Introduction

Hindustan Unilever is one of India’s oldest and largest FMCG companies. It is impossible not to have used their products once in your life. It is also said that HUL is CEO churning machine, and many senior people from the company have gone on to lead other organizations to their glory. That speaks a lot about the management quality and how they run their business.

This is a best-in-class company with the best corporate governance standards and has also been a considerable wealth creator for shareholders. So let us try to understand Hindustan Unilever better and see if it is still an attractive investment opportunity.

Hindustan Unilever Overview

With nearly 90 years of heritage in India, Hindustan Unilever Limited is India’s largest fast-moving consumer goods (FMCG) company. It is a subsidiary of Unilever, a British-Dutch multinational company that owns several well-known brands in the FMCG space.

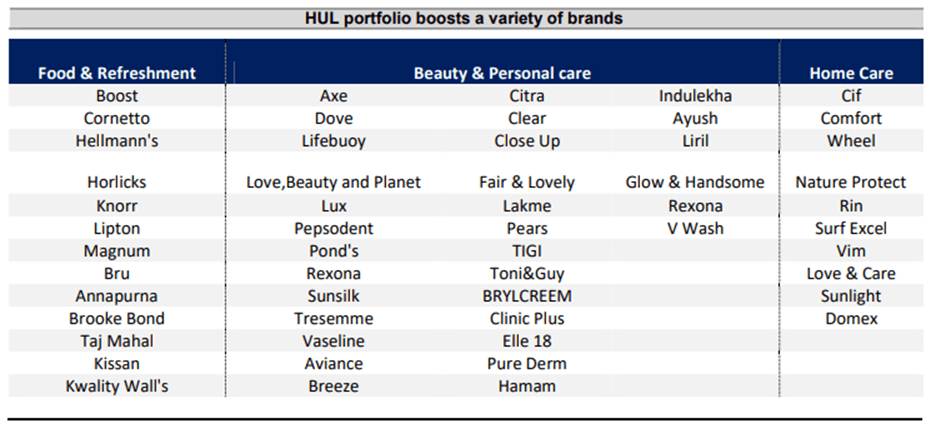

The company owns 50+ brands across 15 distinct categories, such as fabric solutions, home and hygiene, life essentials, skin cleansing, skincare, hair care, color cosmetics, oral care, deodorants, tea, coffee, ice cream & frozen desserts, foods, and health food drinks, the company is a part of the everyday life of millions of consumers across India.

It has a strong presence in India and is one of the most trusted brands in the country. Some of its famous brands in the personal care category include Dove, Lux, Lifebuoy, In addition, Pepsodent, and Fair & Lovely. In addition, the company offers brands like Surf Excel, Rin, Wheel, and Vim in the home care category. It also has a popular food and beverages segment, with brands like Lipton, Brooke Bond, Kissan, and Knorr.

Besides its strong brand portfolio, the company has been recognized for its sustainability and social responsibility efforts. The company has undertaken several initiatives to improve hygiene and sanitation in rural India, promote women’s empowerment, and reduce its environmental footprint. As a result, the company has also been ranked as the most sustainable company in India by the Dow Jones Sustainability Index for several years.

The company’s brands are available across 80 lakh+ stores across India, and around 90% of all households in India use one or more of the company’s branded products. It is a category leader in more than 90% of its businesses. India is the company’s primary place of business, accounting for 96% of revenues, and the rest 4% of revenues are earned from sales outside India.

Forbes rated Hindustan Unilever as the most innovative company in India and #8 globally. In addition, Aon Hewitt recognized HUL as one of the best companies to work for.

Hindustan Unilever Company Journey

- In 1931, Unilever established its first Indian subsidiary, Hindustan Vanaspati Manufacturing Company, followed by Lever Brothers India Limited (1933) and United Traders Limited (1935). These three companies merged to form Hindustan Unilever in November 1956. It offered 10% of its equity to the Indian public, the first among the foreign subsidiaries to do so.

