Introduction

The vision of this company is “To be the World’s leading power company, energizing India’s growth,” and it has stood up to its expectations over the last three decades. Although the name is National Thermal Power Corporation, the company has power generating capacity across Wind, Solar, and Renewable, expanding into newer sources of green energy.

Let us study this institution in detail and understand how it intends to create value for various stakeholders.

NTPC Company Overview

NTPC was established in 1975 as a government-owned company. In 1976 Mr. D.V Kapur became the company’s first Chairman and Managing Director. Since then, NTPC has established itself as the dominant power major with a presence in the entire value chain of the power generation business. From fossil fuels, it has forayed into generating electricity via hydro, nuclear, and renewable energy sources.

To strengthen its core business, the corporation has diversified into consultancy, power trading, training of power professionals, rural electrification, ash utilization, and coal mining.

The company’s total installed capacity is 73,024 MW (including JVs). Own stations include 23 coal-based, seven gas-based, 1 Hydro, 1 Wind, 18 Solar, and 1 Small hydro plant. Under JV, NTPC has nine coals based, four gas based, 8 Hydro based, and five renewable energy projects.

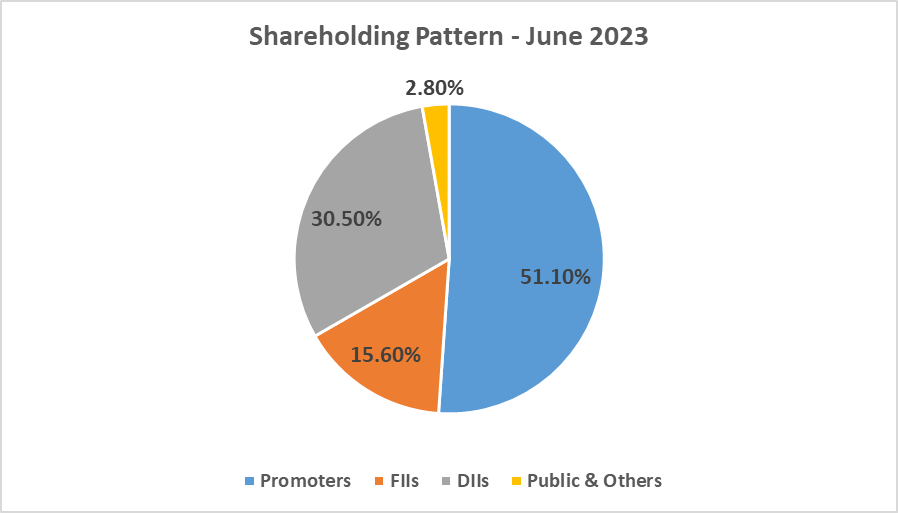

NTPC contributes 20.96% of total power generation due to its focus on high efficiency. In October 2004, NTPC launched its Initial Public Offering (IPO) consisting of 5.25% as a fresh issue and 5.25% as an offer for sale by the Government of India. NTPC is also expanding its global footprint by venturing into the power sector worldwide.

The company is expanding globally by providing the following services:

- Project development

- Takeover and Turning around of underperforming Power Projects,

- Concept to Commissioning and Beyond for Coal / Gas Based and Renewable Energy Projects.

NTPC Company Journey

NTPC has had a long and illustrious history. Here are some of the critical milestones in the company:

Here is a timeline of NTPC history:

- 1975: NTPC was incorporated as a 100% Government of India (GOI) owned company

- 1982: First Unit commissioned at Singrauli, Uttar Pradesh – 200MW

- 1997: Accorded Navratna status

- 2004: Stock listed on NSE and BSE

- 2010: GOI accorded Maharatna status

- 2012: Commissioned First Super Critical Unit

- 2013: First RE (Solar) project commissioned

- 2015: First Hydro project commissioned

- 2016: NTPC started mining at its 1st coal block, Pakri Barwadih, in Jharkhand

- 2017: Group capacity crossed 50,000 MW mark & commissioning of 1st wind turbine

- 2019: Commissioned India’s 1st Ultra-supercritical & most efficient plant (Khargone)

- 2020: Recorded highest single-day gen (977.07 Mus)

- 2021: Became the 1st energy company to declare energy compact goals

- 2021: Largest Floating Solar PV Project in the country was commissioned at NTPC Simhadri

NTPC Management Profile

Mr. Gurdeep Singh is the Chairman & Managing Director of NTPC Limited since 2016. Before joining NTPC, he was Managing Director of Gujarat State Electricity Company Limited. He has had an illustrious career spanning over three decades in the power sector. He graduated in Mechanical Engineering from NIT Kurukshetra and has undergone Management Education Program from IIM Ahmedabad. He has launched a series of initiatives to sustain NTPC’s growth and bring about the cultural change necessary to maintain NTPC’s position as a leading global energy company.

