Investing – Blog Category

Explore investing blogs covering stocks, mutual funds, and long-term wealth creation. Practical insights to help you make smarter investment decisions.

Understanding a company’s financial health goes far beyond looking at profits alone. Two important financial statements that help investors, analysts, […]

As per the Reserve Bank of India (RBI), the net household savings are currently around 5.3% of the Indian GDP. […]

In the world of finance and wealth management, the term High Net Worth Individuals (HNWIs) has become increasingly significant. Financial […]

Investors looking for high-risk, high-return opportunities often consider fundamentally strong penny stocks. These low-priced shares — typically penny stocks under […]

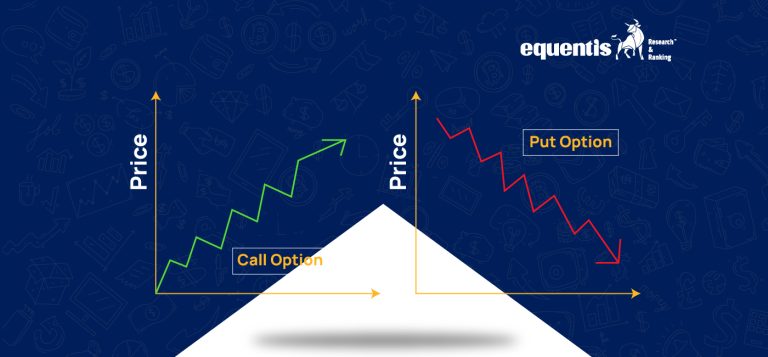

Options trading is one of the most powerful segments of the derivatives market. Whether you are a beginner or an […]

If you have ever wondered what is Nasdaq and why it plays such a crucial role in global finance, this […]

If you’ve ever wondered what are bonus shares and why companies issue them, you’re in the right place. Bonus issues […]

Algo trading (algorithmic trading) has transformed the way modern traders participate in financial markets. Today, more than half of market […]

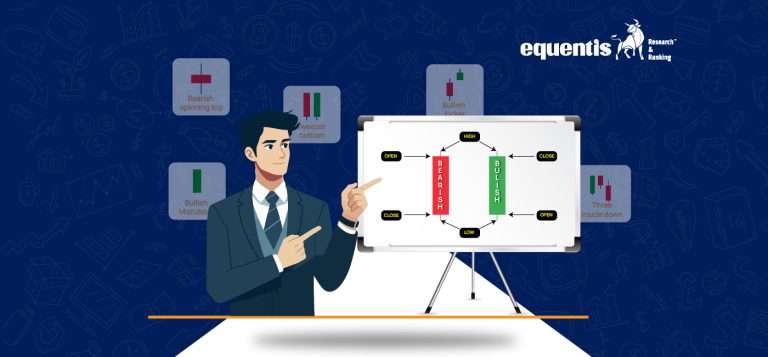

Candlestick pattern analysis is one of the most powerful tools in technical trading. Whether you’re a beginner or an experienced […]

Kaynes Tech has informed investors that it expects its cash flows to turn positive by the end of FY26. This […]

Frequently asked questions

Get answers to the most pertinent questions on your mind now.

What is an Investment Advisory Firm?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Do we have SEBI registration as an Investment Advisory?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Why choose a SEBI Registered Investment Advisor?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

What is the Role of an Investment/Stock Market Advisory Firm in India?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.