- In January 2000, in a historic step, the government decided to award 74% equity in Modern Foods to HUL, thereby beginning the divestment of government equity in public sector undertakings (PSU) to private sector partners. Hindustan Unilever’s entry into Bread is a strategic extension of the company’s wheat business. In 2002, the company acquired the government’s remaining stake in Modern Foods.

- In 2007, the Company name was formally changed to Hindustan Unilever Limited after receiving shareholder’s approval during the 74th AGM on 18 May 2007. Brooke Bond and Surf Excel breached the INR 1,000 Cr sales mark the same year, followed by Wheel, which crossed the INR 2,000 Cr sales milestone in 2008.

- In 2015, the company acquired Indulekha, a premium hair oil brand with strong credentials in Ayurveda.

- It also announced signing an agreement to sell and transfer its bread and bakery business under “modern” to Nimman Foods Private Limited.

- In 2020, with the Merger of GSK Consumer Healthcare with Hindustan Unilever Limited, Iconic health food drink brands – Horlicks and Boost entered HUL’s foods & refreshment portfolio, making it the largest F&R business in India.

- In 2022, Hindustan UUnilever’sturnover crossed the INR 50,000 cr mark.

Hindustan Unilever Management Profile

Mr Sanjiv Mehta is the Chair and Managing Director of Hindustan Unilever Limited. He has led Unilever’s business in India and the South Asia cluster since October 2013. Sanjiv brings with him a wealth of experience. He has been with Unilever for nearly 30 years, and for the last 21 years, he has led Unilever businesses in different parts of the world.

Mr Rohit Jawa is the CEO Designate and whole-time Director of Hindustan Unilever Limited. He will take over as HUL’s Managing Director & CEO from 27th June 2023. Rohit started his career with the company as a management trainee in 1988. He has a proven track record of sustained business results across India, Southeast Asia, and North Asia. As EVP of North Asia and Chairman of Unilever China, Rohit helped transform the business into UUnilever’sthird largest globally.

Mr Ritesh Tiwari is the Executive Director, Finance & IT and Chief Financial Officer of Hindustan Unilever Limited. He is also the Chief Financial officer for Unilever, South Asia. He is a global finance leader with rich experience in leading diverse teams across the UK, India, and other Asian markets. Ritesh joined Unilever as a management trainee in 1999 and is credited with bringing digital transformation, simplification, and leading projects with high business impact throughout his career.

Ms Anuradha Razdan is a member of the Management Committee of Hindustan Unilever Limited as Executive Director, Human Resources (HR) and Vice President of HR at Unilever South Asia. Anuradha spent the first 14 years of her career working with teams in Customer Development, Employee Relations and as an HR Partner to members of the HUL Management Committee in Supply Chain and Marketing.

