TBO Tek’s initial public offering (IPO) kicked off with a bang yesterday, 8th May, generating significant investor interest. The issue received subscriptions 1.15 times over, exceeding the initial offer.

Let’s examine the key details of the IPO, including the subscription status, Grey Market Premium (GMP), and a company overview to help you make informed decisions.

Subscription Status: A Strong Showing Across Categories

The most exciting news for TBO Tek is the overwhelming response from retail investors and non-institutional players. The retail investor portion was fully booked within hours, showcasing strong individual investor confidence. Non-institutional investors followed suit with a healthy subscription rate.

However, Qualified Institutional Buyers (QIBs) haven’t joined the party yet, with their quota subscribed at just 1%. This leaves room for potential growth in the coming days.

Here’s a breakdown of the subscription status for each category:

- Retail Individual Investors (RIIs): 3.14 times subscribed

- Non-Institutional Investors (NIIs): 2.08 times subscribed

- Qualified Institutional Buyers (QIBs): 1% subscribed

- Employees: 2.23 times subscribed

TBO Tek GMP: Positive Signal from the Grey Market

The Grey Market Premium (GMP) for TBO Tek’s IPO sits at ₹540. This indicates that investors in the unofficial market are willing to pay ₹540 more per share than the IPO price of ₹920. Considering this premium, the expected listing price could be around ₹1,460, reflecting a potential increase of 58.7% from the IPO price. It’s important to remember that GMP is an unofficial indicator and doesn’t guarantee the actual listing price.

TBO Tek IPO Details

| Offer Price | ₹875 – ₹920 per share |

| Face Value | ₹1 per share |

| Opening Date | 8 May 2024 |

| Closing Date | 10 May 2024 |

| Total Issue Size (in Shares) | 16,856,623 |

| Total Issue Size (in ₹) | ₹1,550.81Cr |

| Issue Type | Book Built Issue IPO |

| Lot Size | 16 Shares |

Allocation and Objectives: Understanding the Use of Funds

The IPO allocation reserves 75% of the net offer for QIBs, 15% for NIIs, and 10% for retail investors. This breakdown highlights the focus on attracting institutional investors while ensuring participation from individual and non-institutional players.

The company aims to utilize the funds raised through the fresh issue for various growth initiatives. Here’s a breakdown of the intended use of funds:

- ₹135 crore: Investment in technology and data solutions

- ₹100 crore: Investment in subsidiary Tek Travels DMCC for user acquisition

- ₹25 crore: Building sales and marketing infrastructure

- ₹40 crore: Inorganic acquisitions

- Remaining: General corporate purposes

Company Overview: A Travel Technology Powerhouse

Founded in 2006, TBO Tek (formerly Tek Travels Private Limited) is a leading travel distribution platform. It connects travel suppliers like hotels, airlines, and car rentals with travel agencies, independent consultants, and corporate customers. Through its platform, TBO Tek simplifies the travel booking process for both sides in over 100 countries. It offers a wide range of travel products, including hotels for over 7,500 destinations, facilitating an impressive 33,000 bookings daily.