Mr. Dillip Kumar Patel has been the Director (HR) of NTPC Limited since 1st April 2020. He started his career at NTPC in 1986 as an Engineering Executive Trainee. He graduated in Mechanical Engineering from NIT, Rourkela, and did his Post Graduate Diploma in Business Management (HR & Finance) from MDI, Gurgaon. He has over three decades of experience in both line and HR functions. He has undertaken various challenging assignments and has successfully managed HR functions while working at various locations comprising thermal, hydro, and JVs, as well as taken-over projects.

Mr. Ramesh Babu is the Director (Operations) of NTPC Limited. He joined National Thermal Power Corporation Limited as an Executive Trainee in 1987. He graduated in Mechanical Engineering from NIT, Srinagar, and did his master’s degree in Thermal Engineering from IIT Delhi. As a Professional Manager and Strategic Planner, he has led several initiatives for improving the reliability and efficiency of plants. He has over 34 years of vast experience with outstanding contributions in the management of large-size plants in the area of power plant operation & maintenance, renovation & modernization of old units, and the efficiency and systems improvement of thermal plants.

Mr. Jaikumar Srinivasan is the Director (Finance) of National Thermal Power Corporation Limited. He joined the company in 2022. He is a commerce Graduate and an Associate Member of the Institute of Cost Accountants of India. He has more than 30 years of experience in the Power and Mining sector in State and Central PSUs in the field of Finance.

Mr. Ujjwal Kanti Bhattacharya is the Director (Projects) of NTPC. He joined National Thermal Power Corporation Limited in 1984 as the 9th batch of Engineering Executive Trainees. He is an Electrical Engineering Graduate from Jadavpur University, Kolkata, and a PG Diploma in Management from MDI, Gurgaon. He is directly responsible for the entire portfolio of Engineering, Projects, R&D, Dispute resolution cell and International Business Development (IBD), IT, and ERP activities as functional Director of these important verticals of NTPC.

NTPC Shareholding Pattern

NTPC Company Analysis

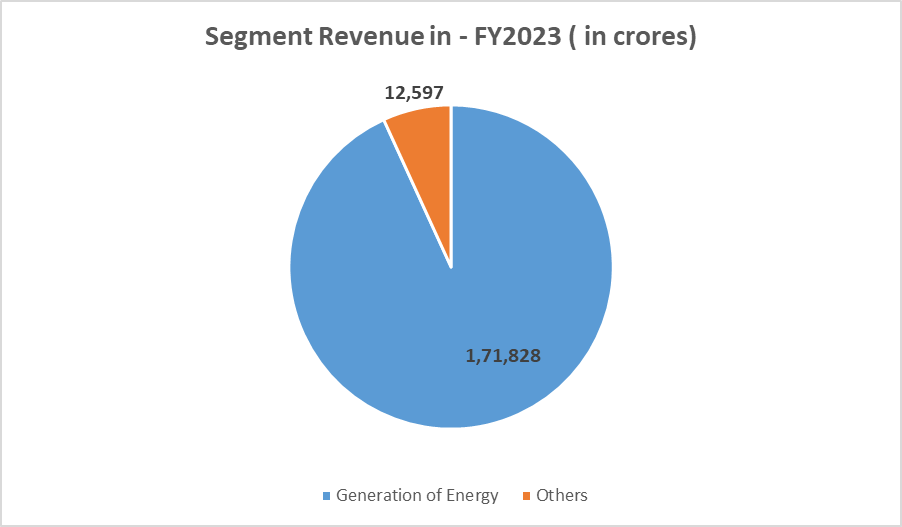

NTPC is into the following business segments:

- Generation of Energy – The Company’s principal business is generating and selling bulk power to state power utilities.

- Others – This segment includes consultancy, project management and supervision, energy trading, oil and gas exploration, and coal mining.

NTPC Fundamental Analysis

National Thermal Power Corporation Limited is India’s largest energy conglomerate, steadily growing in thermal/hydro capacity addition, pumped hydro, coal mining growth, and renewable energy through new company formation.

The company’s total installed capacity is 73,024 MW, but National Thermal Power Corporation Limited has embarked upon an ambitious plan to attain a total installed capacity of 130 GW by 2032. For that, NTPC established a new company, “NTPC Renewable Energy Limited” (NTPC REL), to focus and speed up the timely implementation of projects in the Renewable Energy portfolio.

