Business – Blog Category

This section offers content on business updates and new rules made by the government which could affect the running of a business.

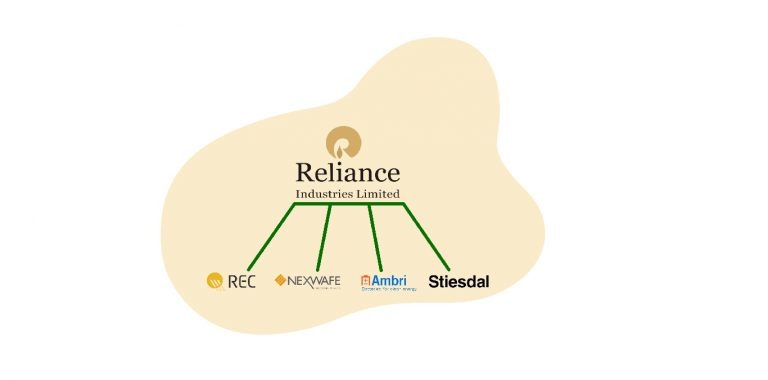

Yesterday we spoke of the rapid changes in the Renewable Energy sector and how Billionaire Barons in India are racing […]

Tata Chemicals Fall in 2021 – The result season is on and looks like the markets are in correction mode. […]

Have you heard of the mills that became defunct and had to close down? What about companies that set up […]

Ratan Tata’s tweet “Welcome home, Air India,” says it all. Not only did the Tatas rejoice, but so did the […]

What Will Tata Do With Three Airlines In Its Stable Now? The Prime Minister Narendra Modi said, “The government has […]

68 years after Government nationalization the Maharajah finds its way back to the TATAs making 8th October 2021 a landmark […]

Electric Vehicles or EVs, as they are commonly called, are vehicles that run on electric power, either partly or fully. […]

As we saw yesterday, the banking sector is going through revolutionary changes led by privatization initiatives of the Government. Among […]

There is a popular joke on social media “If you owe a bank few thousand rupees in loan it is […]

The maiden issue public issue of Brookfield India Real Estate Trust (REIT), India’s only institutionally managed public, commercial real estate […]

Frequently asked questions

Get answers to the most pertinent questions on your mind now.

What is an Investment Advisory Firm?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Do we have SEBI registration as an Investment Advisory?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Why choose a SEBI Registered Investment Advisor?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

What is the Role of an Investment/Stock Market Advisory Firm in India?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.