Nothing describes 2020 better than this line from Charles Dicken’s classic “A Tale of Two Cities”. In his 1859 classic, Dickens talks about the contradictory events in England and France, during the French Revolution. The story revolves around London and Paris. London was described as having the “best of times”, owing to its peace and prosperity while Paris as having the “worst of times” due to unrest and tyranny owing to the French Revolution. The novel also has several other comparisons and contrasts with respect to its characters, personalities and society at large. More on the classic English book some other time, but 2020 was among the most contradictory times that we have seen in recent history for market participants.

We suffered

“Once-in-a-lifetime” global healthcare crisis,

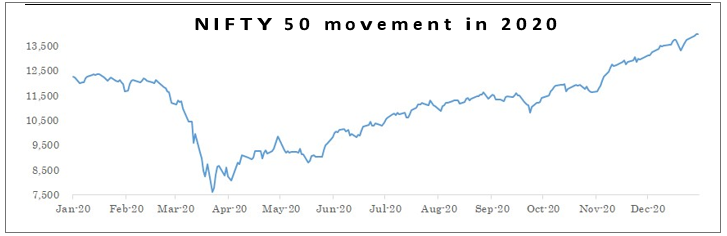

“Once-in-a-decade” stock market crisis,

First-ever recorded GDP contraction for the Indian economy

And yet,

Ended the year with “lifetime-highs” for NIFTY and SENSEX.

2020 was a year of Death, Despair and Decline and also Recovery, Resilience and Resumption.

We begin this newsletter by taking a look at the events that shaped market movements in 2020. We will then look at sectors/stocks that emerged winners. Most importantly, we will leave you with significant financial trends that can shape the next few years. Lot of interesting stuff inside, so read on!!

2020: What An Eventful Year It Was!

Some of the key events that shaped 2020, in alphabetic but not necessarily in the chronological order were:

American elections: Biden “trumps” elections

In a bitterly fought election, Joe Biden defeated Donald Trump to stake his claim to become America’s 46th President. Though very important for America and the world, this event did not have much impact on stock markets, barring some volatility. This is because the official change in the Presidency will happen only in the early part of January 2021. A hung house could have hurt markets more. Markets quickly turned their attention to vaccine development, effects of second COVID wave and Trump’s $900bn relief package.merican elections: Biden “trumps” elections

Brexit: Divorce, finally!

After months of hard negotiations, the UK decided to leave the EU in Jan’20. This kept markets on tenterhooks as the nature of this divorce was unclear. 2020 was supposed to be “transition period” for the deal to be finalized. The verdict remains divided on whether the final deal is favourable or adverse. However, if market movement is any indication, then things seem to be okay. UK benchmark index FTSE 100 has seen a steady rise since “post-Brexit”, and the post-Christmas break is any indicator. GBP has been steady vis-àvis USD.

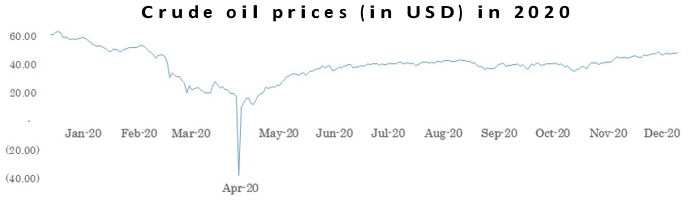

Crude volatility: Negative prices, duh?

2020 started on a volatile note for crude oil as Russia and OPEC flexed muscles against each other, leading to fluctuations in price. The subsequent lockdown and lower economic activity globally led to negative crude oil price in Apr’20, a phenomenon that was never seen before. This scared market participants, with indices across the world immediately seeing significant intraday losses. However, crude was well-behaved in the second half of CY2020, remaining range-bound between $35 and $50.

