Introduction

Energy security is vital for the prosperity and growth of any nation. Adequate availability of coal, petroleum products, and electricity around the clock ensures economic activity can thrive without disruptions and build a conducive environment for investments and development. In India, many state-owned and private companies are ensuring energy security, and GAIL is one of them.

This article will focus on GAIL share price, company analysis, and share price target.

Overview of GAIL

Gas Authority of India Limited (GAIL) is a central public sector undertaking company and one of India’s leading natural gas companies with diversified interests. It is in the business of trading, transmission, LPG production & transmission, LNG regasification, petrochemicals, city gas, E&P of natural gas, and renewables.

GAIL was established on August 16, 1984, as a central PSU under the Ministry of Petroleum and Natural Gas. It was initially tasked with constructing, operating, and maintaining the 1800-kilometer Hazira-Vijaipur-Jagdishpur natural gas pipeline.

It owns and operates a network of 15,413 KM of natural gas pipelines spread across the length and breadth of the country and commands ~70% market share in gas transmission and ~50% share in gas trading.

The company’s operations are not just limited to India, but through its many joint ventures with foreign partners and subsidiaries, it has acquired and operates assets on foreign shores. In September 2011, GAIL became the first company to acquire shale gas acreage in the USA.

GAIL Management Team

Shri Sandeep Kumar Gupta is the Chairman and Managing Director (CMD) and is a qualified Chartered Accountant. He joined GAIL as CMD in October 2022 and previously held the Director (Finance) position at the Indian Oil Corporation Limited. Shri Gupta has over 34 years of experience in the Oil & Gas Industry and has received training from premium b-schools like IIM-A, IIM-C, Harvard, XLRI Jamshedpur, etc.

Shri M.V. Iyer is the Director (Business Development) and Electrical Engineer. He has over 34 years of experience in the Oil & Gas Industry and has executed projects worth over ₹40,000 crores in GAIL spanning 16 states, 150 districts, and the company’s city gas distribution.

Shri D.C. Gupta is the Director (Projects) and is a Mechanical Engineer from DCE. He has a rich experience of more than 31 years in the Oil & Gas industry encompassing project management, construction management, and business development functions. Previously, Shri Gupta was with EIL, where he led the implementation of the highly complex multi-billion dollar 650 KBPSD Dangote Refinery and Petrochemical Project in Nigeria, which is the largest single-train grassroots refinery in the world.

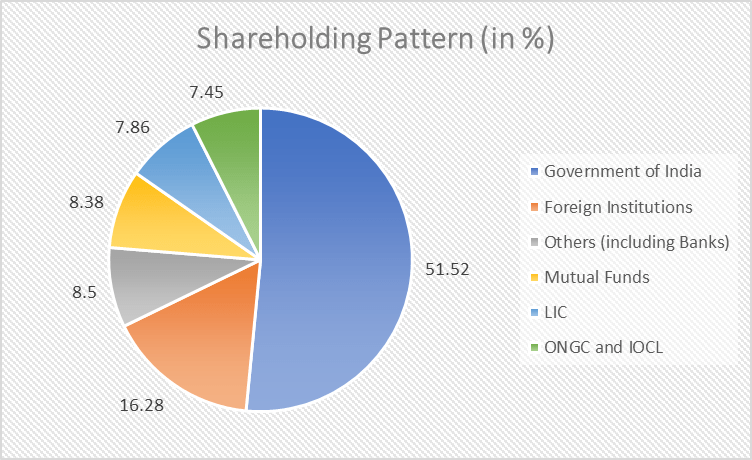

GAIL Shareholding Pattern

GAIL Company Overview

GAIL is a diversified conglomerate in transportation, transmission, exploration, natural gas production, and other petrochemical products.

The company has divided its operations into six business segments based on its business activities.

- Natural Gas Transmission

- LPG Transmission

- Natural Gas Trading/Marketing

- Petrochemicals

- LPG and Other Liquid Hydrocarbons

- Other segments

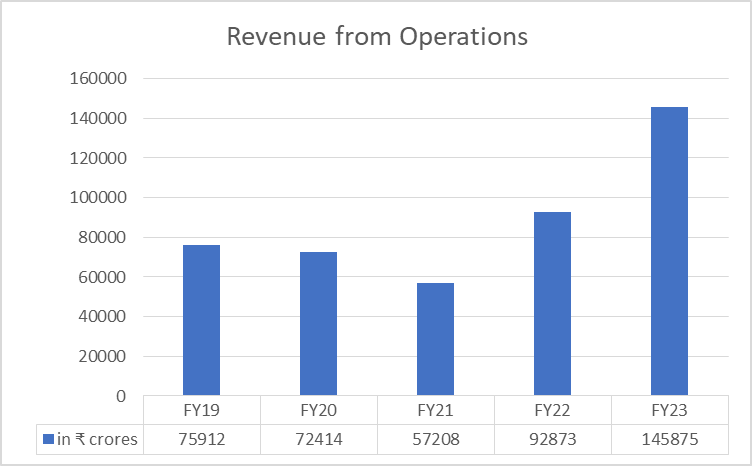

In FY23, its revenue from operations was at ₹1,45,875 crores, and the market capitalization was ₹71,866 crores as of 12th July 2023.