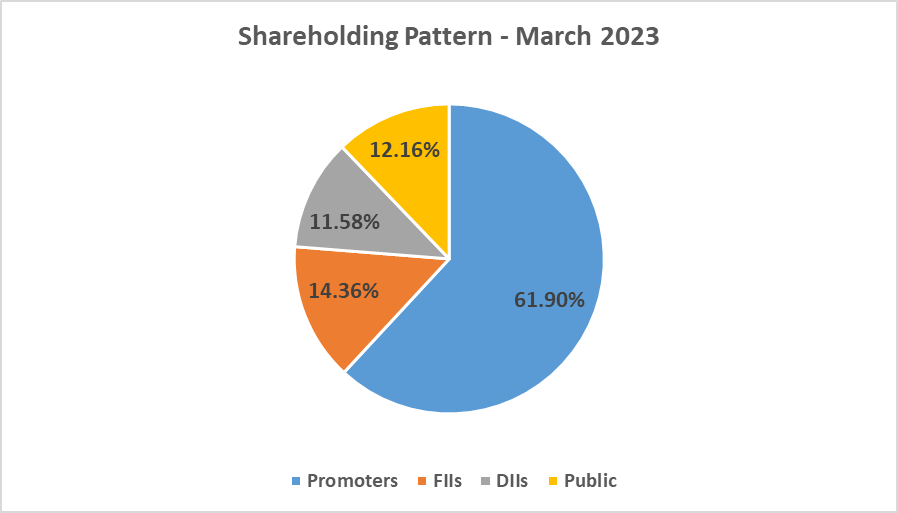

Hindustan Unilever Shareholding Pattern

Hindustan Unilever Business Segments and Financials

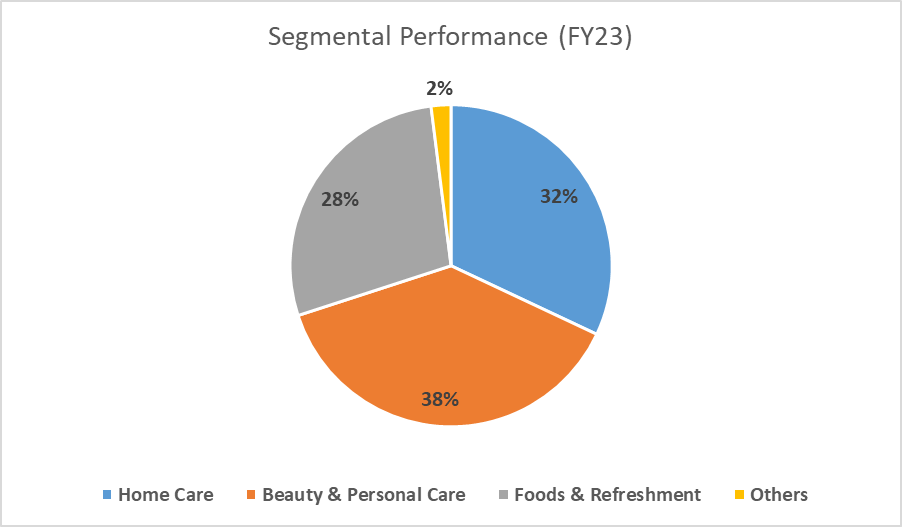

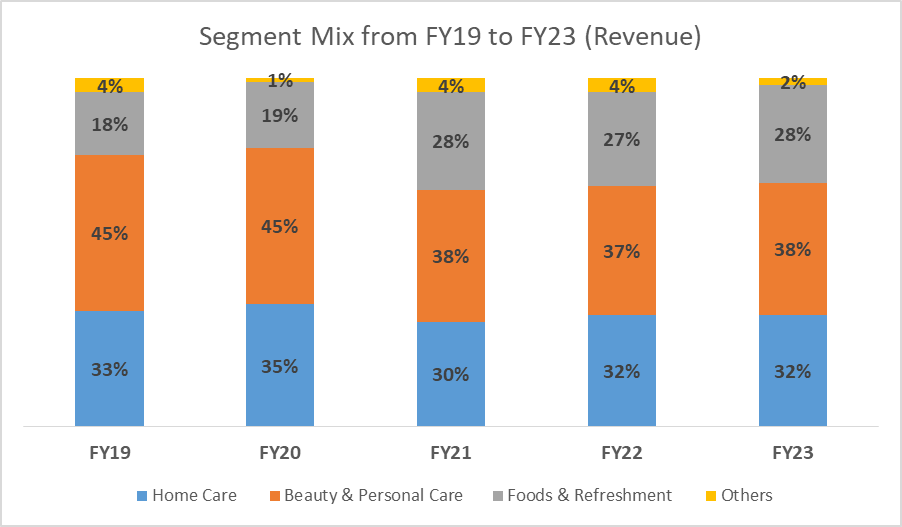

HUL’s revenue can be broken down into three segments:

- Home Car

- Beauty & Personal Car

- Food & Refreshments

The breakup of the revenue for FY23 is shown below.

