India’s emergence as a global consumer powerhouse is a testament to its remarkable economic resilience and strategic market positioning. It is projected to surpass Germany and Japan, becoming the world’s third-largest consumer market by 2026.

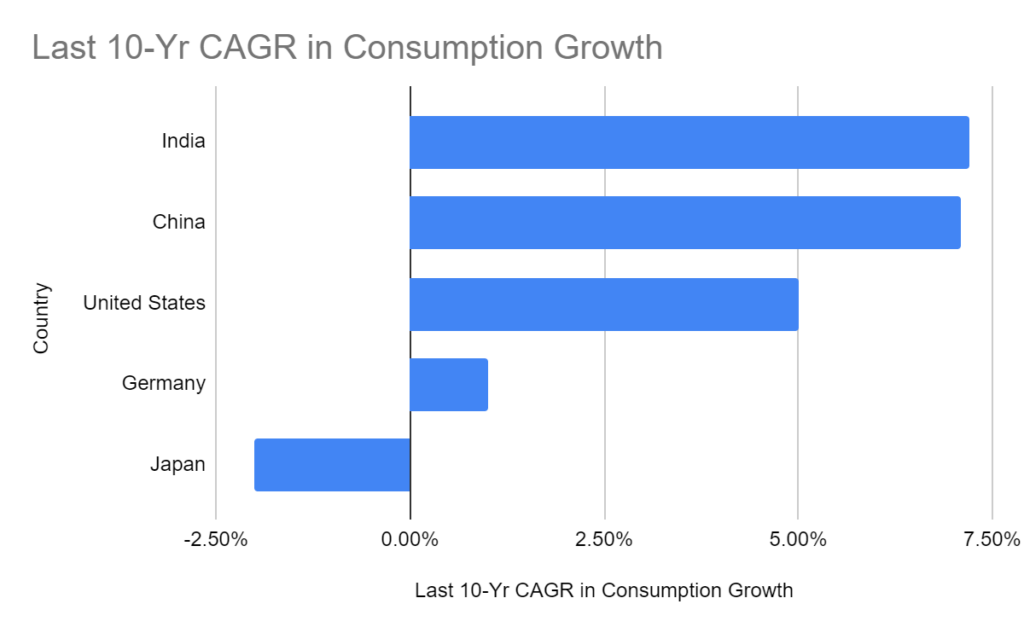

This decade of robust consumption growth, with consumption nearly doubling from $1.2 trillion in 2013 to an impressive $2.1 trillion in 2023, has led to India’s rise in the consumer market. The nation has eclipsed the growth rates of leading economies such as China, the United States, and Germany, boasting an average compound annual growth rate (CAGR) of 7.2 percent.

Domestic Market Dynamics:

India’s strong local market is critical to its economic growth. It absorbs the country’s products well, balancing what’s made and needed. This balance gives India an advantage over other Asian economies. The market’s strength also protects India from global economic problems, making its economy more stable and long-lasting. Plus, it encourages a cycle of spending and investing that’s important for the economy to keep growing and improving.

| Global Market Consumption | ||

| Country | 2013 ($ tn) | 2023 ($ tn) |

| United States | 11.4 | 18.6 |

| China | 3.5 | 6.9 |

| Japan | 2.8 | 2.8 |

| Germany | 2.3 | 2.3 |

| India | 1.1 | 2.1 |

Leveraging the China+1 Strategy

The China Plus One strategy, often called C+1, is a business approach that encourages companies to diversify their investments and manufacturing operations beyond China. This strategy aims to mitigate the risks associated with over-reliance on a single country, particularly in global supply chains.

Here’s a breakdown of the critical aspects of the China Plus One strategy:

- Diversification: Companies adopt the C+1 strategy to avoid investing solely in China and instead spread their business to other countries. This can involve investing in manufacturing in other promising developing economies such as India, Thailand, Turkey, or Vietnam.

- Risk Management: The strategy emerged due to concerns about global dependency on China, highlighted by trade tensions, the COVID-19 pandemic, and rising labor costs. By diversifying, companies can control costs, reduce risks, and gain access to new markets.