GAIL Company Analysis

Pipeline Transmission Services

The company is in the business of natural gas and LPG transmission. For natural gas, GAIL has 15,413 KM of pipelines across the country connecting important industrial points. Its share in the country’s natural gas transmission was 68% on 31st March 2022.

While it owns and operates 2,023 KM of LPG pipeline network. The company is expanding its pipeline network, and in FY24, it has earmarked ₹4100 crore towards pipeline expansion.

Natural Gas Marketing

Natural gas trading is the company’s primary business activity, with over 58% of the country’s gas market in India. It primarily supplies natural gas to fertilizer and the power sector, with over 60% market share in the country.

During FY23, the segment witnessed a close to 77% increase in revenue to ₹1.59 lakh crore, but operating profit declined by 40% to ₹3228 crores.

LPG and Liquid Hydrocarbons

The LPG and Liquid Hydrocarbons are the growth vertical of the company, contributing most to the profitability of the company. In FY23, the segment’s operating profit was ₹ 1228.43 crores on revenue of ₹ 5569.97 crores. GAIL operates five gas processing units with a capacity of 1.4 MMTPA and 4.5 MMTPA of LPG transmission capacity.

Exploration and Production (E&P)

GAIL has a participating interest in 13 blocks, of which 10 are in India, 2 blocks in Myanmar, and 1 block is US shale gas in Texas. The segment doesn’t have a meaningful contribution to the revenue. However, it is primarily done to increase access to gas supplies through equities and joint ventures.

Renewables

GAIL also has a big portfolio of alternative energy and has a total installed capacity of 118 MW wind power and 13.8 MW solar power. The energy drawn is used to substitute the power drawn from the grid and reduce its carbon emissions. It is also exploring opportunities to set up compressed biogas production plants. It is setting up its first plant in Ranchi with a production capacity of 5 tons per day using municipal solid waste.

GAIL Financial Analysis

Revenue

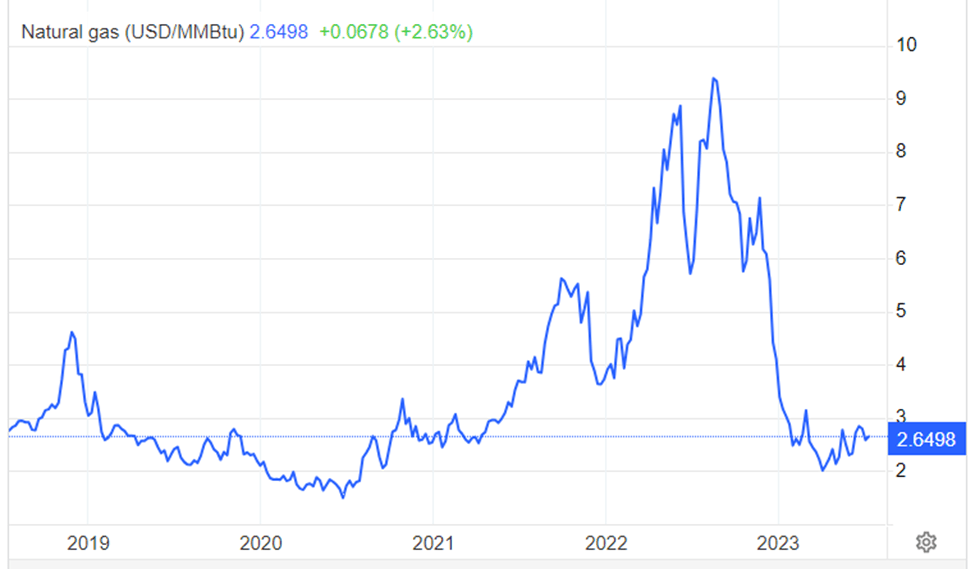

In FY23, GAIL crossed ₹1 lakh crore in revenue for the first time in the company’s history. During the period, GAIL recorded a 57% increase in revenue to ₹1,45,875 crores, up from ₹92,873 crores in FY22. The impressive revenue growth is mostly because of the increased cost of natural gas in the first half of FY23.

