Investing – Blog Category

Explore investing blogs covering stocks, mutual funds, and long-term wealth creation. Practical insights to help you make smarter investment decisions.

Tata Technologies’ stock has turned out to be a letdown for long-term investors. Back when the company launched its IPO […]

Indian share markets broke their 4-day losing streak as they opened higher on July 15, 2025 following better than expected […]

India’s retail sector isn’t just about shopping — it’s a major engine of the country’s economy. The sector powers nearly […]

Filing income tax returns is a mandatory financial responsibility for salaried individuals, professionals, and businesses in India. However, sometimes taxpayers […]

When it comes to promoting ease of doing business and encouraging entrepreneurship in India, tax incentives play a vital role. […]

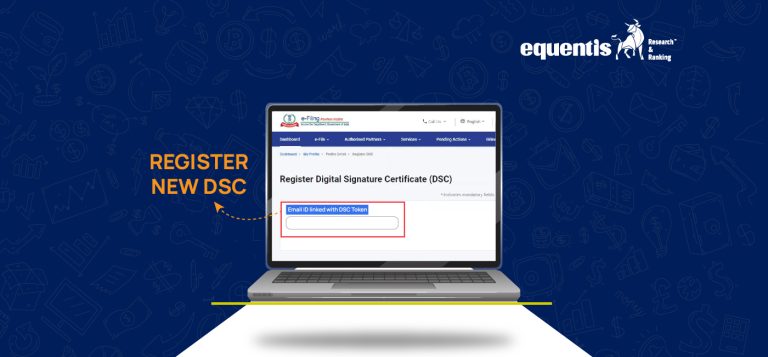

Introduction From signing physical documents to managing everything online, technology has changed the way we work. For businesses, a Digital […]

Bitcoin, the world’s largest cryptocurrency, has touched a record-breaking high of over $116,000, continuing its strong rally in 2025. The […]

When filing TDS (Tax Deducted at Source) or TCS (Tax Collected at Source) returns, many deductors focus mainly on the […]

Transparency and cross-border cooperation are important in tackling tax evasion and ensuring compliance. To align with international tax information-sharing standards […]

Filing income tax returns is a crucial responsibility for every taxpayer in India. Often, individuals and businesses pay excess TDS […]

Frequently asked questions

Get answers to the most pertinent questions on your mind now.

What is an Investment Advisory Firm?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Do we have SEBI registration as an Investment Advisory?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Why choose a SEBI Registered Investment Advisor?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

What is the Role of an Investment/Stock Market Advisory Firm in India?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.