World Earth Day, which was observed on April 22 this year, highlights the importance of environmental conservation and sustainability. It encourages us to band together and take action to make the world healthier and brighter.

To honor Earth Day, which inspires change and promotes the close connection between sustainability and financial wellness, we introduce the concept of Eco-smart Finance.

Eco-smart finance is a strategy that promotes the inclusion of sustainable practices into financial planning. It is about achieving long-term financial health while following environmentally friendly practices.

As we commemorate this day dedicated to planetary well-being, we’ve compiled a list of five easy hacks you can use to boost your financial growth while also benefiting the environment. Let’s get on board.

What is Eco-smart Finance?

Eco-smart finance, also known as sustainable, socially responsible, or green investing, is a strategy that involves making investment decisions based on the environmental, social, and governance (ESG) performance of companies, industries, and assets.

Eco-smart investing is gaining traction as more investors seek to align their financial goals with their personal values and contribute to a sustainable future. Before delving further down, here are some key aspects of eco-smart investing or finance to consider:

- Environmental Considerations: Investors focus on companies that positively impact the environment, such as those involved in renewable energy or pollution reduction.

- Social Responsibility: We invest in companies that use fair labor practices, promote human rights, and engage positively with their communities.

- Governance: Investors look for companies with ethical governance practices, including transparency, shareholder rights, and fair executive compensation.

- Impact Investing: This goes beyond ESG criteria by actively seeking out investments that can generate measurable social or environmental benefits alongside financial returns.

Also Read: Top 10 Solar Energy Stocks in India

Tips For Making Eco-smart Finance Choices

Sustainable finance is becoming increasingly important for individuals who want to align their financial activities with environmental responsibility.

Here are five eco-smart strategies that can help you achieve financial prosperity while contributing to a sustainable future.

1. Invest in Green Bonds and Stocks:

Consider allocating a portion of your investment portfolio to green bonds and stocks in companies that value sustainability.

Green Bonds are fixed-income securities used to finance projects with environmental benefits, such as clean energy or sustainable infrastructure. These sectors can include renewable energy, sustainable agriculture, and green technology.

| Green Stocks | Sub-sector |

| Adani Green Energy | Renewable Energy |

| Zodiac Energy | Renewable Energy Equipment and Services |

| KPI Green Energy | Renewable Energy |

| Inox Green Energy Services | Construction and Engineering |

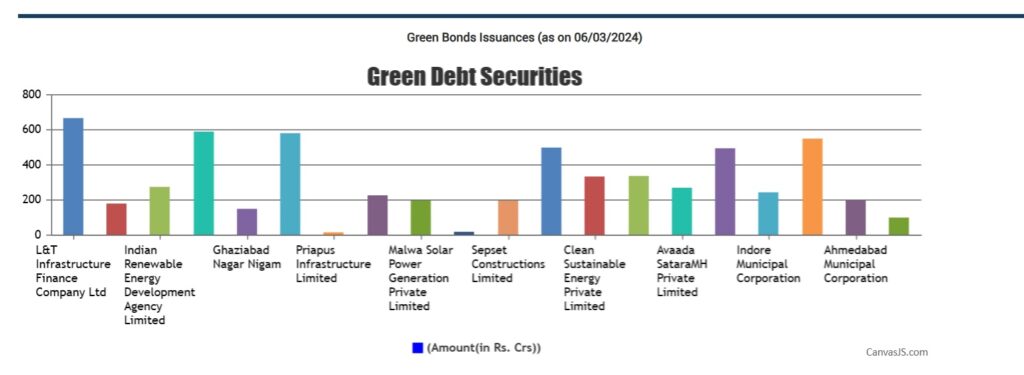

List of Green Bonds In India

| Green Bond | Issue Date | Maturity Date | Amount | Tenure |

| L&T Infrastructure Finance Company Ltd | 29/06/2017 | 18/11/2024 | Rs. 667 Cr | 7.39 years |

| Tata Cleantech Capital Limited | 18/12/2018 | 18/12/2023 | Rs. 180 Cr | 5 years |

| Indore Municipal Corporation | 20/02/2023 | 20/02/2026- 20/02/2032 | Rs. 244 Cr | 3 -9 years |

2. Support companies with eco-friendly initiatives

Adopting eco-smart investing means choosing financial products and services that support sustainable practices. For example, some banks offer credit and debit cards made from recycled or biodegradable materials, and tailored programs are available for businesses to help them adopt greener practices. Some of the Banks that switched to recyclable or biodegradable debit/credit cards are-

- HSBC India has introduced credit cards made from recycled PVC plastic (rPVC) and plans to phase out single-use PVC cards by the end of 2026 as part of its environmental initiatives.

- Airtel Payment Bank has launched an eco-friendly debit card made from recycled polyvinyl chloride (rPVC), a major step towards environmentally responsible banking.

These initiatives reflect a growing trend in the banking industry to adopt more sustainable practices and reduce the environmental impact of plastic waste.

Also Read: Exploring Socially Responsible Investment

2. Opt for Green Loans for Eco-Friendly Projects

If you’re planning to finance a home renovation or purchase an electric vehicle, look for green loans that offer favorable terms for eco-friendly projects. Some of the key advantages of Green Loans include-

- Lower Interest Rates: Green loans typically come with lower interest rates than traditional financing options, making them more cost-efficient.

- Subsidies and Incentives: Depending on the region and the specific green loan program, borrowers may be eligible for subsidies, tax benefits, or other financial incentives.

- Long-Term Financing: Some green banks or financial institutions provide long-term loans, which can benefit projects with a longer payback period.

