There’s enough and more to keep Dalaal Street on its toes, with several IPOs opening and companies listing this week. One of those is Go Digit General Insurance, which intends to raise an enormous ₹2,615 crore. However, you must carefully look at all the IPO details before deciding. Find out more about the company’s financials and other information before investing.

Go Digit General Insurance IPO details

| Offer Price | ₹258 to ₹272 per share |

| Face Value | ₹10 per share |

| Opening Date | 15 May 2024 |

| Closing Date | 17 May 2024 |

| Total Issue Size (in Shares) | 54,766,392 |

| Total Issue Size (in ₹) | ₹2,615 crore |

| Issue Type | Book Built Issue IPO |

| Lot Size | 55 Equity Shares and multiples thereafter |

Here’s what the IPO offers:

- Fresh Issue & Offer for Sale (OFS): The IPO combines a fresh issue of 4.14 crore shares aggregating ₹1,125.00 crores with an OFS of 5.48 crore shares aggregating ₹1,489.65 crores.

- Objective: The company plans to use the net proceeds to continue its business activities and enhance its visibility and brand image among its existing and potential customers.

- Investor Allocation: Up to 75% of the IPO shares are reserved for institutional investors (QIBs), while retail investors get not more than 10%, and non-institutional investors (NIIs) get 15%.

GO Digit General Insurance IPO GMP

As of 15 May 2024, the Gray Market Premium (GMP) of Go Digit General Insurance IPO was ₹47. The GMP is an unofficial indicator of investor interest in the unlisted market, not a guaranteed future price.

Company Overview

Launched in 2017, Go Digit is an insurance company offering car, health, and various other types of coverage, including travel, business, home, and life insurance. So far, the company has a customer base of 3 crore. This company, supported by celebrities Virat Kohli and Anushka Sharma, has 74 insurance products across various business lines. Its distribution network comprises over 61,972 partners, including agents, brokers, and Point-of-Sale Persons (POSPs). The insurer also leverages technology for convenient product access through a user-friendly website and partnerships with web aggregators.

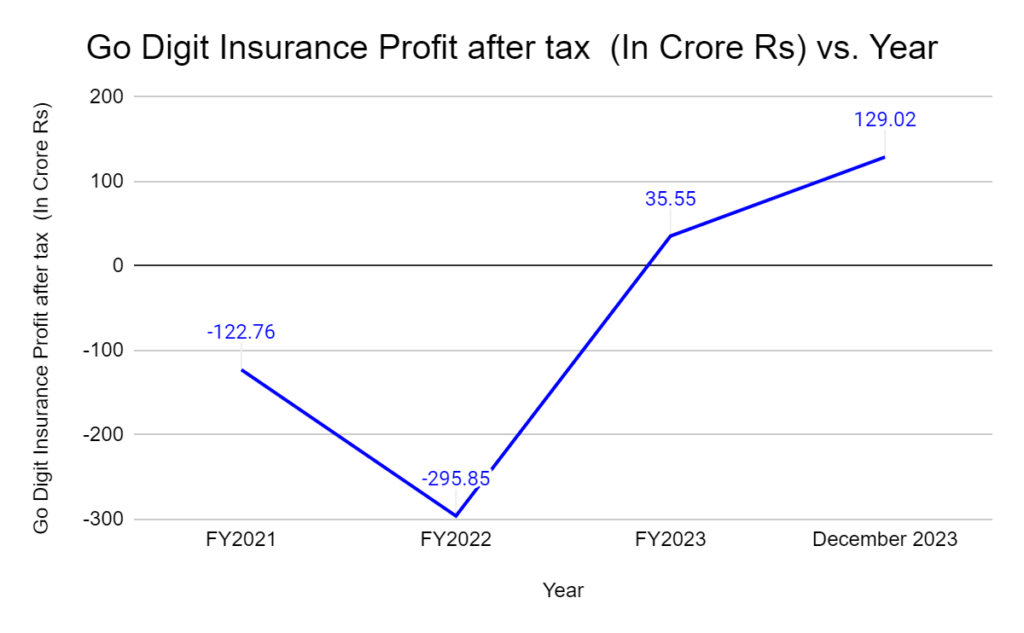

Gradually Improving Financial Performance

The company had a rough two years, as it clocked ₹122.76 crore loss after tax in FY2021, which increased to a loss of ₹295.85 crore in FY2022. However, Go Digit then had a profit after tax (PAT) of ₹35.55 crore in FY2023, and for nine months ended 31 December 2023, the PAT increased to ₹129.02 crore.

SWOT Analysis of Go Digit General Insurance

| STRENGTHS | WEAKNESSES |

| Growing Insurance Market: The Indian insurance industry will likely grow considerably soon, presenting a large potential customer base for Go Digit. Expansion of Product Portfolio: Go Digit can expand its products to reach a broader range of customer needs, including new insurance categories and value-added services. Partnerships: Collaborating with other companies can help Go Digit reach new customer segments and expand its distribution network. Technological advancements: Leveraging new technologies like AI and big data can improve risk assessment, pricing models, and customer service. | Limited Product Portfolio: Compared to other established insurers, Go Digit offers a smaller range of insurance products, especially in non-motor segments. Profitability: The company made losses until 2023, which raises concerns about long-term financial sustainability. Reliance on motor insurance: A major portion of its revenue comes from motor insurance, making it vulnerable to fluctuations in the auto market. Limited brand experience: The lack of physical branches might limit customer reach, especially for those less comfortable with online transactions. Recent Player: Compared to seasoned companies, Go Digit is a relatively newer entity, which might raise questions about its long-term stability for some. |

| OPPORTUNITIES | THREATS |

| Growing Insurance Market: The Indian insurance industry will likely grow considerably soon, presenting a large potential customer base for Go Digit. Expansion of Product Portfolio: Go Digit can expand its products to reach a wider range of customer needs, including new insurance categories and value-added services. Partnerships: Collaborating with other companies can help Go Digit reach new customer segments and expand its distribution network. Technological advancements: Leveraging new technologies like AI and big data can improve risk assessment, pricing models, and customer service. | Increased competition: The Indian insurance sector is becoming increasingly competitive, with seasoned players and startups vying for market share. Regulatory changes: Changes in government regulations might impact its business model or product offerings. Economic downturns: Economic slowdowns can lead to decreased demand for insurance products. Cybersecurity threats: As a digital-first company, Go Digit is especially vulnerable to cyberattacks that could compromise customer data or disrupt operations. |

Go Digit has strengths and weaknesses and has seen considerable ups and downs since its inception. Considering this, even if the IPO market seems exciting, it’s best to Be mindful while investing. Weigh the pros and cons before deciding whether the Go Digit IPO must be added to your portfolio. Thoroughly research before investing in this or any IPO. Consult with a financial advisor to make an informed decision.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/