes in the past?

Some of the worst crashes in the Indian stock market history have occurred in leap years, such as 1992, 2000, 2008, and 2020. These crashes were triggered by various factors, such as the Harshad Mehta scam, the dot-com bubble burst, the global financial crisis, and the COVID-19 pandemic.

What is the reason behind the leap-year effect on the stock market?There is no clear or definitive reason why the stock market behaves differently during leap years. Some possible explanations are the seasonality effect, which suggests that certain months or periods have higher or lower returns than others, and the behavioral bias of the investors, who may perceive leap years as abnormal or unlucky and thus become more cautious or fearful.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/