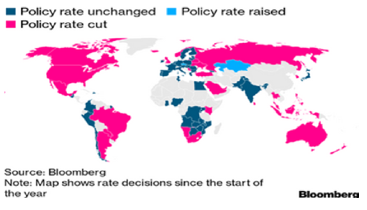

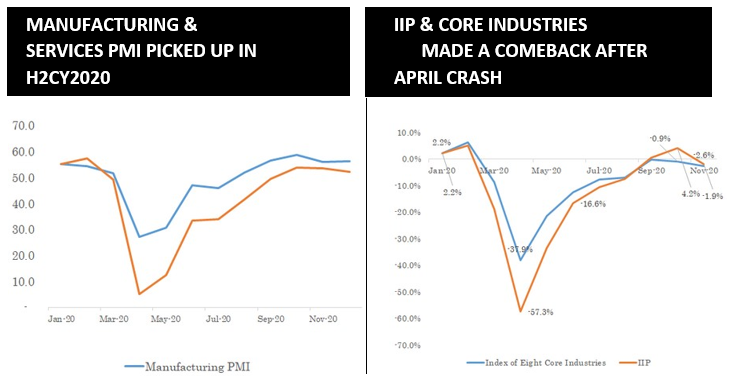

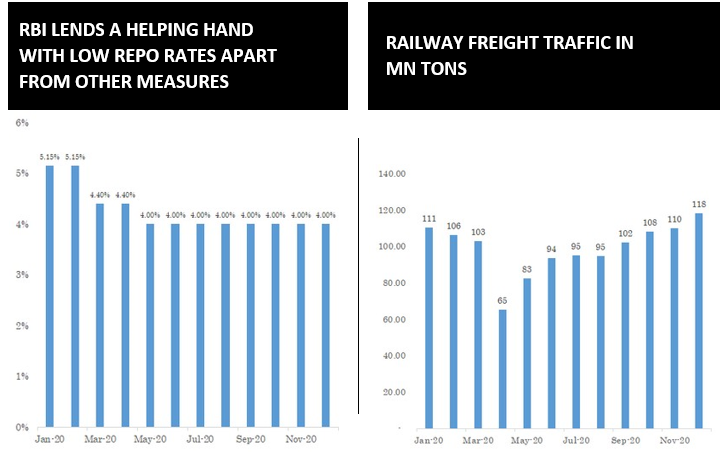

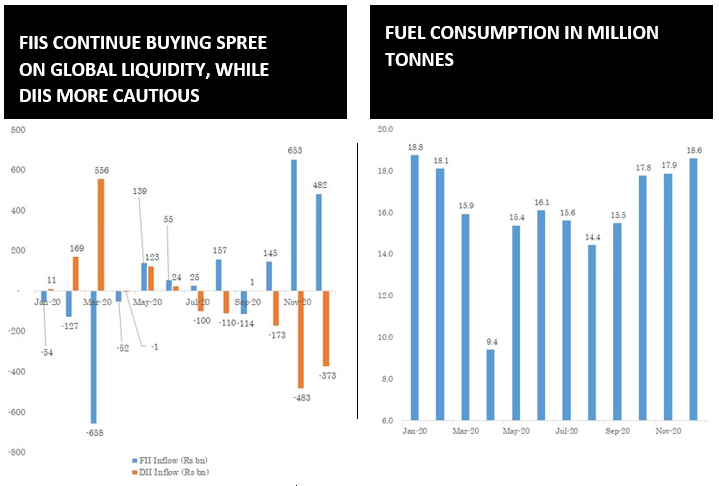

Deluge of liquidity owing to monetary easing and stimulus packages

In a bid to support flagging economies globally, Central Banks across the world eased policy rates in 2020. Fed’s announcement to keep rates lower for longer became famous. The current 10-year government bond yields in developed economies are lowest ever (US: 1.1%, UK: 0.3%, Germany: -0.5%, Japan: 0%). The decline in interest rates leads to a PE (Price to Earnings multiple) rerating for equites. So as long as interest rates remain soft, PEs would remain elevated.