The contribution of the Foods & Refreshment business has increased post the acquisition of GSK Consumer Healthcare Ltd in 2020. HUL got a ready-made portfolio of health food drinks (HFD) brand Horlicks apart from Boost, Maltova, and Viva. Horlicks commands over 60% market share in the country.

HUL’s portfolio of brands across its three major segments is as follows:

Hindustan Unilever Fundamental Analysis

Revenue and Profitability

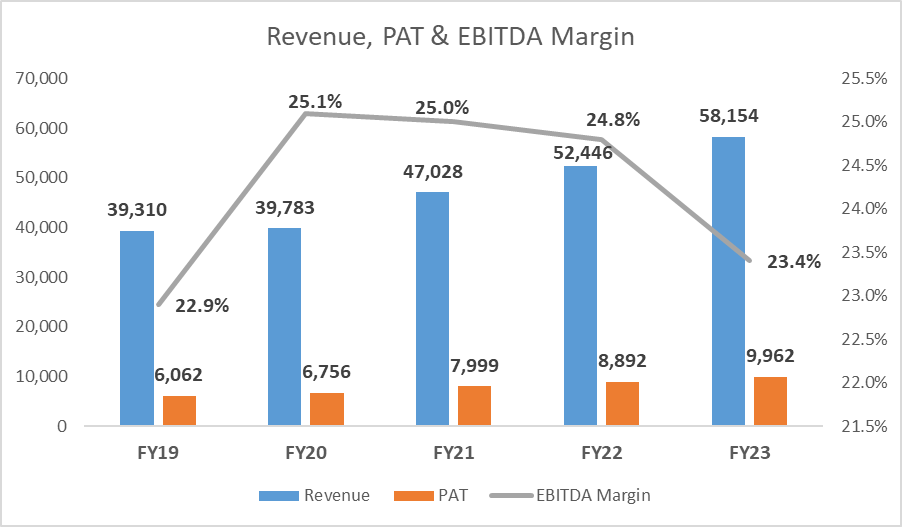

The company reported a total income of INR 58,154 Cr during the Financial Year ended March 2023, compared to INR 52,446 Cr during the Financial Year ended March 2022, an increase of almost 16%. HUL has grown its topline at a CAGR of 11% over the last five years from FY18 – FY23.

Similarly, the company has posted a net profit of INR 9,962 Cr for the Financial Year ended March 2023 as against a net profit of INR 8,887 Cr for the Financial Year ended March 2022. HUL has grown its PAT (bottom line) at a CAGR of 14% over the last five years from FY18 – FY23.

As shown below, the EBITDA margin dipped slightly to 23.4% due to unprecedented inflation during the year compared to ~25% in the previous years.

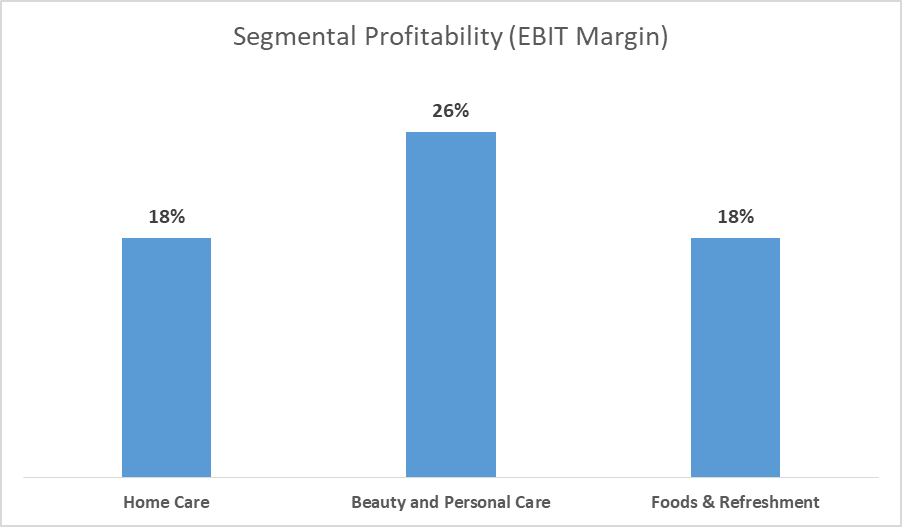

The segmental profitability (EBIT Margin) is highest for the Beauty and Personal Care segment, followed by Home Care and Foods & Refreshments, as shown below for FY23.

