Want to know ITC share price? ITC, once known for frustrating investors with its stubborn rangebound share price movement while the entire market was rising, has now become one of India’s most sought-after shares for long-term investment horizons.

ITC share price has increased by 67.24% in the last year, from ₹232 to currently trading at ₹388, as of March 10 2023. Let’s check what is working in favor of ITC and assess the long-term growth potential of ITC share price.

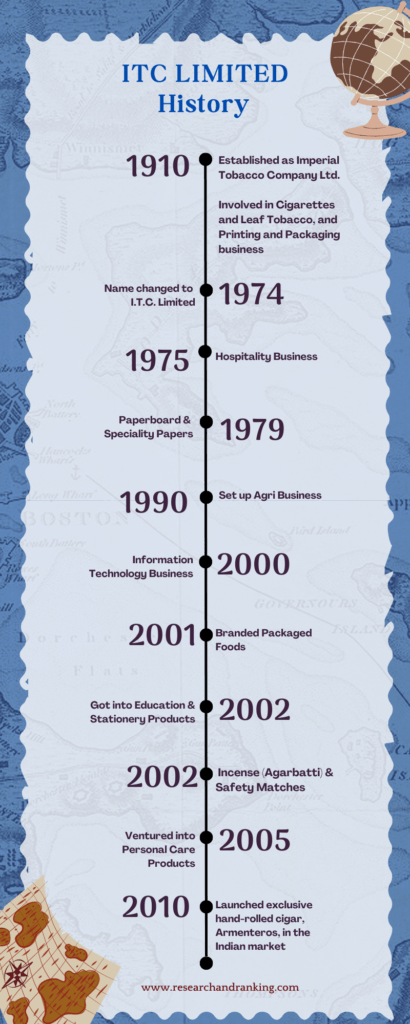

History of ITC

ITC Limited, a diversified conglomerate with operations ranging from FMCG to hotels, cigarettes, stationery products, agribusiness, and information technology, was founded on August 24, 1910, as Imperial Tobacco Company of India Limited. The name was changed to Indian Tobacco Company Limited in 1970 to reflect more Indianness in the company’s name and a change in ownership structure. It was rechristened as ITC Limited on September 18, 2001. The timeline below depicts the ITC’s journey since its inception and the years when it ventured into new businesses.

ITC has diversified significantly over the years, with the primary goal of reducing its reliance on cigarettes and tobacco by focusing more on the FMCG and Agri businesses, and is touching the lives of every Indian in some way.

ITC is one of India’s top ten largest corporations, with a market capitalization of 4.81 thousand crores as of March 10, 2023.

ITC Business Overview

In the tobacco and non-tobacco businesses, ITC manages some of the leading brands in India, and its distribution and reach help create a structural competitive advantage against other players in the market.

ITC manages its business through six business segments:

- FMCG-Cigarettes

- FMCG-Others

- Hotels

- Agri-Business

- Paperboards, Papers, and Packaging

- Others

In FY22, ITC reported gross revenue at ₹59,101 crores, and profit after tax stood at ₹15,057 crores. It has a track record of paying consistent dividends to its shareholders with a high dividend yield percentage.

ITC Management Profile

CEO and Managing Director Mr Sanjiv Puri has led ITC since February 2017. He joined ITC in January 1986, has held several business head positions, and has managed many responsibilities. Before becoming CEO, Mr Puri was the company’s, Chief Operating Officer. He is an IIT Kanpur alumnus and did his business management studies at the Wharton School of Business.

Mr Nakul Anand, Executive Director, oversees the company’s Hospitality and Travel & Tourism businesses. He holds an Economics degree from Delhi University and an AMP from Bond University in Australia. He began his career as a Management Trainee at ITC Hotels Limited in 1978.

Mr Hemant Malik is the Divisional Chief Executive of Foods Business and joined ITC in 1989 after completing management studies at IIM Kolkata.

Mr Sumat Bhargavan, Executive Director, oversees the company’s Paperboards, Paper, Packaging, and Personal Care and Education & Stationery Products Businesses. He joined ITC in January 1986 after completing his studies at NIT, Durgapur.

And Mr Supratim Dutta is the Chief Financial Officer of the company. He is a qualified Chartered and Cost Accountant and joined the company in November 1990.

