Hope you liked our previous article on how banks are making the transition from branch banking to online banking. Check it out here.

In this article, we will shed light on another transformation that is happening for Indian banks – the bank privatization of PSU banks. The current government has already stated that it doesn’t want to do business. According to the government, it is better for corporates and business houses to do business. The role of the government should be that of a facilitator through rightful reforms, regulations, and taxation.

As you read further, you will learn how this facet of the banking sector influences the stock market and what this means for investors like you and me.

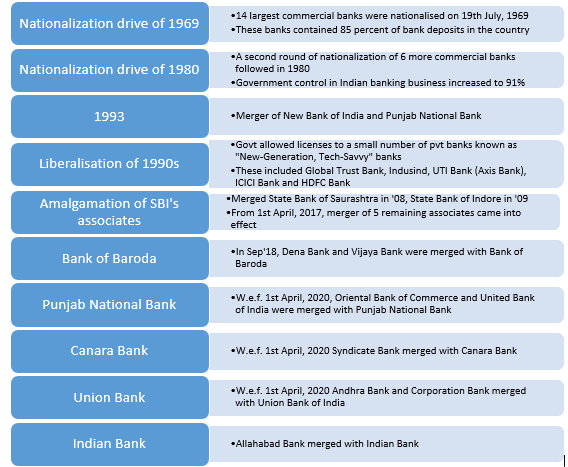

HISTORY OF PRIVATIZATION IN INDIA

Let us take a look at the history of privatization in India. In fact, we have a history of nationalization and privatization at different points of time, which were relevant and necessary in their own context and time frame.

Source: Web sources

REACTION TO Bank PRIVATIZATION ANNOUNCEMENT

The government has been very vocal about the privatization of state-owned entities, more so about banks. The PM famously remarked that \”The government has no business to be in business\”. While the FM during Budget 2021, has adopted a more cautious tone saying that, “Not all public sector banks would be privatized. Even for those banks which are likely to be privatized, the privatized institutions too will continue to function after privatization”.

However, some sections of the banking sector have necessarily agreed to the privatization proposal. PSU bank employees went on a strike following the privatization announcements. Nearly 10L PSU bank employees under the All-India Bank Employees Association went on a two-day strike on 15th and 16th March 2021.

Source: Scroll.in

Some bank unions even went to the extent of saying that a Bank Employee Union strike could take the form of an uglier agitation, just like the farmers’ agitation. Hence, the government has a formidable task at hand.

WHY ARE EMPLOYEES AGITATING?

According to the protesting employees, the following are their grievances for which they are protesting:

- Privatization of banks was a negative move for developing countries such as India.

- Privatization of banks would risk their savings as many private banks in the past have collapsed and people lost their savings.

- It could put thousands of jobs at risk (PSU banks employ close to 8-10L people).

- PSU banks provide the following features to their employees which are absent in private sector banks

- Job security

- Fair wages

- Trade union rights

- Working conditions

- PSU banks are earning operating profits, hence tough action should be taken against defaulters so that they can return to net profits.

- Banks will focus only on profit maximization and overlook social benefits.

WHY HAVE PSU BANKS LAGGED BEHIND PRIVATE BANKS?

There are multiple reasons why PSU banks have lagged behind private sector banks. Reasons are operational, economic, and political:

- Low capital base

- High NPAs

- Poor quality of standard assets vulnerable to further slippages

- A large volume of low-value business due to banking in hinterlands and among masses

- Low market capitalization

- Low investor interest

BENEFITS OF PRIVATIZATION

While there may never be a perfect agreement between the government and protesting parties regarding privatization, both parties will have to take few steps back and then move together forward for the sake of larger national benefit. The move has immense benefits for banks and the economy.

For the government and economy

- Privatization would mean better utilization of its resources (funds), less pressure on the government for the recapitalization of PSU banks.

- The funds thus saved can be used for other welfare-oriented measures.

- Since PSU banks are well-entrenched in rural areas, financial inclusion will not be hampered. In fact, greater presence combined with better technology adoption will ensure greater financial inclusion.