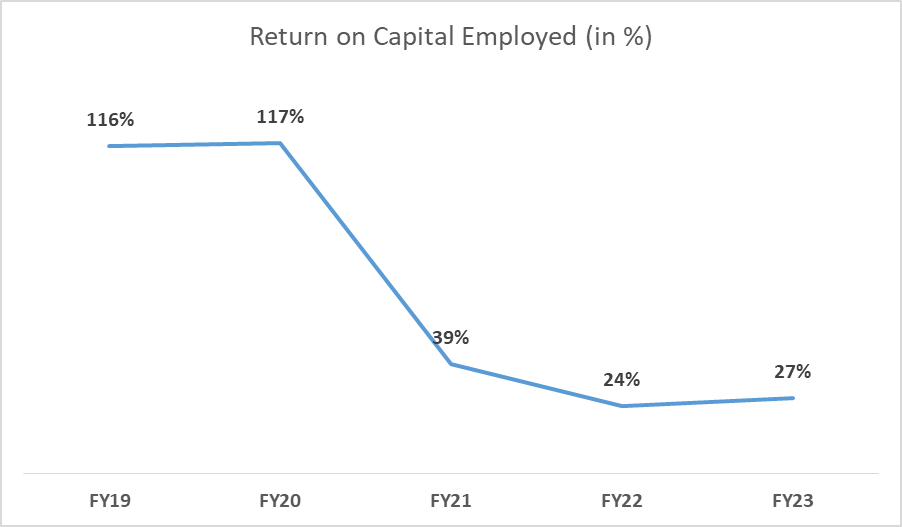

Return on Capital Employed (ROCE)

ROCE is a profitability ratio that determines how efficiently a company uses its capital to generate profits. The Return on Capital Employed has dropped since the financial year 2020-21 because of an increase in shareholder equity due to the GSK Consumer Health Ltd merger.

HUL has more than 19 brands with more than INR 1,000 Cr in revenue, of which two brands are more than INR 5,000 Cr, and nine brands are doing business for more than INR 2,000 Cr in a single year.