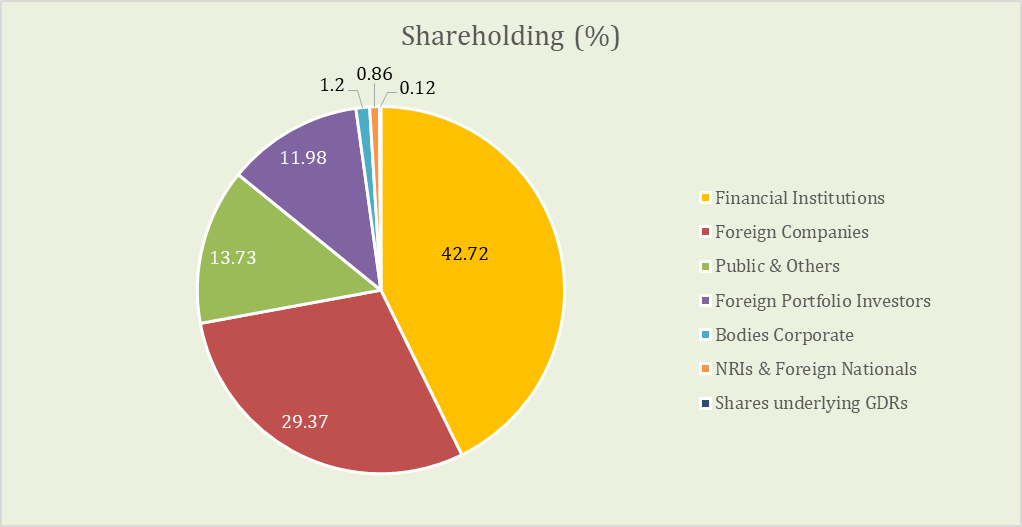

ITC Shareholder Profile

ITC Financials

Revenue

In FY22, ITC reported gross revenue at ₹59,101 crores, 22.7% higher than FY21 at ₹48,151 crores. While in Q3FY23, the company reported gross revenue at ₹17,122 cores, 2.9% higher compared to Q3FY22 at ₹16,634 crores.

Segment-wise revenue breakup

| Operating Segments | Q3 FY23 (in cr.) | Q3 FY22 (in cr.) | FY22 (in cr.) | FY21 (in cr.) |

| FMCG-Cigarettes | 7,288 ▲16.77% | 6,244 | 23,451.39 ▲15.33% | 20,333.12 |

| FMCG-Others | 4,841 ▲18.4% | 4,091 | 15,994.49 ▲8.6% | 14,728.23 |

| Hotels | 712 ▲50.5% | 473 | 1,285.00 ▲104.8% | 627.51 |

| Agri-Business | 3,124 ▼37.1% | 4,962 | 16,196.07 ▲28.7% | 12,582.24 |

| Paperboards, Papers, and Packaging | 2,306 ▲12.7% | 2,046 | 7,641.62 ▲36% | 5,618.55 |

EBITDA

In FY22, EBITDA increased by 22% to ₹18,933.06 crores from ₹15,523 crores in FY21. While in Q3FY22 as well, EBITDA increased by 22% to ₹6,223 crores year-on-year, from ₹5,102 crores in Q3FY21. The hotel segment reported an EBITDA margin of 31.5%, while the FMCG-Others segment achieved a double-digit EBITDA margin of 10% for the first time.

Net Profit

The profit after tax for the company in FY22 stood at ₹15,057.83 crores, compared to ₹13,277.93 crores in FY21. And, in Q3FY22, profit after tax (PAT) grew by 21% to ₹5,031 crores from ₹4,156 crores in Q3FY21.

ITC Key Financial Ratios

Current Ratio: ITC’s current ratio in FY22 was 2.7x, marginally declining from 3.1x in FY21.

Operating Profit Margin: In FY22, ITC’s operating profit margin was 33.6%, which declined from 35.6% in FY21.

Net Profit Margin: In FY22, ITC’s net profit margin was 25.5%, which declined from 27.1% in FY21. As stated by the company, the decline in the operating and net profit margins is due to changes in the business mix during the period.

Return on Net Worth: Return on net worth, the metric that indicates the profit earning capacity of the company’s shareholders’ invested amount, increased to 25% in FY22, up from 21% in FY21.

ITC doesn’t report Interest Coverage Ratio and Debt-to-equity Ratio as it has negligible debt on its book.

ITC Share Price Target Analysis

ITC IPO debuted in 1970 and was offered to the public at a premium of ₹3 per share. ITC’s board of directors has issued numerous bonus shares over the years, and its equity shares were split once at a 10:1 ratio on September 21, 2005.

Starting in 1980, through multiple bonus issues and split once, 100 equity shares of ITC have now become approximately 34,560 units.

Also, ITC has a track record of paying consistent dividends to its shareholders. For example, in the last three years, ITC paid dividends of ₹10.15 in 2020, ₹10.75 in 2021, and ₹11.50 in 2022.

After reaching a low of ₹137.60 in March 2020, the ITC share price has recovered and is now trading at ₹388 as of March 10 2023, representing a 33% CAGR return over the last three years.

ITC Share Price: Fundamental Analysis

Over the years, The Company has gone through a huge transformation and is now better known for its role in FMCG- foods and personal care products. Its accelerated earnings in the non-tobacco businesses over the past two years have helped ITC share price rise and outperform the broader index.