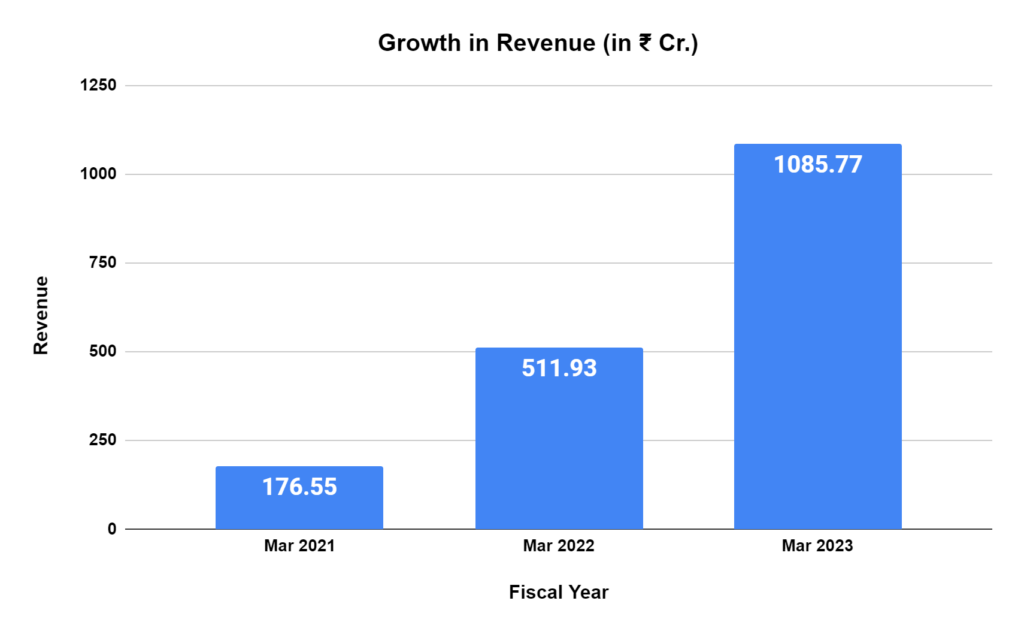

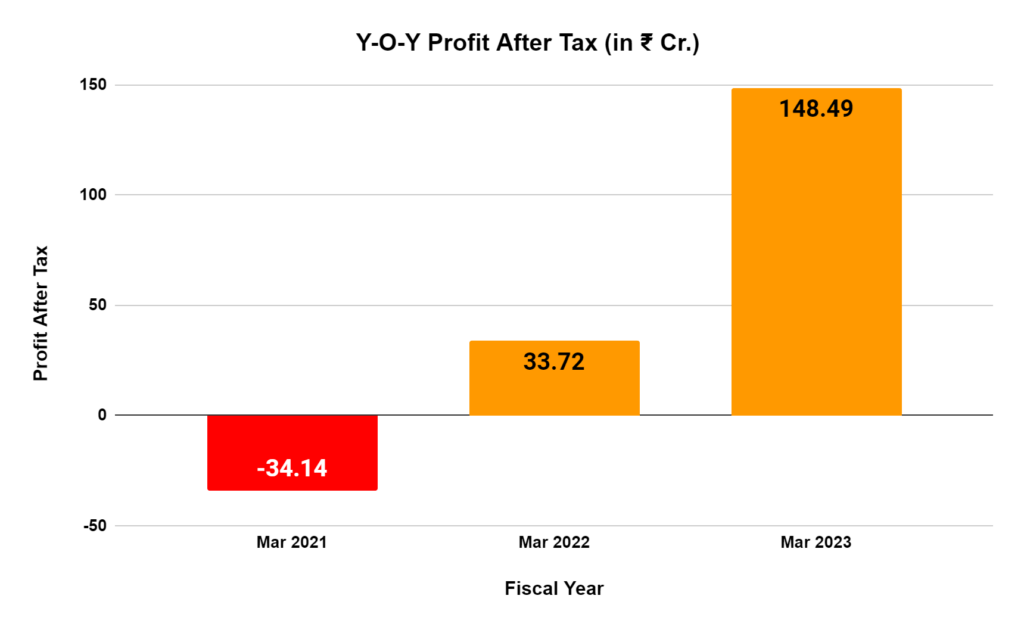

The company’s recent financial performance is also noteworthy, with a 112.09% increase in revenue and a staggering 340.4% growth in profit after tax between FY2022 and FY2023.

SWOT Analysis: A Well-Rounded Look at TBO Tek

| Strengths | Weaknesses |

| Strong brand presence and established track record Diversified product portfolio across various travel segments Robust technology platform facilitating seamless connections Impressive growth in revenue and profitability | Reliance on third-party suppliers for inventory. High dependence on the travel industry’s overall health. Relatively low QIB subscription on Day 1 |

| Opportunities | Threats |

| The growing online travel market in India and globally. Expansion into new markets and travel products. Strategic acquisitions for further growth. Leveraging technology for improved efficiency and customer experience | Intense competition in the travel technology space. The economic downturn may affect travel demand. Regulatory changes affecting the travel industry |

Conclusion:

TBO Tek’s IPO has gotten off to a good start with strong interest from retail investors and non-institutional players. The high GMP in the grey market could further indicate positive investor sentiment. While QIB participation remains low, there’s still time for things to pick up in the coming days. Analyzing the company’s strengths, weaknesses, opportunities, and threats is crucial before making investment decisions.

Know more about

IPOs | Current IPOs | Upcoming IPOs| Listed IPO

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/