Also, globally, the Governments had committed $14tn in the fiscal stimulus, which is 3.5x the hole created in global GDP (~$88tn) because of the pandemic. And this is probably what markets are taking confidence from as they look ahead. India too announced three stimulus packages since March 2020, totalling a whopping Rs. 30tn, or 15% of GDP. Indian FM attempted to cover a broad cross-section of the economy through the packages – MSMEs, migrant workers, street vendors, farmers and allied sectors and several industries.

Epidemic, pandemic and a global scare -COVID’19

The biggest threat in 2020 came from the smallest of (probably) living organisms – the SARS-

CoV-2, commonly known as Coronavirus. What started as a localized infection (epidemic) in Wuhan province of China in the last few days of 2019 soon became a “once-in-a-century” global healthcare scare, a pandemic. Markets across the world reacted with extreme panic between February 2020 and April 2020 as millions of people lost lives, entire countries went into lockdown, factories shut (initially) and everyday life, as we know it, came to a standstill. At last count, there were a total 9.3cr cases globally and close to 20 Lakh deaths. In India, there were 1.05cr cases and

1.5 Lakh deaths. Vaccines are ready for commercial use and sale. However, there remain challenges by way of meeting vaccine demand, administering vaccine to the entire population (India and globally) and its efficacy and (probable future) side effects. A new strain of the virus emerged in the last couple of months of 2020, causing a scare in several countries. While it is yet unclear when we will get out of the crisis, markets seemed to have shrugged off most concerns regarding the pandemic.

Finally, the vaccine in sight!!

As the world got affected by COVID and its effects – health, social, economic, and psychological; pharma companies began searching for a vaccine on this deadly pandemic. The entire process of drug development ideally takes 2-3 years; however, given the advancement of research, the criticality of emergency and best brains globally working on a single mission led to 90-99% efficacy vaccine available in 10months. As per WHO (as on 12th January 2021), 63 vaccines are currently in clinical development, and 173 vaccines are in pre-clinical development. News surrounding these developments have routinely led to positive swings in the market.

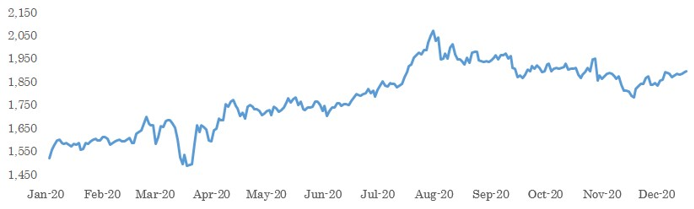

Gold rush!

Gold was one of the best-performing assets of 2020, returning 22% (in USD terms) versus 15% for Nifty. Investors sought refuge in this “safe-haven” asset as COVID-related issues roiled markets globally, especially in the first half of CY2020. Excess liquidity sloshing around globally led to USD depreciation and further supported the gold rally. Prices cooled off somewhat in the second half of the year as equities made a comeback.

2020: Key Sectoral and Macro Trend

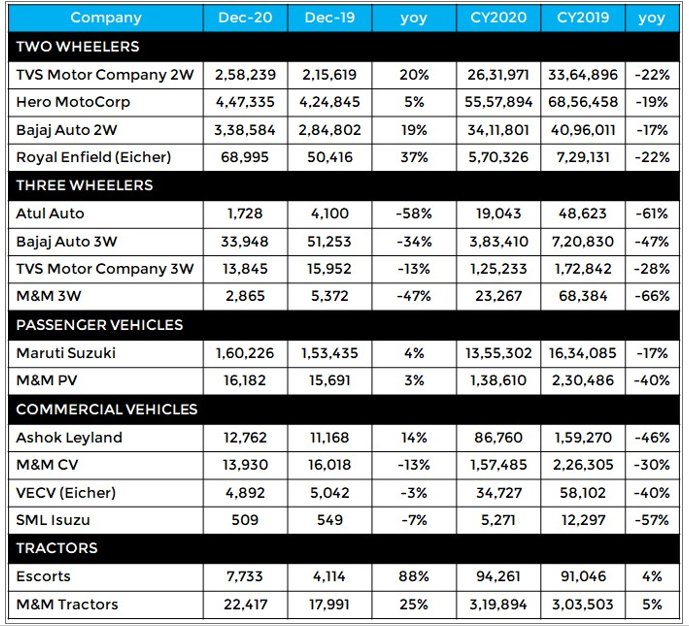

Auto Volumes for December 2020 and CY2020

Some broader trends that emerged from December’20 and CY20 auto wholesale numbers were as follows:

Tractors followed by Two-wheelers and then PVs were the outperformers.