Tobacco Business (FMCG-Cigarettes)

ITC’s tobacco business is the cash cow for the company and has almost 40% share of the group’s revenue and over 75% share in the company’s net profit.

With stability in taxes and enforcement agencies’ crackdown on illicit trade activities concerning the sector, The Company has recorded strong volume growth across the product line in recent quarters. Also, new launches and democratizing premiumization across product segment coupled with strong on-ground execution has helped The Company to higher double-digit revenue and earnings growth.

In Q3FY23, revenue from the segment was ₹7,288 crores, which is 16.8% higher year-on-year, and earnings before interest and taxes were at ₹4,620 crores, over 63% margin in the segment.

With improved earnings visibility, a low material impact from the Union Budget tax increase, and double-digit volume growth, the segment is well-positioned to grow and drive value for the company in the coming quarters.

Non-tobacco Business

FMCG-Others

FMCG-Others is the second-largest contributor to the group’s revenue and is slowly turning the wheels of growth and has witnessed over 230bps expansion in EBITDA margin in the last two years to reach 10% in Q3FY23.

Food, dairy, beverage, frozen foods, personal care brands such as Vivel and Fiama, education, and stationery drive growth across markets and channels. In the last three quarters, revenue from sales growth consistently hits the high teen percentage growth. In Q3FY23, the FMCG-Others segment reported an 18.3% growth in sales revenue to ₹4,841 crores.

Hotel Business

Although the segment has a low contribution to the group’s revenue but has a healthy margin. The sector emerged from the pandemic blues, and occupancy rates are above pre-pandemic levels. In Q3FY23, revenue from the segment was at ₹712 crores, 50.5% higher than Q3FY22. And the segment EBITDA margin is at 31.5%, compared to 24.7% last year.

I.T.C has a healthy pipeline of hotel launches in the coming quarters, allowing it to capitalize on market opportunities.

The outlook for the sector looks bright, with demand coming from the strong growth surge in travel & tourism activity, the G20 summit, IPL tournaments, ICC cricket world cup in FY24.

Agri-Business

The agri-business segment was the third-largest contributor to the group’s revenue in FY22, underperforming due to government restrictions on wheat and rice exports.

The segment’s revenue fell 37% yearly to ₹ 3,124 crores in Q3FY23. However, the margin expanded during the period, with Earnings Before Interest and Tax (EBIT) rising by 32.6% to ₹391 crores.

To reduce the impact of governmental restrictions, I.T.C is now focusing on rapidly scaling up its value-added product portfolio across multiple crop value chains, including millets. The revenue will likely grow in the coming quarters. The manufacturing facility at Mysuru for the export of Nicotine and its derivatives to the US and Europe is expected to be commissioned shortly.

ITC Share Price Target Future Growth Potential

After years of flat growth, I.T.C is witnessing a significant turnaround in business with volume-led growth. Some of the factors that are expected to aid I.T.C share price growth are:

- Moderating inflation rate is likely to aid growth in the FMCG- Others segment

- After years of flattish sales, cigarette volumes are growing at a higher percentage rate in the last eight quarters and the best in over a decade.

- The future-ready product portfolio focuses more on value-added food products and emerging healthceuticals (health drinks).

- Leveraging digital channels to expand the reach and build a next-generation agile supply chain.

- Strategic acquisitions to fill the gap in the product portfolio, for example- the acquisition of Sunrise spices and Savlon, has helped I.T.C to fill the key gap and capitalize on the market opportunity.

- A good monsoon is expected to push rural demand, where The Company has the upper hand over other players in the market.

After years of work, all the cylinders of I.T.C’s growth engine are firing simultaneously, improving the company’s growth prospects. The I.T.C share price is trading near its all-time high and remains in an uptrend. However, risks such as elevated inflation levels in the global market, a poor monsoon, and extended global supply chain disruption can adversely affect The Company’s share price.

Disclaimer Note: The stocks and financials mentioned in this article are for information purposes only. They shouldn’t be considered as a recommendation by Research & Ranking. We will not be liable for any losses that may occur.

FAQs

How has the ITC share price performed in the last 5 years?

Due to rangebound movement, ITC share price has underperformed the broader index in the last five years and has given a CAGR return of 7%. But, in the last three years, because of the improved business outlook, The Company share price has given a CAGR return of 33% as of March 13 2023.

Who is the biggest shareholder of ITC?

ITC is a professionally managed company. Financial institutions hold 42.27% of the company, The second largest shareholders are foreign companies.

When was I.T.C incorporated?

I.T.C was incorporated on August 24, 1910, as Imperial Tobacco Company of India Limited, and in 1970., the company changed its name to Indian Tobacco Company Limited.

Related investing topics

Read more: About Research and Ranking

How Long-term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 3.9 / 5. Vote count: 98

No votes so far! Be the first to rate this post.