Hindustan Unilever Share price analysis

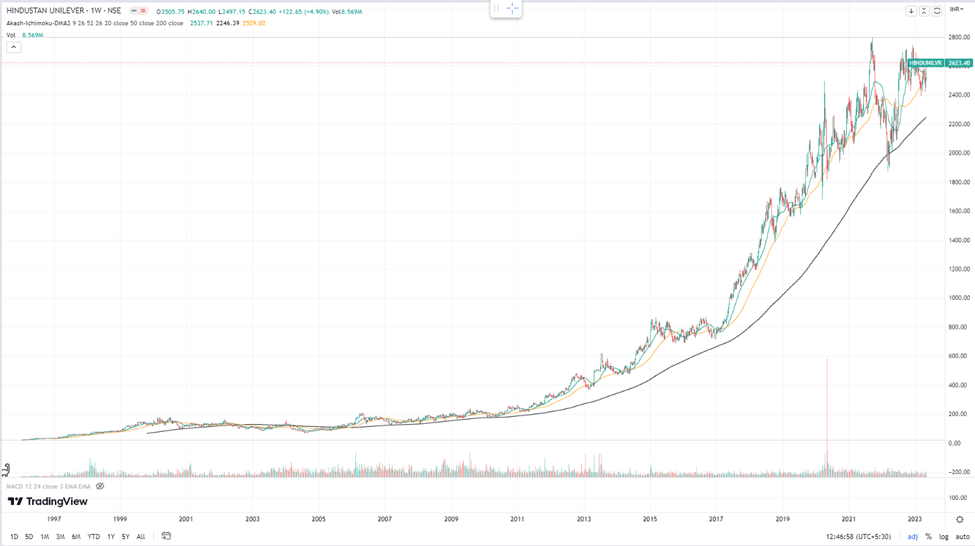

HUL is a stock that hasn’t disappointed investors. The company continues to deliver exceptional performance year after year, which also reflects in HHUL’sshare performance. HUL has delivered a 10-year CAGR of 16% from INR ~500 on 15th May 2013 to currently trading at INR 2,640 per share on 15th May 2023.

The IPO price of the stock was around INR 20 per share in 1996, and since then, the company has multiplied investor wealth by a whopping 132 times. The business has built strong moats around its brands, distribution, and marketing, which is difficult to beat. So one can expect the performance to continue going forward as well.

Hindustan Unilever Share Price Target

HUL is a play on consumption growth in India. The company has pricing power and has proven its ability to effect price hikes while growing its market share simultaneously. That is one of the biggest reasons why it has been a strong wealth generator for the last ten years.

The company has strongly entered the naturals category and termed it a megatrend. Its acquisition of GSK Consumer’s HFD (Health Food Drinks) portfolio could also aid the overall revenue momentum.

The strong execution of its Winning in Many Indias (WiMI) strategies has led to higher growth for the company and may drive positive results in the future. The focus on premiumization, particularly evident in Detergents and Tea, has meant that even these highly penetrated, large categories have grown significantly. The company’s rigorous focus on cost savings has resulted in an unprecedented EBITDA margin improvement (of over 950bp YoY) over the past ten years ended in FY22.

Key risks:

- Beauty and Personal care products demand could be affected if working from home becomes more permanent. As per a recent research report, usage of personal care products dropped in the UK as people had fewer occasions to use them due to working from home. While it is expected that gradually people will return to offices in India, a major permanent shift towards working from home can derail the growth prospects for beauty products for Hindustan Unilever

- High valuations: FMCG companies enjoy higher multiples in India than other sectors due to their huge growth story and premiumization opportunity. Better return ratios, corporate governance, de-levered balance sheet, and market leadership mean HUL will always be the leader in the pack and hence enjoy the best multiples within the FMCG sector. However, if there is any structural shift in consumption/savings patterns owing to COVID, it can lead to the de-rating of multiples for the whole FMCG industry

- Competition: An increase in competitive intensity from new players like Reliance and Ayurveda-focused brands like Patanjali can lead to negative surprises in the company’s future performance.

- Increase in Raw Materials and Rupee Depreciation: The risk of high raw material prices and rupee depreciation can lead to a significant dent in the company’s margin profile.

Disclaimer Note: This aarticle’sstocks and financials are for education only. They sshouldn’tbe considered as a recommendation by Research & Ranking. We will not be liable for any losses that may occur. The securities quoted, if any, are for illustration only and are not recommendatory.

FAQs

Does Hindustan Unilever give bonus shares?

The last bonus that HUL announced was in 1991 in the ratio of 1:2. The share has been quoting ex-bonus from July 19, 1991.

Is Hindustan Unilever a good company to invest in?

HUL is a great company to invest in, but investment depends on your entry valuation and investment time horizon. It is recommended that investors hold this company for the long term and keep averaging at lower valuations to build long-term wealth in this company.

What is the dividend yield of Hindustan Unilever Ltd?

HUL pays regular dividends to its investors. The company gives a dividend payout of 80% to 100% of the total profit. In FY23, the company paid a dividend of almost INR 40 per share.

Read more: About Research and Ranking

How Long-term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 3.8 / 5. Vote count: 15

No votes so far! Be the first to rate this post.