In the crowded field of Indian mobility brands, Bajaj Auto stands out not just for its scale but for a story of transformation, emotional resonance, resilience, and strategic reinvention. Below is a refreshed narrative (with the latest data) of how Bajaj built an enduring brand legacy, navigated turbulence, and continues to command relevance in a changing world.

Act I: Planting the Seed — Early Years & Identity (1945–1970)

The journey began in 1945 with the founding of M/s Bachhraj Trading Corporation, an enterprise rooted in Gandhian values and early industrial enterprise. Over the next decade, it evolved from trading in electrical goods and spare parts to securing a manufacturing license for two- and three-wheelers by 1959. That shift was profound: from distribution to making the machines that would shape public mobility in India.

By 1960, Bajaj became a public limited company and entered into licensing agreements to produce scooters (notably under Piaggio’s Vespa lineage). The very act of building mobility locally — in a young, import-constrained India — planted a deep brand identity: reliability, “Indian made,” and accessible mobility for many households. Through the 1960s, Bajaj built infrastructure, refined processes, and assembled a foundation for scale.

Act II: Brand Building, Emotional Connect & Diversification (1970s–1990s)

In the 1970s and 1980s, Bajaj evolved from a manufacturer to a cultural icon. The launch of the Chetak scooter in the early 1970s provided a vehicle that ordinary Indians could take pride in owning. In 1977, Bajaj’s three-wheeler (RE) entered the scene, soon becoming an indispensable part of urban and rural life across India and many export markets.

But more than product, Bajaj built emotional equity. Its 1989 campaign “Hamara Bajaj” (meaning “Our Bajaj”) was a masterstroke: it told Indians that this was a brand belonging to them. Every ad, every tagline, reinforced that Bajaj was embedded in India’s story, not just in its roads. Over time, that emotional hook became part of the brand’s DNA.

Parallel to branding, Bajaj also diversified. It entered into a technology and co-development tie-up with Kawasaki to bring motorcycles like KB100 into its lineup, signaling its intention to go beyond scooters. The 1980s saw the establishment of new plants (for instance, the Waluj facility), process expansion, and a drive to push output. These moves bolstered capacity and lowered per-unit cost, laying groundwork for more ambitious expansion.

Still, Bajaj faced constraints: industrial licensing, import restrictions on critical components, constrained capital markets, and the slow pace of bureaucratic approvals. Many growth decisions had to be calculated years in advance. Through it all, the emotional bond with consumers acted as ballast: Bajaj was not an outsider; it was part of India’s mobility journey.

Act III: The Pulsar Breakthrough, Exports & Premium Push (1990s–2010s)

Liberalization in the 1990s opened doors; Bajaj responded with ambition. In 2001, it launched the Pulsar motorcycle series—a model that disrupted the market by marrying sporty aesthetics and performance to an accessible price point. Pulsar grew into a cult brand: youthful, aspirational, and performance-oriented. It dramatically improved Bajaj’s brand perception and profit margins.

At the same time, Bajaj ramped exports of both two- and three-wheelers. It became one of India’s top automotive exporters, with presence in 60+ countries. Over time, Bajaj would position itself as a global leader in autorickshaws, reinforcing its dominance in that segment. The co-investment in KTM (Austria) deepened its access to premium motorcycle technology, design, and global markets.

To engage customers more deeply, Bajaj adopted experiential marketing—organizing rider meets, long-ride events, brand communities, and content that appealed to lifestyle, not just specs. The shift from transactional to relational marketing strengthened brand loyalty and advocacy. Posters, print ads, radio, and eventually digital campaigns were woven around identity, belonging, and freedom, not just features.

Yet challenges loomed: rising fuel costs, emission norms, aggressive competition (domestic and global), and the decreasing margin in commoditized segments. Bajaj responded by pruning low-margin ventures (it exited mass scooter business) and focusing resources on higher-value segments—premium motorcycles, exports, and three-wheelers.

Act IV: Reinvention, Electrification & Strategic Aggression (2015–2025+)

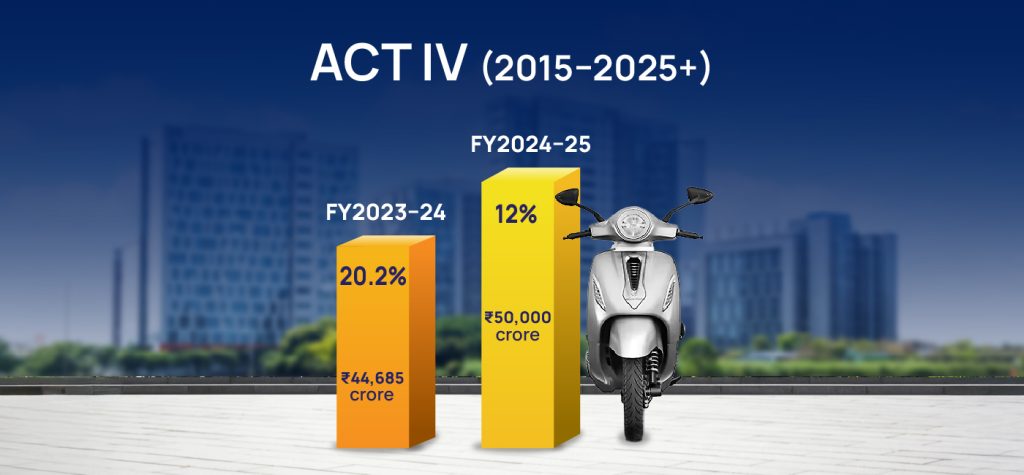

As the global auto world pivoted toward sustainable mobility, Bajaj began its second act of transformation. The revival of Chetak as an electric scooter was a signal: the brand was readying for future mobility. In FY2024–25, Bajaj’s revenue crossed ₹50,000 crore (an all-time high), growing ~12 % year over year from ₹44,685 crore in FY2023–24. The company also crossed ₹10,000 crore in EBITDA, with margins at ~20.2%. Latest reports confirm this record performance.

