Investing – Blog Category

Explore investing blogs covering stocks, mutual funds, and long-term wealth creation. Practical insights to help you make smarter investment decisions.

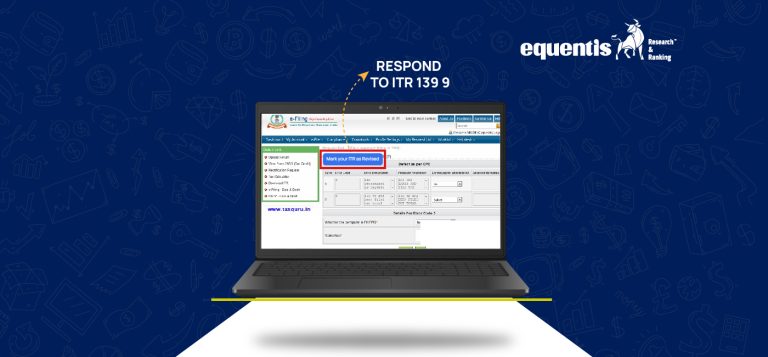

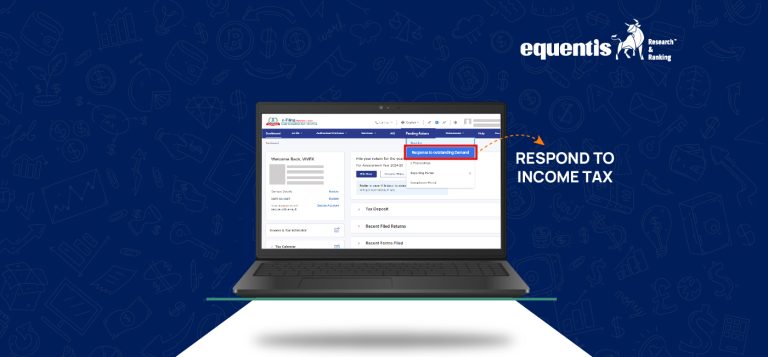

Income tax compliance is an important part of financial planning. Filing your Income Tax Return (ITR) correctly is a crucial […]

Did you know – every second, the Sun releases enough energy to power the entire Earth for 500,000 years! In […]

Imagine a business considering the construction of a new building in the suburbs; one that is moving its old facility […]

Despite falling revenues, HCC share price has seen a massive jump of over 500% in the last five years. The […]

Recent reports about the United Arab Emirates (UAE) offering a Golden Visa to Indian nationals at a significantly lower cost, […]

Editor’s Note: The Bombay Stock Exchange (BSE) completes 150 years today — but only 8% of Indians invest. That’s the […]

Income tax is a part of every earning individual or business’s financial responsibility. But sometimes, even after filing your return […]

Medical expenses are a significant portion of household budgets today. For salaried employees, managing doctor visits, hospital stays, and health […]

Frequently asked questions

Get answers to the most pertinent questions on your mind now.

What is an Investment Advisory Firm?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Do we have SEBI registration as an Investment Advisory?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Why choose a SEBI Registered Investment Advisor?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

What is the Role of an Investment/Stock Market Advisory Firm in India?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.