Retirement

Read retirement planning blogs on savings, investments, pensions, and building a secure, stress-free retirement.

Introduction Importance of Knowing Retirement Age The main goal of savings in most Indian households is a comfortable retirement, one […]

Dreaming of long vacations, relaxed mornings, and doing all those things you always wanted to do? Early retirement might sound […]

Retirement marks a significant transition in life. Starting from working hard to build a life and choosing to leave work […]

Introduction You deserve to enjoy your retirement when you work hard all your life. But how can you ensure you […]

Lingering cross-border tensions, high oil and commodity prices, sustained supply chain disruptions, heightened market volatility, and fears of a COVID-19-like […]

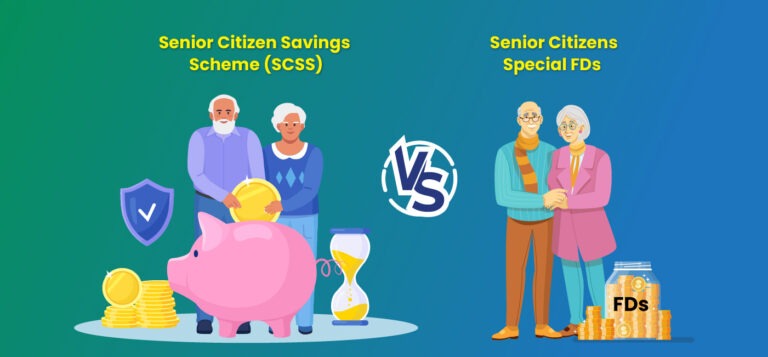

Senior citizens have several investment options, some government-backed and others private. Senior Citizen Saving Scheme (SCSS) and Senior Citizens Special […]

Porting Of NPS Annuity: National Pension Scheme (NPS) is a way you can regularly invest while building a healthy retirement […]

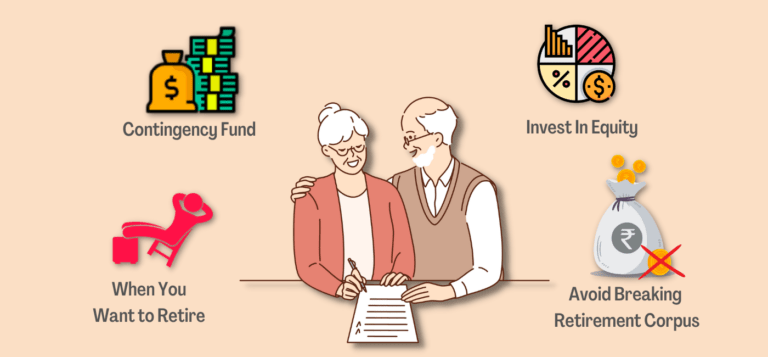

A smooth sailing retirement is a dream we all share. You finally get to settle into this period, having retired […]

As retirement sets in, your regular income stops, but the expenses keep rolling. When inflation skyrockets, so will everyday expenses. […]

Frequently asked questions

Get answers to the most pertinent questions on your mind now.

What is an Investment Advisory Firm?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Do we have SEBI registration as an Investment Advisory?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Why choose a SEBI Registered Investment Advisor?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

What is the Role of an Investment/Stock Market Advisory Firm in India?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.