Indian share markets staged a gap-down opening today after US President Donald Trump said overnight that he would impose a tariff of at least 25% on India’s exports to the US starting this Friday. Though he later added that the two sides were still in talks.

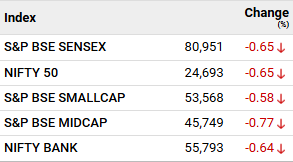

Indian Markets React to Trump’s Tariffs

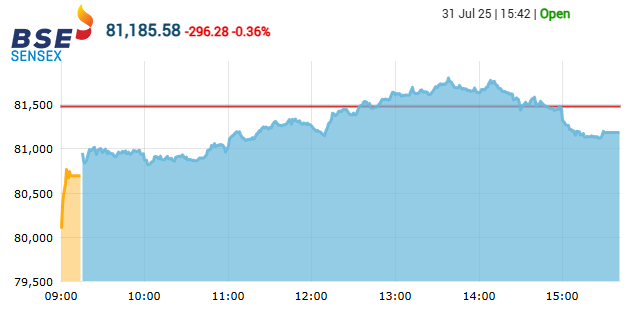

While the initial response was negative and Indian markets fell, indices were quick enough to recover in the second half as earnings from HUL and other companies improved sentiment.

At the end of the day, Indian markets ended marginally lower.

BSE Sensex Daily Chart

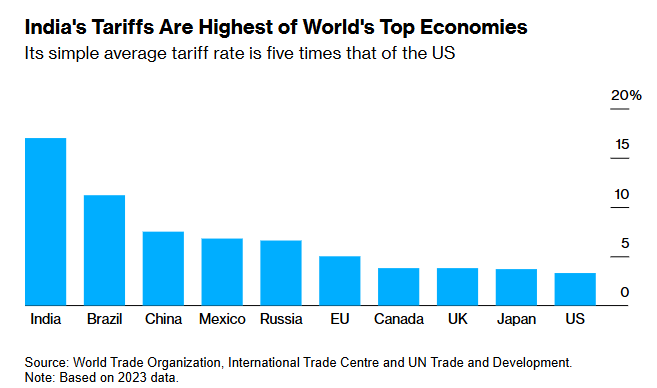

US President Donald Trump said he made this decision because India has tariffs that are among the highest in the world.

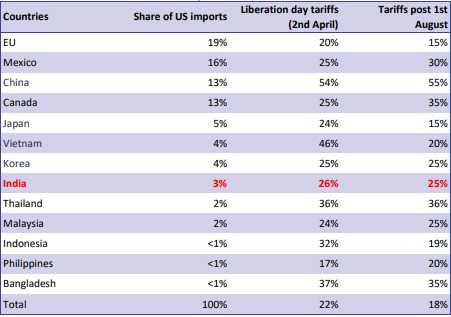

India’s 25% tariff rate is higher than the 20% secured by Vietnam, 19% for Indonesia and 15% for Japan, putting India at a competitive disadvantage.

Other emerging peers like the Philippines also have lower tariffs than India (20%), Korea has tariffs similar to India (25%) while Bangladesh (35%) and China (55%) have higher tariffs.

These nations are also vying for global manufacturing flows amid the ongoing “China+1” shift.

Source: Nuvama

Sectors Impacted by Trump’s Tariffs on India

While India and US are still in discussion, should the tariffs remain, India’s electronics manufacturing sector, along with pharma and auto components, are the top three that could cede ground to rivals which have secured a better deal with Trump.

Source: Nuvama

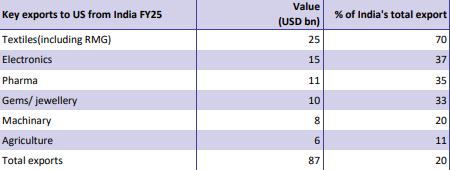

Right now, the US market is key for Indian sectors like textiles, pharma, electronics, agri and machinery exports.

Source: US Census Bureau, as of 2024

Pharma Sector Impact: The BSE Healthcare index slipped over 1% today, in reaction to Trump’s tariffs. Lupin, Dr Reddy’s Lab, Sun Pharma, among others slipped over 2%.