For banks,

- Banks could take a re-look at their entire operating structure and shave off some (unwanted) expenses to improve operating profits.

- Constant bullying by politicians for achieving their motives will reduce, enabling banks to function more independently.

- Top management can be made accountable for the performance of the bank.

- Private Banks, in general, follow better risk management practices.

- More foreign investors would flock to these banks once their operations become efficient and transparent. This will make their stocks liquid and fund-raising easier.

WHAT ARE STOCK MARKETS SUGGESTING?

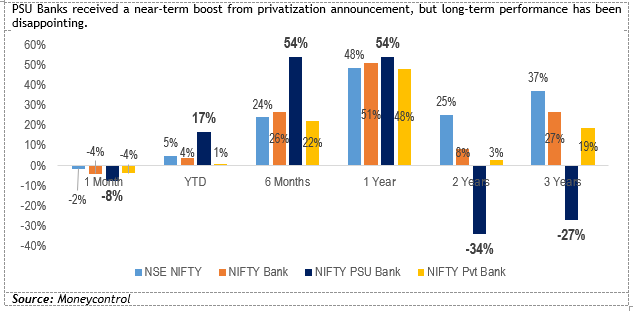

PSU Banks have grossly underperformed over the long term

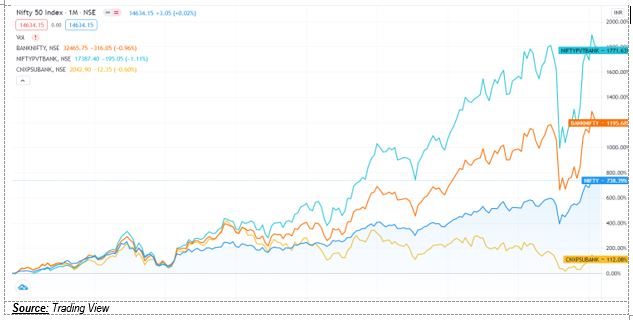

Source: Trading View

For long, stock market participants have been skeptical of investing in PSU banks, owing to their poor financial performance and asset quality issues. Hence, PSU banks have hardly generated any wealth for investors over the long term. On the other hand, the wealth creation potential of private sector banks such as HDFC Bank, Kotak Mahindra Bank, etc. has been exemplary.

As seen in the chart above, the BSE PSU Bank index has under-performed the NIFTY, NIFTY Bank, and NIFTY Private Bank indices by a wide margin. However, over the past 12 months, it has outperformed all these indices significantly. This is due to the strong emphasis on PSU Bank privatization. As stock markets always do, the news started getting digested even before the formal announcement in this year’s budget. Hence, NIFTY PSU Banks surged ahead of private banks.

Hence, it is clear that PSU banks, if they are privatized and properly managed, can generate immense wealth for investors over the longer term. With improvement in operations, foreign investors too could start looking at these banks, leading to greater liquidity, higher Market Capitalization, and ease of raising funds. This will increase the depth of equity markets.

Privatization of PSU banks is the need of the hour given that the Indian banking system is burdened with inefficiencies. A country of 1.3 billion people looking to grow close to double digits cannot afford such inefficiencies. The decision to privatize PSU banks will be extremely difficult from a voter\’s point of view. However, this government is known to take unpopular decisions, if they are for the long-term good of the country. This is yet another bitter pill that we, as a nation, will have to swallow.

Hope you enjoyed reading this story. In the next story, we will tell you about the wonderful use of technology that banks have made to do more things with less, leading to higher profitability and greater reach. It has also left customers spoilt for choices with competitive rates and benefitted the society at large owing to greater financialization of savings.

If you are liking these stories and you think this is adding up to your knowledge base, feel free to write to us about your views on the story. Our email id is createwealth@researchandranking.com.

Knowledge is worth sharing. So, share this article with your friends, colleagues, and relatives.

To create a winning portfolio with the potential to generate 4-5 times returns in 5-6 years, click here.

Read more: About Research and Ranking.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.