After several months of a slump, CVs picked up towards December; sustenance will be key. It was the most affected segment in 2020 due to drop-in economic activity and stalling of infrastructure projects due to lack of labour and prevention taking precedence.

3Ws were affected as people avoided public transport and instead preferred personal mobility.

PVs pushed volumes on sustained retail demand and low channel inventory; 2W OEMs took some inventory correction in Dec’20

Exports revival continued as more markets opened up globally.

Most OEMs announced price hikes ahead starting from the new year to offset raw material and other cost pressures.

Source: Company data

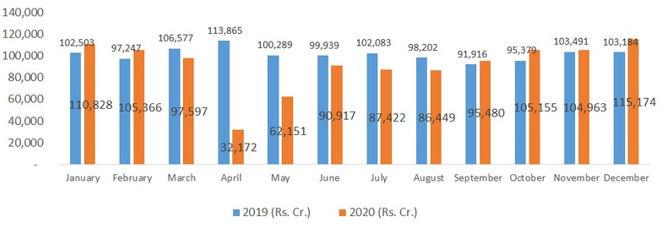

GST COLLECTION – CY21 VS CY20

GST collection hit an all-time high of Rs. 1.15L crore in December 2020, 12% higher than December 2019. The key reasons for this jump were:

Increase in business and economic activities owing to the festive season. This was the fourth consecutive month of monthly YOY GST growth.

The Government has been going after tax evaders for the past few months. The jump in collections could be due to more people falling in line and complying. Nearly 1.6L company registrations were cancelled in October 2020 and November 2020 which could have prompted many others to make timely GST payments.

While GST collection on domestic transactions was up only 8% YOY in December 2020, the same from imports were up 27% YOY. This indicates that imports are picking up, and international trade is slowly crawling back to normalcy.

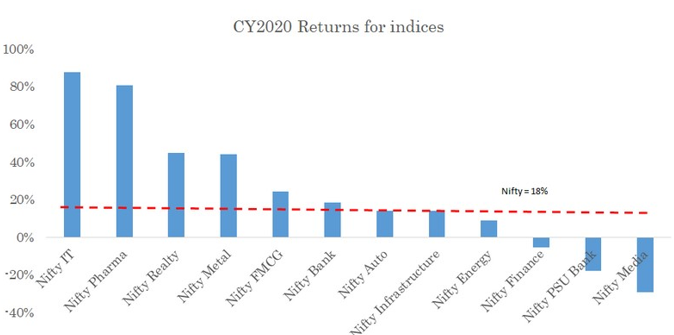

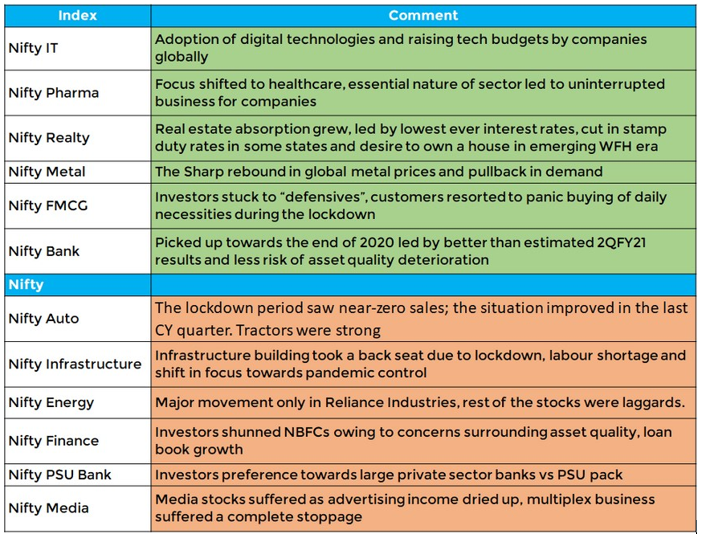

2020: Sectoral Stars and Duds

Note:- Sectors marked in green outperformed NIFTY in 2020, while those in red under-performed NIFTY