| Company | Movement |

| Sun Pharma | -0.9% |

| Dr Reddy’s Lab | -1.5% |

| Lupin | -2.6% |

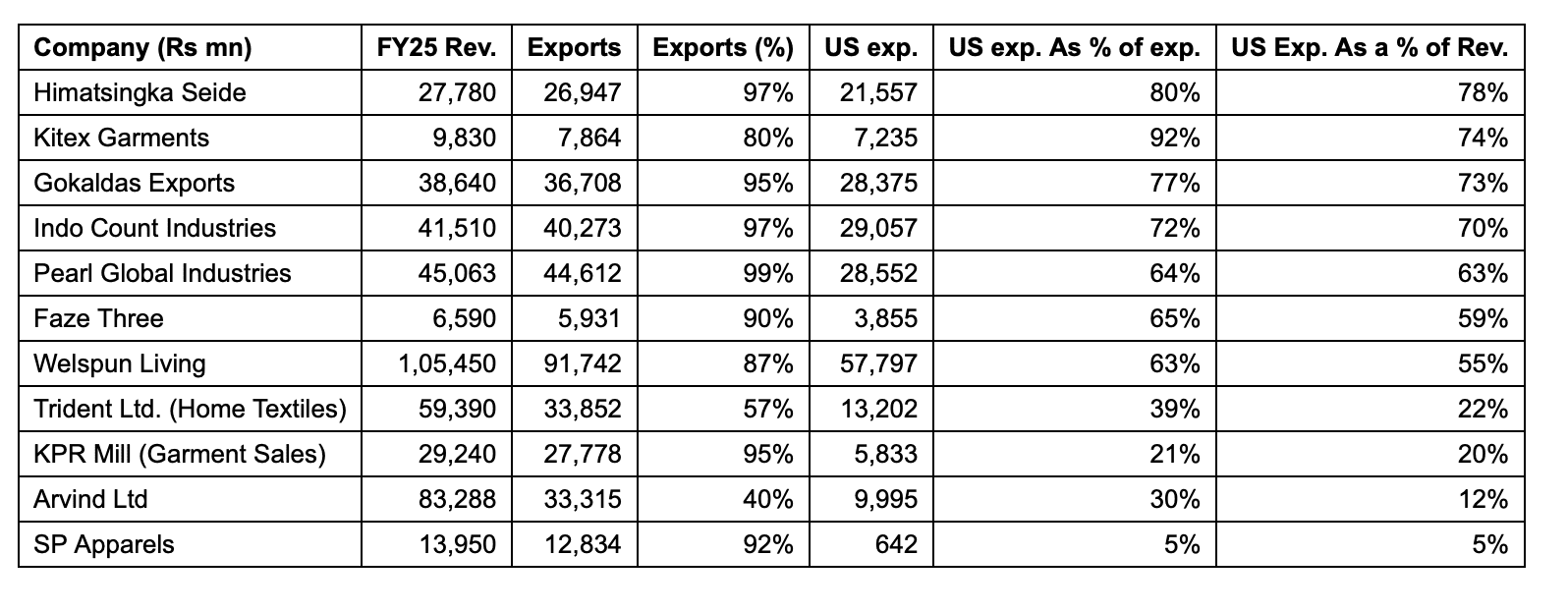

Textile Stocks Impact: Textile Stocks were also trading with deep cuts today, with Trident, KPR Mill, Alok Industries, Raymond Lifestyle and Welspun Living leading the losses.

Textile Stocks Fall After US Imposes Tariffs on India

| Company | Movement |

| KPR Mill | -2.9% |

| Trident | -2.8% |

| Alok Industries | -2.9% |

| Raymond Lifestyle | -1.5% |

| Welspun Living | -5.3% |

According to experts, textiles could be the most impacted as they have heavy reliance on US exports.

Electronics manufacturing stocks were also in focus, with Dixon falling 2%, followed by PG Electroplast and Havells.

| Company | Movement |

| Dixon Technologies | -2.7% |

| Havells India | -0.6% |

| PG Electroplast | -1.5% |

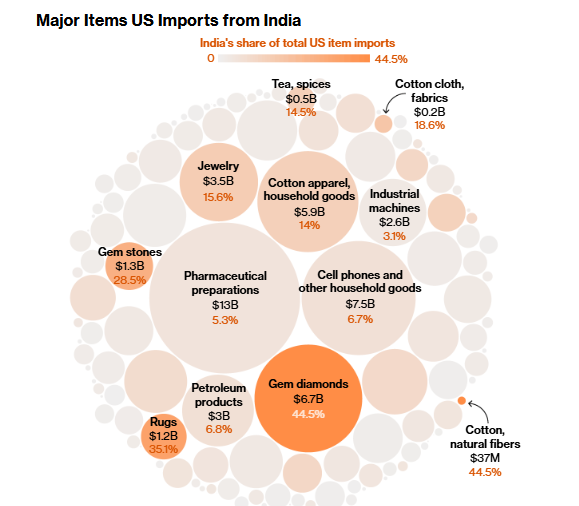

Gems & Jewellery: India’s gem & jewellery sector could also be at risk. The US accounts for over $10 billion worth of India’s exports from this industry and a blanket tariff will inflate costs, delay shipments, distort pricing, and place immense pressure on every part of the value chain, from workers to large manufacturers.

Shares of Vaibhav Global, Titan, Thangamayil Jewellery, Rajesh Exports, Kalyan Jewellers all fell in the range of 1-3%.

Refinery: Shares of state-run refiners such as Indian Oil Corp., Bharat Petroleum (BPCL) and Hindustan Petroleum (HPCL) fell, along with private sector firms like Reliance Industries dropping as much as 2%.

India gets nearly 37% of its oil imports from Russia. Those barrels come at a discount to market rates and have been a key support for gross refining margins. If Russian crude is no longer available, the cost of imports will spike and dent refiners’ profits.

Reliance had signed a deal to buy as much as 500,000 barrels a day from Russia this year to become India’s largest buyer of Russian crude.

What Next for India After the US Puts 25% Tariffs?

The higher tariffs on India versus expectations could potentially weigh on capital flows and markets could turn volatile.

However, experts suggest that some of the blow could be offset by redirecting exports to other countries.

Moreover, the recent underperformance of India rupee, if it sustains, could work to offset higher tariffs on India to some extent and make Indian goods competitive in other markets.

Rupee’s Underperformance

Source: Nuvama

Conclusion

Trump’s tariff move has clearly rattled Indian markets in the short term — especially sectors like pharma, textiles, electronics, gems & jewellery, and refiners with heavy US exposure. But the bigger question is: how will India respond?

While the initial damage was visible on stock prices, market resilience in the second half suggests investors are watching earnings and policy responses closely.

In the long run, this could accelerate India’s push to diversify export destinations and build deeper trade partnerships beyond the US. If the rupee remains weak and the government steps in with tactical support, Indian exporters could still remain competitive globally.

Bottom line? These tariffs may be a wake-up call — but not a knockout punch. The key lies in how India adapts. Investors would do well to track export-heavy sectors, global trade policy shifts, and India’s evolving position in the China+1 world.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora