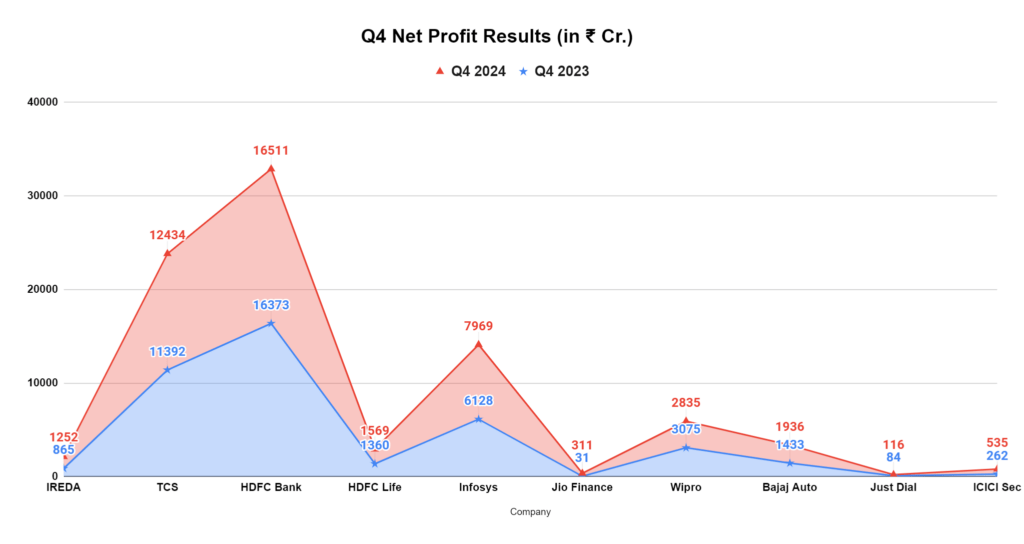

The Q4 results or earnings season is always a time of excitement and anticipation for investors. This quarter, we saw mixed results from some of India’s biggest companies. Some companies exceeded expectations, while others haven’t been as fortunate. Let’s look at the performances of 10 notable players and see who impressed and who fell short.

IREDA Shines Bright

IREDA reported strong financial results for the year. Their annual profit after tax (PAT) reached ₹1252.23 crore, marking a significant 44.83% increase year-on-year. This performance was accompanied by a substantial reduction in net non-performing assets (NPAs) – down to 40.52% year-on-year. The company’s net worth also increased by 44.22%.

TCS: Consistent Growth Despite Challenges

TCS navigated a challenging economic environment to deliver better Q4 results. They reported a 9% year-on-year growth in PAT, reaching ₹12,434 crore. While revenue from operations grew at a slightly slower pace of 3.5%, reaching ₹61,237 crore, it’s important to note they secured an order book of $42.7 billion for the year, with $13.2 billion in Q4 alone.

HDFC Bank: Steady Performance

India’s largest private sector bank, HDFC Bank, maintained its growth trajectory with a net profit of ₹16,511 crore for Q4. This represents a modest 0.84% increase compared to the previous quarter. Their net revenue grew to ₹47,240 crore, partially fueled by a one-time gain from the sale of a subsidiary. However, net interest income fell slightly below market expectations.

HDFC Life: Double-Digit Growth Despite Hurdles

HDFC Life delivered a 15% year-on-year jump in consolidated net profit for Q4, reaching ₹1569 crore. Net premium income also saw a modest increase of 5%. Despite budget changes impacting high-value policies, the company managed a 20% growth in APE (annual premium equivalent). Overall, the year saw a 15% increase in profit after tax, driven by an 18% growth in profit emergence from existing policies.

Infosys: Mixed Bag with Focus on Future

Infosys’ Q4 results were a mixed bag. The company surpassed analyst estimates with a net profit of ₹7,969 crore compared to ₹6128 in the same quarter last year, a 30% y-o-y growth. Revenue increased slightly by 1.3% to ₹37,923 crore compared to ₹37,441 last year. Looking ahead, Infosys is projecting a revenue growth of 1-3% in constant currency for the upcoming year. The company declared a final dividend of ₹20 per share and a special one-time dividend of ₹8 per share.

Jio Finance: Impressive Growth Trajectory

Jio Finance’s net profit for the full year touched ₹1,604 crore, a significant jump from ₹31 crore the previous year. Revenues followed a similar upward trend, multiplying several times over to reach ₹1,854 crore. Q4 results also maintained this positive momentum, with profit rising nearly 6% QoQ to ₹310.63 crore.

Wipro: Decline in Profit Amidst Restructuring

Wipro’s Q4 results marked a decline in net profit. The company reported a profit of ₹2,835 crore, down 8% year-on-year. Revenue also witnessed a dip, falling to ₹22,208.3 crore. This decline comes amidst a company restructuring, with Wipro reporting a significant reduction in employee headcount throughout the year.

Bajaj Auto: Strong Growth Across the Board

The company reported a year-on-year increase in net profit for Q4 last year at ₹1,432.88 crore, reaching ₹1,936 crore this year. Revenue also saw a 30% growth, reaching ₹11,484.68 crore. This performance was mirrored in their total income, which jumped nearly 30% year-on-year. The company further rewarded its shareholders with a substantial dividend payout.

Just Dial: Numbers Ring True with Revenue and Profit Increase

Net Sales climbed 16.23%, and quarterly net profit rose 38.02%. Net Sales at ₹270.27 crore in March 2024, up from ₹232.53 crore in March 2023. Quarterly Net Profit at ₹115.65 crore in March 2024, up from ₹83.79 crore in March 2023. Other financial metrics like EBITDA and EPS also reflected strong growth. The company’s stock price also enjoyed significant returns over the past year.

ICICI Securities: Soaring High with Revenue and Profit Surge

ICICI Securities reported a 74% YoY jump in total revenue and a 104% YoY increase in profit. Profit for the period jumped to ₹535.35 crore in the March quarter against ₹261.95 crore in the same quarter last year. The company’s operating income also witnessed significant growth.

Conclusion

The recent earnings season offers a glimpse into the financial health of some of India’s most prominent companies. While IREDA’s record profits and Bajaj Auto’s surging revenue painted a rosy picture, companies like Wipro faced challenges, and Infosys presented a mixed bag. This reinforces the reality that the market is dynamic, and individual company performance can vary significantly.

This is a crucial reminder of the importance of diversification in a portfolio. By spreading your investments across various sectors and company sizes, you can mitigate risk and capture opportunities presented by market fluctuations. As the market landscape evolves, a diversified portfolio remains a powerful tool for navigating calm and choppy waters.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.2 / 5. Vote count: 6

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/