Have you been keeping an eye on Yes Bank’s stock price lately? If you have, you might have noticed a significant jump recently. Yes Bank’s share price surged 8% after the bank announced strong financial results for the fourth quarter (Q4) of the financial year. This increase suggests that investors are optimistic about the bank’s future prospects.

What was the buzz about?

Yes Bank shareholders saw their investment rise sharply on Monday after the bank released its Q4 2024 results on Saturday. Capitalizing on the positive news, there was a surge in buying during early morning trade. The share price opened strong at ₹27.50 on the NSE and quickly climbed to an intraday high of ₹28.55 within minutes of the market opening. This translates to an 8% gain for Yes Bank shares on Monday.

What led to this positive movement in Yes Bank’s share price?

The primary driver behind the stock price surge appears to be Yes Bank’s performance in Q4.

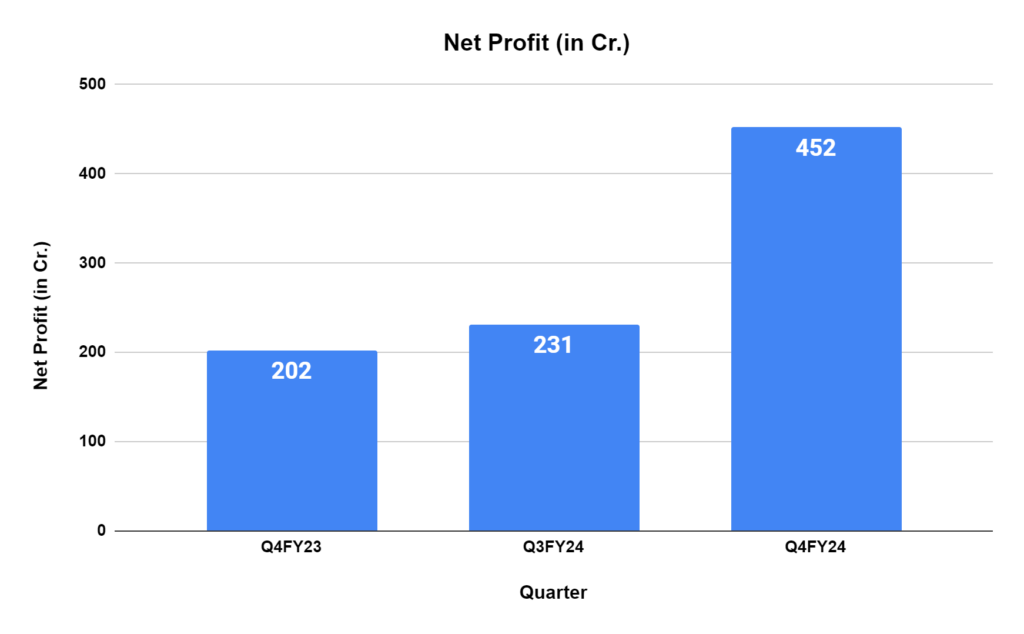

Net Profit Soars 123%

One major driver of the stock price jump was the bank’s net profit increase. Compared to the same quarter in the previous financial year, Yes Bank reported a significant jump of 123%. In concrete terms, the bank’s net profit for the January-March quarter of FY 2023-24 stood at ₹452 crore, a stark increase from ₹202 crore in the year-ago period. This rise in net profit suggests that Yes Bank is on a growth trajectory.