- Economic Shifts: The increasing cost of doing business in China has led to higher operating costs, especially for manufacturers. As a result, the advantages of cheap labor and market demand that China initially provided are balanced by the benefits that ASEAN countries offer, such as lower labor costs and risk diversification.

- Macro-Level Phenomenon: The China Plus One strategy is considered a macro-level phenomenon, reflecting a broader shift in international business strategies. It’s not just about individual companies making changes but about a larger movement in the global economic landscape.

- Challenges: While the strategy offers several benefits, it also comes with difficulties, such as navigating new laws and markets and managing business operations across multiple locations.

- India’s Role: India, with its large and young workforce, lower labor costs, and economic advancements, is seen as a strong contender to benefit from the China Plus One strategy. The country’s demographic advantage and competitive labor costs make it an attractive destination for companies looking to diversify their manufacturing base. This strategy, proactive policy measures, and structural reforms have propelled India’s rise as a leading consumer market.

The Imperative for High-Quality Job Creation

Creating high-quality jobs is paramount to maintaining this growth trajectory. UBS emphasizes this need, noting a disparity between consumption growth, investment rates, and economic expansion in the post-pandemic era.

Investment-GDP-Consumption Correlation

Since mid-2022, there has been a notable divergence between the growth of investments and GDP versus that of consumption. This gap is particularly significant given that household consumption accounts for nearly 60 percent of India’s nominal GDP. Understanding and addressing this divergence is crucial for ensuring that consumption growth aligns with broader economic advancements.

Factors Influencing Consumption

The disparity observed between GDP and consumption recovery post-pandemic can be traced back to a trio of pivotal factors:

- Discretionary vs. Staples:

There’s a noticeable divergence in the recovery pace between two key consumer spending segments. On one hand, discretionary spending and services are witnessing a slower rebound. This includes non-essential items and luxury services, which tend to be more sensitive to economic fluctuations. On the other hand, consumer staples, which encompass essential goods necessary for daily living, have demonstrated a more resilient and steady recovery.

- Rural-Urban Divide:

The economic revival has been uneven across different geographies. The rural economy, largely dependent on agriculture and allied activities, has shown remarkable resilience and has bounced back from the pandemic-induced lows. However, the urban economy continues to outperform, primarily driven by income continuity among the higher-income groups situated at the top of the income pyramid. This is reflected in the sustained demand for goods and services within urban centers.

- Affluent vs. Broad-Based Demand:

The affluent consumer category in India, characterized by higher disposable incomes and a propensity for premium consumption, is on an upward trajectory. It is expected to double in size over the next five years, significantly contributing to the overall consumption growth. This contrasts with the broad-based demand, which is more reflective of the general population’s spending patterns.

Outlook for FY25-26

Looking ahead to the fiscal years 2025-26, the projection for real household consumption growth, when adjusted for inflation, is anticipated to hover around 4-5 percent. This is modest compared to the robust 6.5-7 percent annual average growth witnessed during the fiscal years 2011-20.

The affluent segment is poised to maintain its strong performance through increased earnings and a preference for high-quality goods and services. Meanwhile, rural consumption is also expected to rise. This optimism is led by factors such as the anticipation of normal monsoon seasons, lifting export bans on key agricultural commodities, and a recovery in capital expenditure within the construction sector, a significant employer in rural areas.

In conclusion, India’s economic landscape is characterized by a potent mix of internal market strengths, strategic global positioning, and policy-driven initiatives. These factors collectively contribute to its status as an emerging consumer behemoth poised for continued growth in the global market.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What is the projected status of India’s consumer market by 2026?

India is projected to become the world’s third-largest consumer market, surpassing Germany and Japan by 2026.

How much has India’s consumption grown over the past decade?

India’s consumption nearly doubled from $1.2 trillion in 2013 to $2.1 trillion in 2023.

What has been India’s average compound annual growth rate (CAGR) in consumption?

India’s average CAGR in consumption has been 7.2 percent.

How does India’s domestic market contribute to its economic growth?

India’s strong local market absorbs the country’s products well, creating a balance between production and need, which fosters economic stability and growth.

What is the China Plus One (C+1) strategy?The C+1 strategy is a business approach that encourages companies to diversify their investments and manufacturing operations beyond China to mitigate risks and reduce dependency.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/