Segment-wise Revenue

| Segments | FY21 (in ₹ crores) | FY22 (in ₹ crores) | FY23 (in ₹ crores) |

| Transmission Services | 6619.85 | 7061.07 | 7382.69 |

| Natural Gas Marketing | 52736.35 | 89932.95 | 159067.91 |

| Petrochemicals | 7060.89 | 8548.52 | 4917.26 |

| LPG and Liquid Hydrocarbons | 3293.87 | 4865.16 | 5569.97 |

| City Gas | 4218.12 | 7221.72 | 11286.69 |

| Others | 901.02 | 914.76 | 1213.56 |

Segment-wise Operating Profit

| Segments | FY21 (in ₹ crores) | FY22 (in ₹ crores) | FY23 (in ₹ crores) |

| Transmission Services | 4028.77 | 4140.79 | 2288.38 |

| Natural Gas Marketing | (435.34) | 5420.72 | 3228.59 |

| Petrochemicals | 1064.86 | 1245.26 | (1060.85) |

| LPG and Liquid Hydrocarbons | 1303.45 | 2899.70 | 1228.43 |

| City Gas | 252.20 | 470.18 | 429.19 |

| Others | 383.16 | 341.50 | 513.72 |

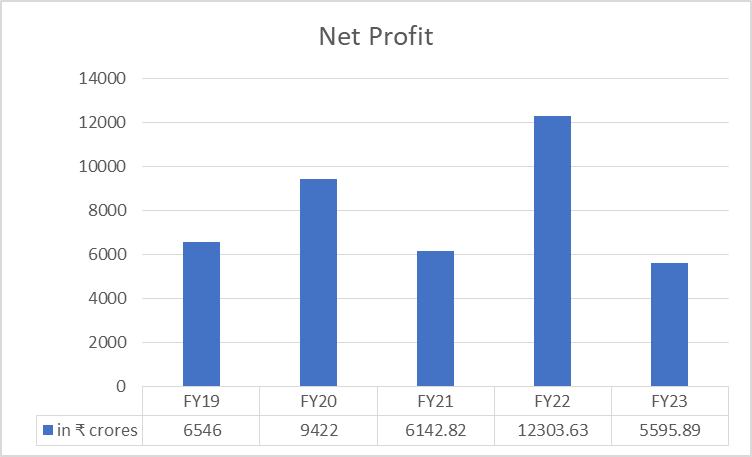

Net Profit

In FY23, GAIL posted a 54% decline in net profit to ₹5,616 crores from ₹12,256 crores in FY22.

GAIL Key Financial Metrics

- Current Ratio: In FY23, GAIL’s current ratio declined to 0.92 times from 1.08 times in FY22.

- Operating Profit Margin: The operating profit margin declined to 3.20% from 13.01% in FY22.

- Net Profit Margin: GAIL reported a net profit margin of 3.68% in FY23, down from 11.34% in FY22.

- Debt-to-equity Ratio: The company reported a 7 bps increase in debt-to-equity ratio to 0.22 times from 0.15 times in FY22.

- Return on Capital Employed (ROCE): GAIL’s ROCE declined to 10% in FY23 from 20% in FY22.

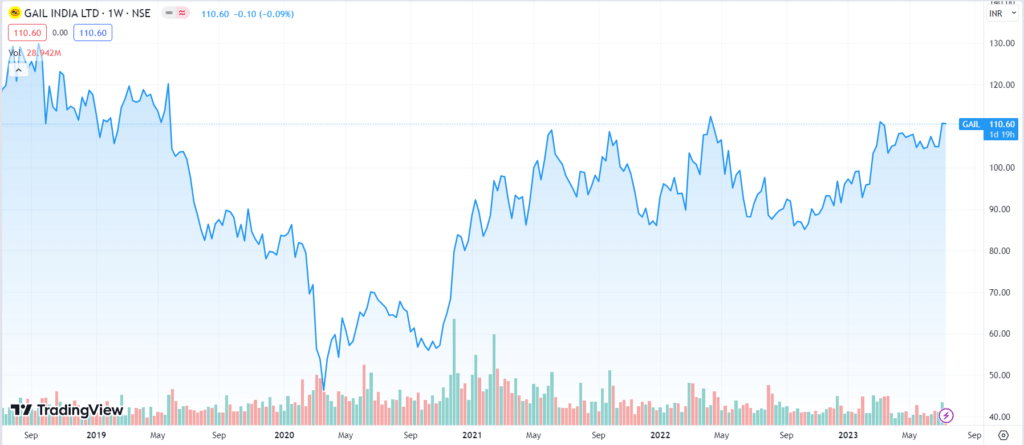

GAIL Share Price History

GAIL launched its initial public offering (IPO) on February 27, 2004, at a price per share of ₹194, raising a total of ₹1649.02 crores. The IPO was oversubscribed by approximately 32.6 times.