(FY25 standalone revenue ₹50,010 crore, up 12 %)

(FY24 revenue base ₹44,685 crore) Bajaj Auto Annual Report -+5Motoroids+5Autocar Pro+5

In FY2025, Bajaj’s market landscape also sharpened. It reported a dominant position in many commercial vehicle segments: its RE and Maxima three-wheelers captured ~80 % share in goods carriers in some subsegments. Bajaj Auto Annual Report – The electric three-wheeler rollout saw early traction. Bajaj’s EV line (Chetak EV) tripled volumes year over year, climbing to 164 cities in presence, supported by product upgrades (floorboard battery, integrated motor + MCU) and cost optimization. Bajaj Auto Annual Report -+1

Globally, Bajaj expanded its footprint. In Brazil, it established a dedicated manufacturing facility (capacity ~20,000 units) to serve Latin American markets. In CY 2024, the Brazil arm sold ~13,000 units, tripling its sales from CY 2023, while dealership network expanded from 10 outlets to 31. Bajaj Auto Annual Report –

On the strategic front, Bajaj struck a call option agreement in 2025 to acquire controlling stake in KTM, a bold step targeting end-to-end control over premium motorcycle prowess. Reuters+2The Economic Times+2 At the same time, Bajaj has absorbed recent GST hikes in its premium motorcycle segments (KTM, Triumph) to keep momentum intact. The Economic Times

However, the transition is not without headwinds. As of mid-2025, Bajaj flagged that output of electric scooters would be constrained (meeting only 50-60 % of planned deliveries) due to rare earth material shortages. Reuters Domestically, its two-wheeler share fell from ~11.54 % in FY24 to ~10.78 % in first nine months of 2025, reflecting its strategic pivot toward premium rather than volume dominance. Autocar Pro Despite that, its export engines and premium aspirations have helped offset domestic softness. In Q4 FY25, the company beat profit estimates: net profit of ₹20,490 million (~₹2,049 crore), aided by ~20 % jump in motorcycle exports and favorable forex movement, even as domestic demand dipped ~8 %. Reuters

Recent data also suggests Bajaj’s share in India’s electric two-wheeler market in H1 FY26 is ~19 %, second among legacy players. The Times of India

Narrative Arc & Emotional Anchor

The emotional thread in Bajaj’s story is resilience through identity. From “our Bajaj” to Chetak’s emotional revival, the brand has repeatedly cast itself as part of the Indian journey—mobility, empowerment, aspirations. Each product launch or pivot is accompanied by storytelling: the Pulsar rider’s journey, the EV owner’s cleaner ride, the rickshaw driver’s livelihood. The brand doesn’t just sell machines, it sells memory, trust, and belonging.

At each inflection—liberalization, premium expansion, electrification—Bajaj has leaned on that emotional capital to retain consumer loyalty, even while transforming itself internally.

Key Lessons & Strategic Blueprint for Business Readers

Emotional equity matters: Words like “Hamara Bajaj” are not fluff—they anchor the brand in people’s hearts, providing ballast during transitions.

Portfolio fluidity: Bajaj has periodically pruned commoditized low-margin segments and reallocated capital to higher-growth arenas (exports, premium motorcycles, EVs).

Global + local balance: The Brazil facility, expanded export thrust, and domestic redeployment help de-risk geography concentration.

Partnerships & control: From Kawasaki to KTM and now call options, Bajaj has combined alliances with the ambition to internalize critical tech.

Operational discipline under change: Even as it scales, Bajaj has held margins (~20 % EBITDA) and managed supply constraints, cost pressures, and regulatory change.

Community engagement: Building a rider base, content, experiential marketing, and brand communities help Bajaj shift from just selling to co-creating the brand narrative.

Closing Reflections: Legacy, Relevance & the Road Ahead

Bajaj Auto’s journey—spanning nearly eight decades—is more than a business chronicle. It is a testament to how a brand can evolve without losing its soul. Its current milestone of ₹50,000+ crore in revenue is not a peak but a launchpad. Its pivot into EVs, premium brands, and global markets places it at the crossroads of legacy and future mobility.

For business readers, Bajaj exemplifies how emotional connection, disciplined reinvention, and strategic boldness can allow a brand to straddle mass appeal and premium evolution. As Bajaj Auto steers into a world of electrification, supply chain uncertainty, and changing consumer mindsets, its legacy—the trust it has built, the stories it owns—will remain its most durable competitive edge.

If you like, I can also provide a clean timeline infographic or bullet version optimized for SEO (with headers) you can drop into your blog. Do you want me to generate that?

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin

- Equentis Admin