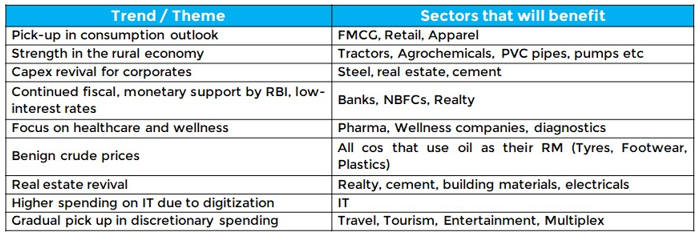

A Mirror Into the Future: Looking Ahead at 2021

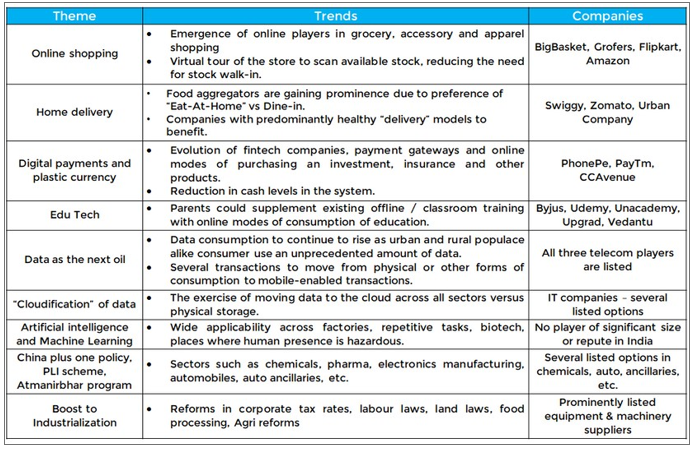

As we move into the New Year, we look at trends that emerged in 2020 that could lead the economy and market in 2021. These trends began in 2020 and are here to stay at least for the near term.

Naya Bharat: Emerging Themes for 2021 and Beyond

Kya Karein Kya Na Karein, Yeh Kaisi Mushkil Hai Koi To Bata De Iska Hal O Mere Bhai

Song of 1995 released Rangeela movie would play in most investors mind these days

The current mood in the street reminds us of a party floor where the DJ towards the end of the party starts taking requests for one last song and sometimes the request queue is long and extends beyond the stipulated time. Here, the too the broader market (like the DJ) may have seemed to accommodate all the requests/directives.

The prominent ones are:

Gush of liquidity from domestic participants Decline in US dollar leading to big money moving to emerging markets including India (Nov-Dec saw over 1.1lakh cr)

Decline in interest rates and dovish outlook in the near term

Improvement in on-ground sentiments related to vaccine availability and sharp decline in new Covid cases

‘Super Se Bhi Upar’ earnings recovery in FY21 followed by prospects of continuation of mega growth in FY22 and FY23. Nifty EPS estimate the change in FY21 is now -5% to -1% vs -20 to -30% till Jun’20. Similarly, FY22 growth is now upped from ~30% to ~40%.

But the fact remains that even after the party is over on that night, the participants are back to another place after a break of couple of days/weeks/months. Similarly, as long as our belief on India story, power of equity and ability to identify winners is rock solid, be assured any short-term dips/consolidation is the time market is taking to prepare for the next party/next big move upwards).

We have been advocating a staggered buying and stock specific approach and continue to believe in its merit. Given India’s long term growth potential, we advise our readers to capitalize on every market correction in the next 2-3 years to build a long-term portfolio.

Click here to get started with a winning portfolio of 20-25 multibagger stocks.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

- Archana Chettiar