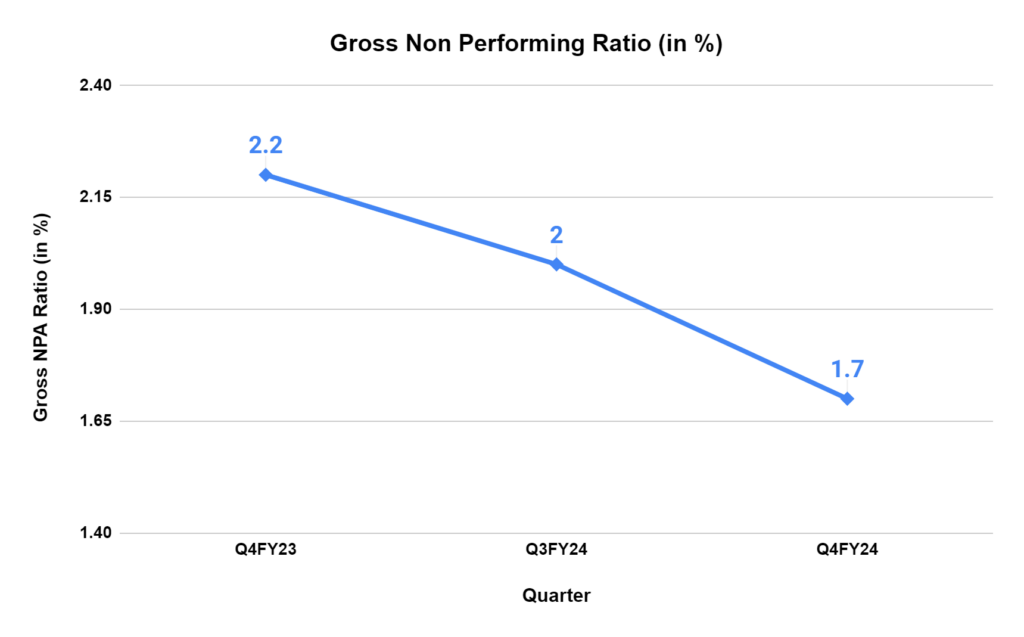

Decline in Gross NPAs Signals Improved Credit Management

In addition to the net profit growth, Yes Bank also improved its asset quality. Gross non-performing assets (NPAs) decreased, representing loans unlikely to be repaid. The bank’s gross NPA ratio decreased to 1.7%, a positive shift from 2.2% in the same quarter last year. This indicates that Yes Bank is managing its loan portfolio more effectively and reducing its risk of bad debt.

Experts’ Analysis

Financial experts believe a strong net profit increase and a declining NPA ratio are the key factors behind the Yes Bank stock price surge. These positive results have instilled confidence in investors, leading them to buy more shares, which increases the price. Some analysts have even increased their target prices for the stock, reflecting their optimism about the bank’s future potential.

It’s important to remember that analyst recommendations should not be considered financial advice. Investors should conduct their own research and due diligence before making investment decisions.

Also Read: Paid Up Capital Explained

So, what does this mean for you as an investor?

Well, that depends on your investment strategy and risk tolerance. Yes Bank’s recent performance is certainly positive, but it’s important to remember that the stock market is inherently volatile. Past performance is not necessarily indicative of future results.

Here are some factors to consider before making any investment decisions:

- Your investment goals: Are you looking for short-term gains or long-term growth?

- Your risk tolerance: How comfortable are you with potential losses?

- Your overall portfolio diversification: How much exposure do you already have to the banking sector?

Conducting research and due diligence before investing in any stock is always wise. Consult with a financial advisor to discuss your investment needs and risk tolerance.

What’s Next for Yes Bank?

While Yes Bank’s Q4 results are certainly encouraging, it’s important to maintain a long-term perspective. The bank still faces challenges, and it will be interesting to see how it navigates the competitive landscape in the coming quarters.

Key questions to keep in mind:

- Can Yes Bank sustain its profitability growth?

- Will the bank be able to reduce its NPA ratio further?

- How will Yes Bank respond to competition from other banks?

Only time will tell how Yes Bank’s story unfolds. But one thing is for certain: the bank’s recent performance has generated significant interest and optimism among investors.

Conclusion

Yes Bank’s stock price surge directly results from its strong Q4 performance. The bank’s improved financial health and decreasing NPAs have instilled confidence in investors. However, it’s crucial to remember that the stock market is unpredictable, and investors should carefully consider their options before making investment decisions.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3.4 / 5. Vote count: 22

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/