Fundamental Analysis of Stocks – Blog Category

Fundamental analysis of stocks based on the quarterly and annual reports of the companies.

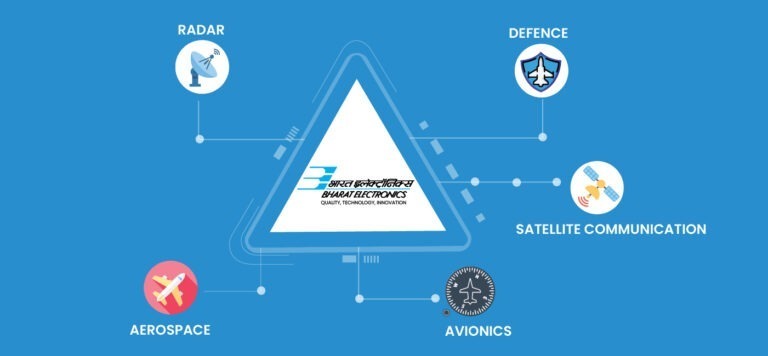

Next time you visit a polling booth to cast your vote, the incredible machine that records your vote is a […]

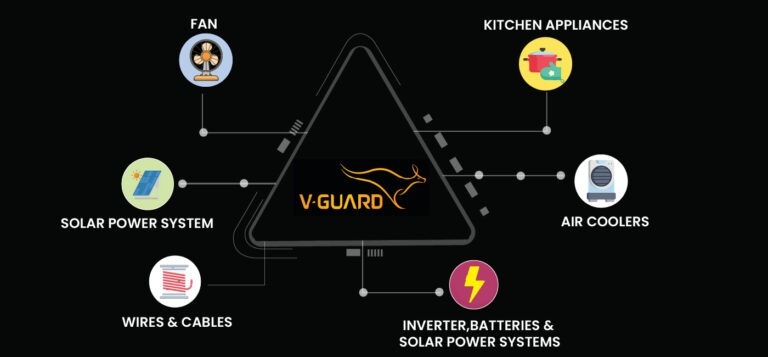

Haven’t we all used stabilizers at some point in our life? These days you also get in-built stabilizers for consumer […]

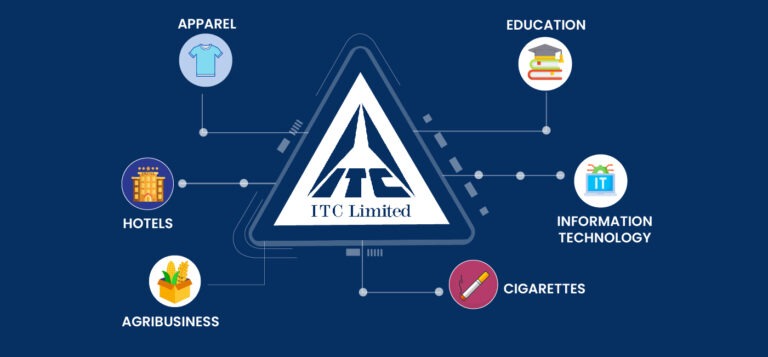

Want to know ITC share price? ITC, once known for frustrating investors with its stubborn rangebound share price movement while […]

As countries race to meet the COP26 climate change agreement, governments globally are focusing on the renewable sector and setting […]

From meeting the needs of its people to supplying affordable medicines worldwide during challenging times, the Indian pharmaceutical industry has […]

Eight sectors are considered core sectors in India, and cement is one of them. The sector has given good returns […]

Overview of the Asian Paints Share Price Asian Paints Limited is an international paint manufacturer with Indian roots headquartered in […]

Chalti Ka Naam Gaadi– this movie name perfectly goes with India’s largest IP company -Saregama. A treasure house of intellectual […]

IRCTC, Indian Railway Catering, and Tourism Corporation Limited is a prominent player in e-commerce and leading catering and hospitality services. […]

It is human nature to associate countries with successful businesses that originate from them. When we talk about companies like […]

Frequently asked questions

Get answers to the most pertinent questions on your mind now.

What is an Investment Advisory Firm?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Do we have SEBI registration as an Investment Advisory?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Why choose a SEBI Registered Investment Advisor?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

What is the Role of an Investment/Stock Market Advisory Firm in India?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.