In the evolving narrative of global investments, India’s story is one of remarkable transformation and forward-thinking adaptation. With the digital economy taking center stage, India has redefined its investment appeal, no longer just a destination for manufacturing and inexpensive labor.

The stock market has become a vibrant digital medium, reflecting the country’s economic dynamism and attracting investors eager to participate in India’s financial success.

India’s Investment Landscape: A Digital Revolution

India’s investment environment is metamorphosing, reflecting its broader economic revolution. As the country transitions from traditional manufacturing to a digital-first economy, it’s capturing the attention of global investors. Initially focused on manufacturing, the “Make in India” initiative has evolved into “Digital India,” a campaign that underscores the nation’s commitment to becoming a global digital powerhouse.

This shift is evident in the rise of digital manufacturing and the integration of Industry 4.0 technologies such as the Internet of Things (IoT), artificial intelligence (AI), robotics, and data analytics into manufacturing processes. These advancements enhance productivity and transform India into an innovation hub, attracting FDI not merely for cost advantages but for its burgeoning digital ecosystem.

The Stock Market: A Gateway to India’s Economic Progress

The Indian stock market has become a digital gateway for investors to tap into the country’s economic progress. It’s no longer just about investing in tangible assets or manufacturing units; it’s about being part of a digital revolution reshaping India’s financial landscape. With a focus on tech-driven sectors like fintech, e-commerce, and IT services, the stock market offers a spectrum of opportunities for investors to align with India’s growth trajectory.

As India continues to demonstrate its prowess in technology and innovation, the stock market reflects this progress, offering a transparent and efficient platform for investment. It’s a testament to India’s robust regulatory framework and the growing confidence of domestic and international investors in its economic policies.

India’s Economic Ascendancy

India’s economic landscape is undergoing a profound transformation, setting the stage for the nation to emerge as a global economic superpower. With a GDP of $3.5 trillion, India is on an accelerated path to becoming the world’s third-largest economy by 2027 and more than double its GDP to over $7.5 trillion by 2031.

This remarkable growth trajectory is propelled by three pivotal megatrends: global offshoring, digitalization, and energy transition. These trends are not mere economic shifts; they fundamentally reorientate India’s role in the global market, positioning it as a central hub of innovation, manufacturing, and services.

India’s Market Stability and Returns: Outshining Peers

One of the most compelling aspects of India’s investment landscape is the relative stability of its market, combined with the promise of higher returns. Despite global economic fluctuations, the Indian market has demonstrated a remarkable resilience to volatility. Recent analyses suggest that Indian equities have been less volatile than many other emerging markets.

This stability is particularly notable given the high-performance trajectory of the Indian market, which has consistently delivered robust returns. The Indian stock market stands on the 5th rank in market capitalization compared to its global peers, surpassing the UK and Canada.

| Country (or group) | Market Cap |

| U.S | $52.6T |

| Magnificent Seven | $13.1T |

| China | $11.5T |

| Japan | $6.5T |

| India | $4.4T |

| France | $3.2T |

| UK | $3.1T |

| Saudi Arabia | $2.9T |

| Canada | $2.6T |

| Germany | $2.2T |

| Taiwan | $2.0T |

| Switzerland | $1.9T |

| South Korea | $1.8T |

| Australia | $1.6T |

| Netherlands | $1.1T |

Moreover, experts have observed that the Indian market continues to command a valuation premium, thanks to the increased participation from domestic investors through systematic investment plans (SIPs) and direct investments. This shift towards equity markets for long-term investment has been a significant factor in absorbing the impact of volatility, especially during periods of foreign institutional investors (FIIs) selling off their holdings.

Regarding returns, the Indian stock market has outperformed many global peers over the last decade, offering investors substantial growth potential. Over the past five years, the Indian market has shone with an 18.8% annualized return, surpassing the US, Japan, and UK markets. This trend is a short-term and sustained growth pattern, making India an attractive destination for investors seeking stability and superior returns.

This combination of lower volatility and higher returns positions India as a unique and promising hub for global investment, setting it apart from its peers and highlighting its potential as a cornerstone of the global economy in the years to come.