As of 12th July 2023, GAIL share price has given a CAGR return of -1%, 17%, and 19% in the last 5 years, 3 years, and 1 year respectively. Since 2004, the company has done five bonus issues, and 100 shares issued at IPO are now approximately 800 shares.

| Ratio | Number of Shares | |

| Shares held at IPO | – | 100 |

| Bonus Issue on 23rd June 2008 | 1:2 | 150 |

| Bonus Issue on 25th Jan 2017 | 1:3 | 200 |

| Bonus Issue on 12th Feb 2018 | 1:3 | 266 |

| Bonus Issue on 27th May 2019 | 1:1 | 532 |

| Bonus Issue on 27th July 2022 | 1:2 | 798 |

GAIL has a consistent track record of paying dividends to its shareholders, and in the last three years, it has paid ₹6.4 in 2020, ₹9 in 2021, ₹5 in 2022, and ₹4 in 2023.

GAIL share price has underperformed the market in the last 5 years and has failed to break its all-time high level of ₹133 it made on 13th August 2018. During FY23, GAIL completed a share buyback of 5.7 crore shares at a price of ₹190, aggregating up to ₹1,083 crores.

GAIL Share Price Target Growth Potential

Opportunities

The primary users of natural gas in India are fertilizer, power, and city gas distribution sector, accounting for more than half of India’s natural gas availability.

Indian fertilizer market is expected to grow at a CAGR of 4.7% between 2023 and 2028, reaching a projected value of $1160 billion. And, with natural gas being the primary feedstock of fertilizer production in India, its demand is expected to remain strong.

In the power sector, gas comprises 6.2% of India’s energy mix, far behind the global average of 24%. The government plans to increase this share to 15% by 2030 to meet the climate commitment. And, with the government’s ambitious target of making gas accessible to 70% of the population for household, transportation, and industrial application, city gas distribution is expected to witness an investment of ₹1.2 lakh crore in over ten years.

Risks

The extremely volatile nature of natural gas prices is a significant challenge for any gas distribution company.

For instance, in FY23, GAIL was hit by high volatility in spot LNG prices, where price moved approximately from $45 per MMBtu in October 2022 to $20 per MMBtu by the end of December 2022, which led to significant inventory loss to the tune of ₹1100 crore.

Apart from price volatility, the government’s full control over domestic natural gas pricing is the biggest risk for GAIL as it directly impacts the profitability margin and can take full advantage of favorable market conditions.

Also, India has to depend on imports to meet its domestic demand for natural gas. In the first six months of FY23, the share of imports was 46.3% of India’s total natural gas supply. Disruptions in gas supply, primarily due to geopolitical tensions, impact GAIL’s ability to source natural gas from global energy players, lowering the company’s future earning outlook.

Low Profitability Ratios

In FY23, GAIL reported over 57% jump in revenue at ₹1.59 lakh crore, mainly because of increased gas prices in the first nine months of FY23.

Its Natural Gas Marketing segment, which brought in ₹1.59 lakh crore revenue in FY23, reported an operating profit of a meager ₹3228.59 crores. And overall, the operating profit margin in FY23 was 3.20%, which is significantly lower to generate alpha for investors.

Given the government’s emphasis on transitioning India’s energy mix towards gas and renewables, GAIL is strategically positioned to capitalize on this opportunity due to its expertise and extensive gas pipeline network. However, there is a scope for improvement in GAIL’s operating margin, particularly in the natural gas transmission segment, which currently contributes over 80% of its revenue. Enhancing financial performance could impact GAIL share price.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

When was GAIL established?

GAIL was established on 16th August 1984 under the Ministry of Petroleum and Natural Gas, Government of India, to construct natural gas pipelines throughout the country.

How GAIL share price has performed in the last 3 and 5 years?

As of 12th July 2023, GAIL share price has underperformed the market over the last 5 years. In the last 3 and 5 years, the CAGR return of 17% and -1%, respectively.

What are the products of GAIL?

GAIL is in the business of transmission, exploration, and production of natural gas, petrochemical production, city gas distribution, and renewable energy in India.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 6

No votes so far! Be the first to rate this post.