Following is a break-up of the current capacity:

| Sr. No | Number of Plants | Capacity (MW) |

| NTPC Owned | – | – |

| Coal | 26 | 51,810 |

| Gas/Liquid Fuel | 7 | 4,017 |

| Hydro | 1 | 800 |

| Small Hydro | 1 | 8 |

| Solar PV | 15 | 403 |

| Wind | 1 | 50 |

| Total (NTPC Owned) | 50 | 57,038 |

| Owned by JVs/Subsidiaries | – | – |

| Coal | 9 | 7,664 |

| Gas/Liquid Fuel | 4 | 2,494 |

| Hydro | 8 | 2,925 |

| Small Hydro | 1 | 24 |

| Wind | 3 | 163 |

| Solar | 14 | 2,716 |

| Total (JVs/Subsidiaries) | 39 | 15,986 |

| Total | 89 | 73,024 |

National Thermal Power Corporation Limited is also focusing on other business sectors like providing consultancy, power trading, training of power professionals, rural electrification, ash utilization, oil and gas exploration, and coal mining. To focus on these sectors, the company established subsidiary companies that are engaged in businesses other than power generation.

Revenue and Profitability

The total Income of the group for FY23 is INR 177,977 crore as against the previous year’s Total Income of INR 134,994 crore, registering an increase of 31.84%. PAT of the group for FY23 is INR 17,121 crore as against the previous year’s PAT of INR 16,960 crore. It has delivered a 5-year Revenue CAGR of 15.13%, while the PAT CAGR has been 4.05%.

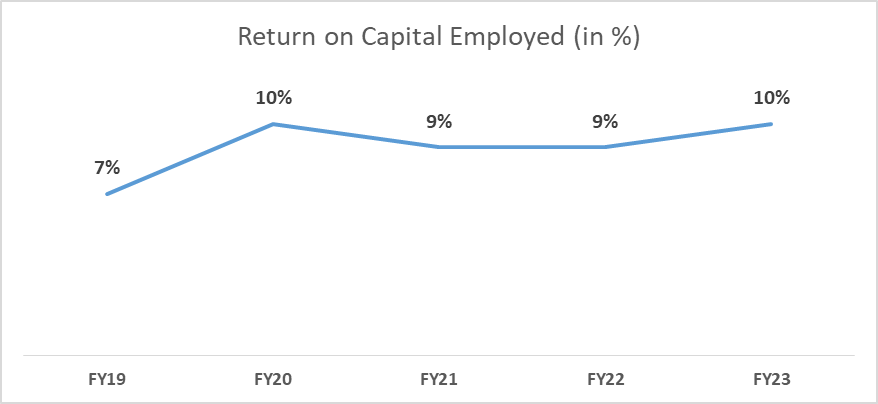

Return on Capital Employed

National Thermal Power Corporation Limited has delivered low ROCE numbers historically. The company has been doing 9-10% ROCE over the last four years, from FY20 to FY23, because of its high capital base.

The company has a high debt-to-equity ratio of ~1.5x as it uses debt to fund its expansion plans. In spite of this, the company pays handsome dividends, and its dividend payout ratio is ~40%. No wonder its annual borrowings have been increasing consistently year on year.