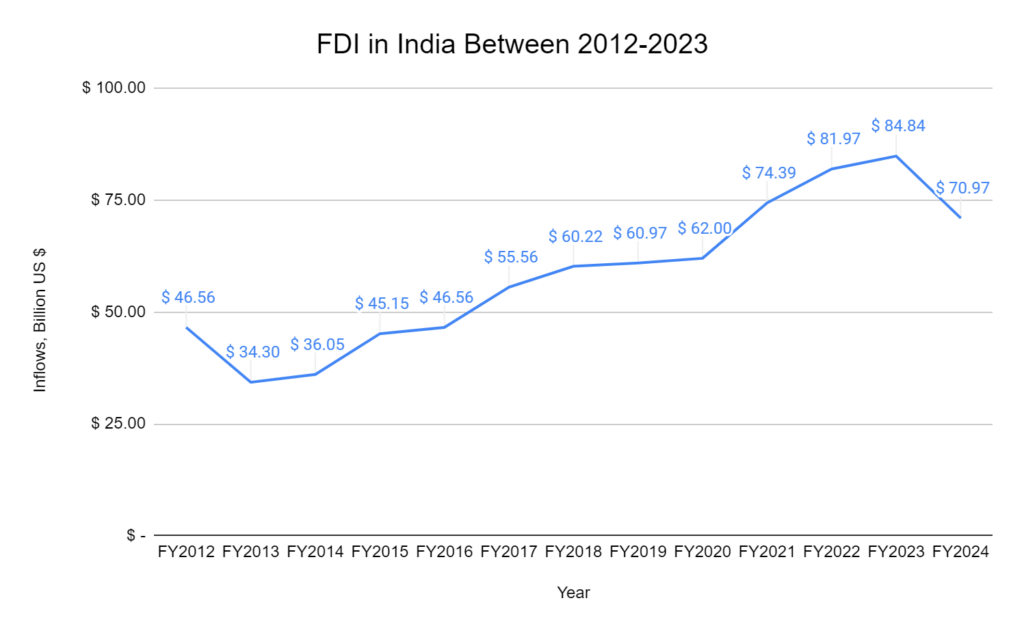

The Influx of Foreign Direct Investment

The surge in Foreign Direct Investment (FDI) into India is a testament to the country’s burgeoning potential and investor confidence. In FY2023, FDI inflows soared to Rs 49.93 lakh crore, a significant increase from Rs 46.72 lakh crore in the previous fiscal year.

The United States has been the most substantial contributor, infusing Rs 8.58 lakh crore into the Indian economy, which accounts for 17.2% of the total FDI share. This influx is primarily credited to India’s rapidly growing digital sector, bolstered by several government measures to liberalize the FDI regime and enhance the ease of doing business.

Outward Direct Investment: India Goes Global

Parallel to the inflow of foreign capital, Indian firms are making their mark on the global stage through strategic Outward Direct Investment (ODI). In FY2023, there was a robust 19.46% increase in ODI, with investments reaching Rs 9.11 lakh crore. Singapore, known for its business-friendly environment, has emerged as the top destination for Indian ODI, signaling a clear intent of Indian firms to expand their international footprint.

Moreover, tax havens like Bermuda, Jersey, and Cyprus, among the top recipients of Indian ODI, underscore the strategic financial planning and global aspirations of Indian corporations.

Key Growth Areas and Investment Prospects

As we look towards 2024-25, several key industries stand out as beacons for foreign investment in India. The healthcare and insurance sectors are poised for exponential growth, driven by an aging population, rising chronic diseases, and increased disposable income.

The fintech sector is revolutionizing financial services with innovative solutions, while renewable energy and electric vehicles are at the forefront of the sustainable revolution. Additionally, the IT services sector continues to be a cornerstone of India’s economic strength, alongside burgeoning opportunities in real estate, infrastructure, fast-moving consumer goods (FMCG), and tech innovation. These sectors offer promising returns and the chance to be part of India’s dynamic growth story.

Conclusion

The shift in global investment trends toward India is a testament to the country’s robust economic policies, strategic market positioning, and the government’s commitment to fostering a conducive environment for investment. As India continues to grow and integrate into the global economy, it stands as a beacon of opportunity for investors worldwide.

India’s rise as a new hub for global investment is not just a fleeting trend but a reflection of its potential to shape the future of the global economy. The coming years will undoubtedly see India solidifying its position as a key player on the world stage, offering a wealth of opportunities for growth, innovation, and investment.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

How is India’s economy transforming?

India is on track to become the world’s third-largest economy by 2027, with its GDP expected to more than double to over $7.5 trillion by 2031. This growth is driven by global offshoring, digitalization, and energy transition.

What makes India’s market attractive to investors?

India’s market offers stability and higher returns. Indian equities are less volatile than other emerging markets and have delivered an 18.8% annualized return over the past five years.

What has been the trend in FDI inflows into India?FDI inflows into India increased to Rs 49.93 lakh crore in FY2023, with the US being the most significant contributor, largely due to India’s growing digital sector.

How are Indian firms expanding globally?

Indian firms are increasingly investing abroad, with ODI reaching Rs 9.11 lakh crore in FY2023. Singapore is the top destination for Indian ODI, reflecting Indian companies’ aspirations to grow internationally.

Which sectors in India are attracting foreign investment?

Healthcare, insurance, fintech, renewable energy, electric vehicles, IT services, real estate, infrastructure, FMCG, and tech innovation are key growth areas for investment in India.

What is the significance of India’s role in the global investment landscape?

India’s rise as a hub for global investment highlights its strong economic policies, market positioning, and government support, making it a promising destination for investors worldwide.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/