- Additional Loan Proceeds: Borrowers might receive extra loan proceeds to cover additional costs associated with their green projects.

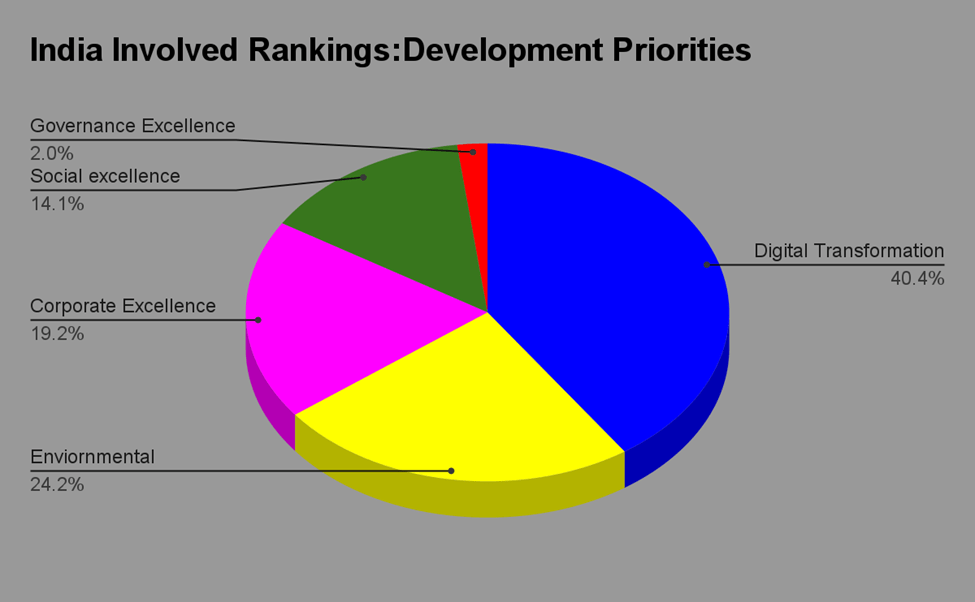

3. Support Sustainable Companies: Use your purchasing power to help companies that prioritize environmental, social, and governance (ESG) practices. SKOCH’s recent report, “India Involved Index 2023,” assesses India’s commitment to becoming a developed nation by 2047 and how well its actions align with ESG parameters.

Here, sharing a glimpse of the report highlights-

- Reliance Industries ranks first, followed by Hindustan Unilever, and the Adani Group demonstrates the highest commitment to Viksit Bharat.

- Hindustan Unilever leads India’s ESG involvement ranking; Adani Group is second, and Britannia is third.

- Jio Platforms leads India’s involvement in digital transformation, with Lupin coming in second and Heritage Foods third.

- Bank of India ranks first in India for corporate excellence, followed by HDFC Life Insurance and Aditya Birla Health Insurance.

4. Practice Energy-Efficient Habits

Adopting energy-efficient habits at home can reduce your carbon footprint and save you money. These include using LED lighting, energy-saving appliances, switching to renewable energy sources like Solar or wind energy, and reducing water waste.

5. Financial Recycling: Applying the principles of “reduce, reuse, recycle” to personal

Financial Recycling is a concept inspired by the environmental mantra “reduce, reuse, and recycle.” It is about using these principles to manage money sustainably and efficiently. Here’s a breakdown of how each principle can be applied:

Reduce: This includes reducing unneeded costs and debt. It’s about being more aware of your spending habits and looking for ways to cut costs without sacrificing your quality of life.

Reuse: This principle promotes the use of existing financial resources in new ways. It could include reinvesting dividends from investments or finding new uses for saved money, such as using a shopping-day fund for an investment opportunity.

Recycle: Recycling means taking the profits from one investment and putting them into another, keeping the money active and working for you.

It can also refer to strategies such as debt recycling, which involves replacing non-deductible debt (such as a home loan or a car loan) with deductible debt (such as an investment loan) to reduce taxes and increase wealth potentially.

The Bottom Line

Combining eco-friendliness with financial growth can lead to financial benefits such as tax incentives, lower utility bills, and potentially higher returns on investments. In this article, we’ve shared five super-useful hacks you can use to keep up with the growing trend of sustainability.

By adopting eco-friendly practices, from investing in green stocks or bonds to supporting green business operations, we can pave the way for a healthier planet. Furthermore, green deposits are an excellent way to achieve eco-smart finance, as banks offer competitive interest rates and promote sustainable practices. Central Bank offers the CENT Green Time Deposit, AU Bank the AU Green Fixed Deposit, and SBI the Green Rupee Term Deposit.

All of these Eco-smart investments share the goal of using the deposits to lend to renewable energy projects, green building projects, and waste management. Do your research on Eco-smart finance thoroughly. Understanding the impact of your financial decisions can lead to more mindful choices.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

How can eco-smart investments contribute to a healthier planet?

Investors can drive innovation and support India’s commitment to the Sustainable Development Goals by channeling funds into renewable energy, clean technology, and sustainable agriculture.

What sectors in India are prime for eco-smart investments?

Sectors like clean energy, electric vehicles, and green infrastructure are ripe for investments that align with both profitability and ecological impact

Can eco-smart investments also be financially rewarding?

Absolutely; with India’s growing focus on sustainability, eco-smart investments are increasingly seen as opportunities for robust financial growth and long-term value creation.

Can small investors participate in eco-smart investments?

Yes. Some platforms and funds allow retail investors to contribute to eco-friendly projects with smaller capital outlays.

What are the risks associated with eco-smart investments?

While eco-smart investments are forward-looking, they may carry risks like regulatory changes and market volatility, which should be carefully evaluated.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/