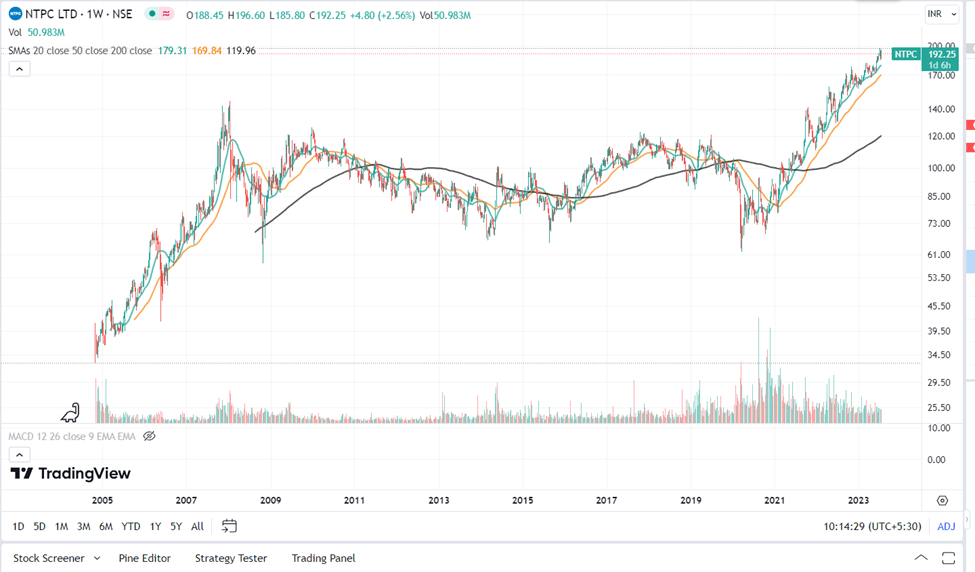

NTPC Share Price History

While NTPC has delivered a three-year stock price CAGR of 29% (INR 90.40 on 10th July 2020 to INR 187.45 on 14th July 2023), its 10-year stock price CAGR has been a dismal 5%. High debt, low ROCE, and high dividend outflow could be reasons the stock is not doing well over the long term.

NTPC Strengths & Risks

The company has delivered stellar growth over the last couple of years. Going forward, the company is looking to augment its capacity. By 2023, the company is looking to install 60 GW of renewable energy capacity out of the total 130 GW it intends to reach.

Non-fossil fuel-based capacity would achieve a share of 30%, and thermal-based generating capacity share would be 70%. Coal would continue as the predominant fuel, with a 65% share of coal-based capacity in the portfolio. Following is a break-up of the proposed capacity by 2032.

| In GW | By 2032 | % Mix |

| Coal | 85 | 65.4 |

| Gas | 6 | 4.6 |

| Hydro | 5 | 3.8 |

| Solar | 30 | 23.2 |

| Other RE | 2 | 1.5 |

| Nuclear | 2 | 1.5 |

| Total | 130 | 100 |

National Thermal Power Corporation Limited remains the only hybrid player in the power sector, with growth from thermal/hydro capacity additions, pumped hydro, captive coal mining increase, and renewed aggression in renewables through new company formation/bilateral tie-ups to secure guaranteed C&I (Commerical and Industrial) business.

New initiatives:

- Green Hydrogen: The company is exploring opportunities to produce green hydrogen using electricity from RE sources for mobility, production of green fuel (ammonia, methanol), establishing microgrids, natural gas blending with hydrogen for CGDs, etc.

- E-Mobility: It envisages providing hydrogen and pure electric powertrain-based green mobility solutions for public transport, including hydrogen fuel cell-based EVs and pure battery-operated electric buses. The company’s subsidiary has supplied 40 e-buses to the Department of Transport, Andaman & Nicobar, and 90 e-buses to Bengaluru Metropolitan Transport Corporation. Approximately 1000 chargers are planned for installation at 204 locations.

- International Business: NTPC is exploring business opportunities in the areas of power generation, PMC, O&M contracting, R&M of power plants, capacity building, etc., in regions such as the Middle East, South East Asia, CIS regions, Latin America and Africa

Key risks

- The generation cost of thermal power may increase due to renewable capacity expansion: To increase the share of power from renewable sources into the grid, coal-based plants must regulate their generation and operate at technical minimum capacity, frequent load fluctuations, and two-shift operations. This would result in lower efficiency, leading to a higher generation cost. Reduced life due to flexible operations and the cost of balancing services would also increase the generation cost.

- Challenges in scaling up Renewable Energy: There is a major dependency on China to source the required raw materials for setting up solar capacity. Further, the government has imposed basic customs duty on imported modules and increased the GST rate for specified renewable energy parts from 5% to 12%, increasing the cost of setting up a solar power plant. Wind energy has not scaled up due to the unavailability of good wind land locations.

- The weak financial position of distribution companies: State distribution companies remain the weakest link in the power sector. The company’s collections may be affected if power sector reforms do not fundamentally improve state power utilities’ financial position.

- Fuel Shortage: Imported coal prices have risen steeply. Fuel shortage would result in declining PAFs and, therefore, reduced profitability. NTPC has managed to mitigate this by increasing production from captive coal mines and arranging imported coal.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Is NTPC Ltd good to buy for the long term?

NTPC is a Maharatna company with strong support from the government. The company has the potential to grow in line with the GDP growth rate of the country. However, you should be cautious about the entry valuation and make sure there is enough margin of safety. Regular dividend payment is an added advantage that adds to the overall returns.

What is the face value of NTPC Ltd? Share?

The face value of NTPC is INR 10 per share.

What is the Market cap of NTPC Ltd?

The market cap of NTPC Ltd is INR 1,86,612 crores as of 20th July 2023.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3.9 / 5. Vote count: 11

No votes so far! Be the first to rate this post.